PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911379

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911379

Indonesia E-commerce - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

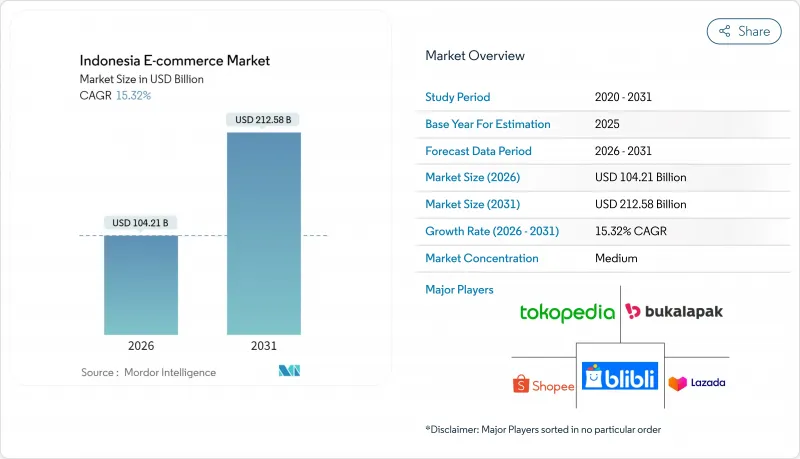

The Indonesia e-commerce market is expected to grow from USD 90.35 billion in 2025 to USD 104.21 billion in 2026 and is forecast to reach USD 212.58 billion by 2031 at 15.32% CAGR over 2026-2031.

Smartphones, social commerce and fintech-enabled payments are raising transaction frequency and average order values, while government programmes accelerate the onboarding of micro-, small- and medium-enterprises. Consolidation among leading platforms is reshaping price competition and fulfillment standards. Live-stream shopping, quick-commerce grocery and cross-border offerings are widening revenue pools, yet data-localisation rules and Jakarta's traffic restrictions elevate operating costs. Investors continue to fund logistics micro-hubs, embedded finance and cold-chain capacity to capture emerging white-space opportunities across outer islands.

Indonesia E-commerce Market Trends and Insights

Surge in Live-stream Shopping Adoption on Mobile Apps

Sixty percent of online buyers already purchase through live sessions, driving video commerce to 20% of online GMV in 2025 from less than 5% in 2022. Conversion rates average triple those of catalogue-based listings, reinforcing its role in customer acquisition and retention. TikTok Shop leverages 22 million local active users and embedded payments to turn entertainment scrolls into impulse purchases, particularly among Gen Z who value peer validation. Brands pivot marketing budgets to creator partnerships and on-platform flash deals, while logistics players integrate real-time inventory feeds to support promised delivery windows. The format's immediacy reduces return rates by showcasing product authenticity in real time.

Rapid Digitisation of Tier-2/3 Cities via Logistics Micro-Hubs

Tier-2 and tier-3 locations are expected to contribute 50% of the Indonesia e-commerce market by 2025, up from roughly 40% in 2021. Operators such as JNE Express and TIKI deploy container-scale hubs closer to consumers, trimming last-mile distances and enabling next-day delivery beyond Java. Government infrastructure spending of IDR 400 trillion (USD 25.8 billion) accelerates road, port and air-cargo upgrades that underpin this model. Quick-commerce grocers benefit from shorter cold-chain routes, supporting the 22.4% CAGR in food and beverages. For sellers, the micro-hub network cuts shipping costs 12-18%, unlocking demand from newly banked households in provincial capitals.

Fulfilment Cost Inflation from Jakarta Traffic Restrictions

Odd-even licence rules and restricted freight hours add 30-45 minutes per journey and push last-mile costs up 20%. Time-sensitive categories such as ready-to-eat meals suffer deteriorating on-time performance, harming customer satisfaction metrics. To mitigate, major platforms lease peripheral warehouses, deploy electric motorbikes exempt from restrictions and pilot bicycle couriers for dense districts. These tactics require capital outlays that squeeze smaller sellers' margins and may slow assortment expansion into perishables. Regulators plan phased freight corridors, yet near-term congestion remains a drag on delivery economics.

Other drivers and restraints analyzed in the detailed report include:

- Fintech-Led Checkout ('PayLater') Boosting Average Order Value

- Government's 'Making Indonesia 4.0' SME On-Boarding Programmes

- Persistent Cash-on-Delivery Risk Elevating Return Rates

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The B2C segment led the Indonesia e-commerce market with an 86.90% share in 2025. Its scale is anchored in 215 million internet users but its growth moderates as urban penetration nears saturation. In contrast, the B2B vertical is forecast to compound at 18.74% annually, riding procurement digitalisation across 64 million MSMEs. Indonesia e-commerce market size for B2B transactions is expected to double between 2025 and 2030, propelled by tailored catalogues, deferred-payment terms and API links to enterprise resource planning. Platforms such as Ralali bundle bulk-discount engines and delivery scheduling, lifting switching costs for corporate buyers. Government procurement platforms and wholesaler digitalisation further catalyse adoption. Robust logistics corridors outside Java shorten restock cycles, making online sourcing economically superior to traditional wholesale trips.

