PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721511

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721511

Ethanol Biofuel Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

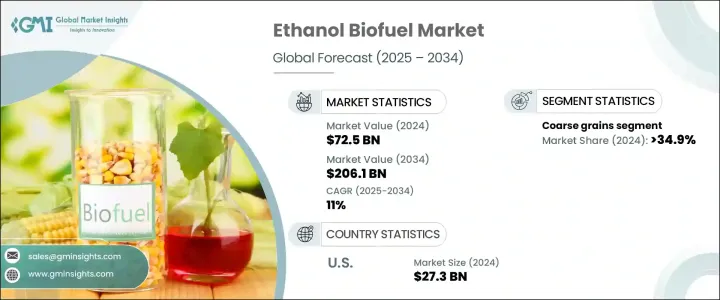

The Global Ethanol Biofuel Market was valued at USD 72.5 billion in 2024 and is estimated to grow at a CAGR of 11% to reach USD 206.1 billion by 2034. Ethanol biofuel continues to gain traction worldwide as countries look for sustainable alternatives to fossil fuels. The growing urgency to reduce carbon emissions, meet renewable energy targets, and transition toward low-carbon economies has intensified global investments in biofuel infrastructure. Ethanol, derived primarily from renewable biomass like coarse grains and sugar crops, offers a reliable and environmentally responsible solution for the transportation sector. With increasing government mandates, rising oil prices, and heightened consumer awareness about climate change, ethanol biofuel emerges as a strategic energy resource that balances performance with sustainability. Its compatibility with existing vehicle engines and infrastructure, combined with rising demand for cleaner fuel blends like E10 and E85, is further fueling its market appeal. Additionally, advances in enzyme technology and fermentation processes are reducing production costs and improving conversion efficiencies, boosting the commercial viability of ethanol biofuels across regions.

Ethanol biofuel is being widely recognized as a cleaner and more sustainable alternative to gasoline, especially in transportation. When blended with gasoline, ethanol helps lower harmful emissions, such as carbon monoxide and particulate matter, while also increasing octane levels. These benefits make ethanol blends like E10 (10% ethanol) and E85 (85% ethanol) attractive choices for both consumers and governments, aiming to reduce environmental impact without compromising vehicle performance. The flexibility of ethanol to be integrated into existing fuel systems positions it as a practical short- and mid-term solution to emissions reduction goals.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $72.5 Billion |

| Forecast Value | $206.1 Billion |

| CAGR | 11% |

The aviation industry is increasingly shifting toward sustainable aviation fuel (SAF) produced from ethanol, which supports net-zero carbon initiatives. Ethanol-based SAF has demonstrated the potential to cut lifecycle emissions by up to 80% compared to conventional jet fuel, making it a viable and scalable path for decarbonizing air travel. This growing application further strengthens ethanol's position in the global fuel market.

The market is categorized based on feedstock types, including coarse grains, sugar crops, and vegetable oils. In 2024, the coarse grains segment accounted for a 34.9% share of the ethanol biofuel market. High starch content makes coarse grains particularly efficient for biofuel production, as they are easily converted into fermentable sugars. Supportive government policies, including blending mandates and subsidies for agricultural producers, have significantly encouraged the use of coarse grains in ethanol production.

The U.S. Ethanol Biofuel Market was valued at USD 27.3 billion in 2024. The Renewable Fuel Standard (RFS) mandates the blending of 15 billion gallons of ethanol annually, ensuring steady demand and continued growth. Ethanol remains a key player in the country's strategy to advance sustainability and energy security.

Leading market participants include ADM, BP, Cargill, Chevron, Codexis, DuPont, Green Plains, Royal Dutch Shell, Valero Energy, and LyondellBasell Industries. These companies are focusing on expanding production capacity, investing in advanced biofuel technologies, and entering long-term feedstock agreements. Many are also working to minimize their carbon footprints while delivering renewable fuels that align with global sustainability goals.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Feedstock, 2021 - 2034 (MToe, USD Billion)

- 5.1 Key trends

- 5.2 Coarse grain

- 5.3 Sugar crop

- 5.4 Vegetable oil

- 5.5 Others

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034 (MToe, USD Billion)

- 6.1 Key trends

- 6.2 Transportation

- 6.3 Aviation

- 6.4 Others

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (MToe, USD Billion)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 France

- 7.3.3 Spain

- 7.3.4 UK

- 7.3.5 Italy

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 ADM

- 8.2 Borregaard

- 8.3 Blue Biofuel

- 8.4 BTG Bioliquids

- 8.5 Cargill

- 8.6 Chevron

- 8.7 Clariant

- 8.8 COFCO

- 8.9 CropEnergies

- 8.10 Munzer Bioindustrie

- 8.11 Neste

- 8.12 POET LLC

- 8.13 Praj Industries

- 8.14 Raizen

- 8.15 The Andersons

- 8.16 TotalEnergies

- 8.17 UPM

- 8.18 Valero

- 8.19 Verbio

- 8.20 Wilmar International

- 8.21 Zilor