Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1651025

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1651025

Biofuels - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 125 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

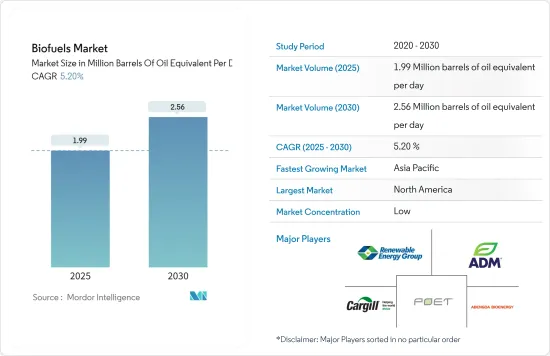

The Biofuels Market size is estimated at 1.99 million barrels of oil equivalent per day in 2025, and is expected to reach 2.56 million barrels of oil equivalent per day by 2030, at a CAGR of 5.2% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the increasing demand for secure, sustainable, and clean energy coupled with government mandates for increasing blending in automotive fuels is expected to propel the demand for biofuels across the globe.

- On the other hand, the high cost of production of biofuels, even with all the benefits associated with them, is likely to restrain the growth of the market.

- Nevertheless, with the recent technological advancements, the production of biofuels has increased, which is going to act as an opportunity for the market's expansion.

- North America dominates the market, and it is likely to witness the highest CAGR during the forecast period. The growth is attributed to the rapid increase in production facilities coupled with the increase in demand for biofuels in the region.

Biofuels Market Trends

Ethanol Likely to Experience a Significant Growth

- Globally, the transportation sector is the biggest emitter of greenhouse gases due to the combustion of fossil fuels in its internal combustion engines. To limit the emission of greenhouse gases, countries worldwide have adopted norms to promote the use of renewable energy resources. Biofuels such as ethanol affirm themselves as a cleaner energy source for the transportation sector, which could lead to a developed biofuel market in the future.

- According to the Renewable Fuels Association (RFA), in 2022, the United States produced 15,4 billion gallons of fuel ethanol, making it the leading producer of biofuel in the world.

- Primary blending mandates that drive the global demand for biofuels are set in North America, India, Brazil, Europe, Indonesia, Malaysia, etc. For instance, in India, there is a mandate to begin 20% ethanol blending by 2025. In Indonesia, a commission of 35% biodiesel blending is expected to start in 2023, whereas in Brazil, the existing order for ethanol blending is 27%. Such measures highlight the increase in the use of biofuels across countries.

- Furthermore, in March 2022, Brazil's Ministry of Economy announced the withdrawal of import tariffs on ethanol, including other products, to alleviate inflationary pressures. This is expected to boost the ethanol blend in gasoline and drive the market.

- In 2022, SGP BioEnergy announced the development of the world's most extensive biofuel distribution and production hub in Panama, in association with the country's government, which is estimated to produce 180,000 barrels per day of biofuel. Similarly, in 2023, the US Department of Energy awarded USD 118 million for 17 projects to scale up ethanol and other biofuels to help America's transportation and manufacturing needs. Such trends are likely to ramp up the biofuel market.

- Therefore, owing to the above points, the ethanol segment is expected to experience significant growth in the biofuels market during the forecast period.

North America is Expected to Dominate the Market

- The North American region houses one of the biggest aviation markets, primarily fossil fuels, and a well-established transportation infrastructure. The North American region has been at the forefront of lowering emissions to limit the greenhouse effect.

- According to the U.S. Energy Information Administration, the total production volume of biodiesel production in the United States was 1.6 billion gallons by 2022

- In January 2022, the US Environmental Protection Agency announced a new initiative for streamlining the review of biofuels and chemicals that can significantly replace higher GHG-emitting fossil fuels, providing a significant push to the biofuels market. Similarly, the US Department of Energy announced an Alternative Fuel Infrastructure Tax Credit of 30% for the fueling equipment for natural gas, propane, liquefied hydrogen, electricity, E85, or diesel fuel blends containing a minimum of 20% biodiesel installed on or after December 2022. Such incentive measures would likely promote the biofuel market.

- Similarly, in Canada, the government aimed to increase carbon taxes by CAD 10 to CAD 50 per ton of emissions from April 2022, thereby pushing for wider adoption of biofuels that emit less GHG.

- Hence, owing to the above points, the North American region is likely to dominate the biofuels market due to government policies and production capacity.

Biofuels Industry Overview

The biofuels market is fragmented. Some of the major players include (in no particular order) Archer Daniels Midland Company, Abengoa Bioenergy SA, Renewable Energy Group Inc., Cargill Incorporated, and POET LLC., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 49858

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Biofuel Production Historic and Forecast, till 2028

- 4.3 Biofuel Consumption Historic and Forecast, till 2028

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.1.1 Increasing Demand for Secure, Sustainable, and Clean Energy

- 4.6.2 Restraints

- 4.6.2.1 High Cost of Production of Biofuels

- 4.6.1 Drivers

- 4.7 Supply Chain Analysis

- 4.8 Industry Attractiveness - Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitute Products and Services

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Fuel Type

- 5.1.1 Ethanol

- 5.1.2 Biodiesel

- 5.1.3 Other Fuel Types

- 5.2 Feedstock

- 5.2.1 Palm Oil

- 5.2.2 Jatropha

- 5.2.3 Sugar Crop

- 5.2.4 Coarse Grain

- 5.2.5 Other Feedstock

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States of America

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 Denmark

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Indonesia

- 5.3.3.4 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Chile

- 5.3.4.4 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 South Africa

- 5.3.5.4 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Abengoa Bioenergy SA

- 6.3.2 Cargill Incorporated

- 6.3.3 Shell PLC

- 6.3.4 Wilmar International Ltd.

- 6.3.5 Renewable Energy Group Inc.

- 6.3.6 Archer Daniels Midland Company

- 6.3.7 BP PLC

- 6.3.8 POET LLC

- 6.3.9 Neste Oyj

- 6.3.10 Verbio Vereinigte BioEnergie AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements in Production of Biofuels

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.