Competitive intensity in B2B remains moderate, with fewer scaled players compared to B2C. Margins benefit from larger basket values and lower marketing spend per rupiah transacted. However, the service mandate is higher, demanding credit assessment tools and after-sales support. As marketplace data capture widens, embedded financing is likely to tip the economics decisively in favour of digital channels.

Smartphones accounted for 69.40% of Indonesia e-commerce market share in 2025 and will retain leadership, expanding at 18.38% CAGR on the back of 5G roll-outs and 94% smartphone penetration expected by 2030. App developers prioritise low-bandwidth design, single-page checkout and reward gamification to keep session durations high. Indonesia e-commerce market size derived from mobile orders is projected to surpass USD 155.6 billion by the end of the decade. Desktop remains relevant for high-ticket business procurement and complex travel bookings, yet its share inches down annually.

Second-screen behaviours see shoppers comparing prices on mobile while completing payment on laptop for large orders. Voice-assistant and smart-TV commerce are embryonic but gain visibility as broadband penetration widens. Feature-phone users in rural zones still rely on agent-assisted orders, underscoring the need for multi-channel customer service.

The Indonesia E-Commerce Market Report is Segmented by Business Model (B2C, B2B), Device Type (Smartphone / Mobile, Desktop and Laptop, Other Device Types), Payment Method (Credit / Debit Cards, Digital Wallets, BNPL, Other Payment Method), B2C Product Category (Beauty and Personal Care, Consumer Electronics, Fashion and Apparel, Food and Beverages, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Sea Ltd (PT Shopee International Indonesia)

- PT GOTO Gojek Tokopedia Tbk

- Lazada (Alibaba Group Holding Limited)

- PT Bukalapak.com Tbk

- Blibli (pt Global Digital Niaga Tbk)

- PT Bhinneka Mentaridimensi

- PT Silicon Media Indonesia

- PT Raksasa Laju Lintang

- PT Metrotech Jaya Komunika

- Global Fashion Group

- TikTok Pte Ltd

- PT Warung Pintar Sekali

- Amazon Services LLC

- PT Lion Parcel

- PT Matahari Putra Prima Tbk

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in Live-stream Shopping Adoption on Mobile Apps

- 4.2.2 Rapid Digitisation of Tier-2/3 Cities via Logistics Micro-Hubs

- 4.2.3 Fintech-Led Checkout ('PayLater') Boosting Average Order Value

- 4.2.4 Government's 'Making Indonesia 4.0' SME On-Boarding Programmes

- 4.2.5 Rising Cross-border Seller Participation via Singapore and China Gateways

- 4.2.6 Social-Commerce Integration with WhatsApp and Instagram APIs

- 4.3 Market Restraints

- 4.3.1 Fulfilment Cost Inflation from Jakarta Traffic Restrictions

- 4.3.2 Persistent Cash-on-Delivery Risk Elevating Return Rates

- 4.3.3 Data-Localisation Rules Raising Cloud-Hosting Expense

- 4.3.4 Talent Shortage in Last-Mile Cold-Chain Logistics

- 4.4 Value Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Key Market Trends and Share of E-commerce in Total Retail

- 4.8 Assessment of Macro Economic Trends on the Market

- 4.9 Demographic Analysis (Population, Internet, Age, Income)

- 4.10 Cross-Border E-commerce Size and Trends

- 4.11 Current Positioning of Indonesia in the E-commerce Industry in Asia Pacific

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Business Model

- 5.1.1 B2C

- 5.1.2 B2B

- 5.2 By Device Type

- 5.2.1 Smartphone / Mobile

- 5.2.2 Desktop and Laptop

- 5.2.3 Other Device Types

- 5.3 By Payment Method

- 5.3.1 Credit / Debit Cards

- 5.3.2 Digital Wallets

- 5.3.3 BNPL

- 5.3.4 Other Payment Method

- 5.4 By B2C Product Category

- 5.4.1 Beauty and Personal Care

- 5.4.2 Consumer Electronics

- 5.4.3 Fashion and Apparel

- 5.4.4 Food and Beverages

- 5.4.5 Furniture and Home

- 5.4.6 Toys, DIY and Media

- 5.4.7 Other Product Categories

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market-Level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Sea Ltd (PT Shopee International Indonesia)

- 6.4.2 PT GOTO Gojek Tokopedia Tbk

- 6.4.3 Lazada (Alibaba Group Holding Limited)

- 6.4.4 PT Bukalapak.com Tbk

- 6.4.5 Blibli (pt Global Digital Niaga Tbk)

- 6.4.6 PT Bhinneka Mentaridimensi

- 6.4.7 PT Silicon Media Indonesia

- 6.4.8 PT Raksasa Laju Lintang

- 6.4.9 PT Metrotech Jaya Komunika

- 6.4.10 Global Fashion Group

- 6.4.11 TikTok Pte Ltd

- 6.4.12 PT Warung Pintar Sekali

- 6.4.13 Amazon Services LLC

- 6.4.14 PT Lion Parcel

- 6.4.15 PT Matahari Putra Prima Tbk

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment