PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1536875

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1536875

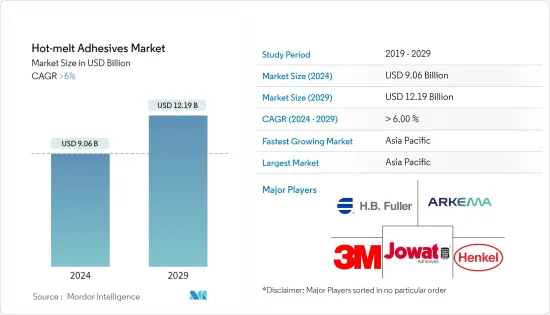

Hot-melt Adhesives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Hot-melt Adhesives Market size is estimated at USD 9.06 billion in 2024, and is expected to reach USD 12.19 billion by 2029, growing at a CAGR of greater than 6% during the forecast period (2024-2029).

COVID-19 hampered the hot melt adhesive market. Various end-use industries for hot melt adhesives, such as automotive manufacturing, construction, and nonwoven hygiene products, experienced slowdowns or shutdowns in production due to government-mandated restrictions, reduced consumer demand, and supply chain disruptions. With the easing of lockdown measures and restrictions, many industries have resumed operations, leading to increased demand for hot melt adhesives.

* Increasing demand for hot melt adhesives from the packaging industry, rising demand from the construction sector, and increased adoption of hot melt adhesives in nonwoven hygiene products are expected to drive the market.

* However, volatility in raw material prices is expected to hamper the growth of the hot melt adhesive market.

* Expansion in automotive manufacturing and the advancements in construction technologies are expected to provide opportunities in the upcoming period.

* Due to rapidly growing economies like India, Japan, and China, Asia-Pacific is expected to emerge as a dominant market in the coming years.

Hot Melt Adhesives Market Trends

Paper, Board, and Packaging Segment to Dominate the Market

* The packaging industry is one of the largest consumers of hot melt adhesives. These adhesives are widely used for bonding packaging materials such as paperboard, corrugated cardboard, plastic films, and foils in applications such as case and carton sealing, tray forming, labeling, and lamination. The industry's large-scale use of hot melt adhesives drives significant demand and market dominance.

* The demand for hot melt adhesives in the packaging sector is increasing due to increased food consumption and various applications. For instance, in India, packaging is one of the fastest-growing industries. The sector has witnessed steady growth over the past several years and is expected to expand rapidly, particularly in the export sector.

* For instance, in India, paper imports rose by 37% to 1.47 million tonnes from April to December 2023, according to data reported by The Indian Paper Manufacturers Association (IPMA).

* Further, according to the estimate published by the Statistisches Bundesamt in March 2023, in 2022, around 46 percent of the packaging industry revenue in Germany was generated by paper packaging. Almost 34 percent was made up of plastic packaging.

* Moreover, according to the estimate published by the Statistisches Bundesamt in 2023, the German packaging industry generated around EUR 35 billion (USD 37.94 billion) in revenue. This was an increase compared to the previous year at EUR 29.6 billion (USD 32.09 billion).

* The food and beverage sector is one of the major consumers of packaging. In order to cope with the increasing trend around the world, the bakery sector is growing, and this is driving sales of packaging products.

* Thus, the factors mentioned above are expected to grow the demand for hot melt adhesives from the paper, board, and packaging industries.

Asia-Pacific to Dominate the Market

* Asia-Pacific is experiencing rapid industrialization, urbanization, and infrastructure development, particularly in emerging economies in the region. This growth fuels the demand for hot melt adhesives in construction, packaging, automotive, and other industries, as these adhesives are essential for bonding materials and components in manufacturing and construction processes.

* Governments and private sectors in the Asia Pacific are investing in various infrastructure projects such as transportation, utilities, and residential and commercial construction. Hot melt adhesives are used in various construction applications, including paneling, flooring installation, insulation bonding, and roofing, driving the demand for these adhesives in the region's construction industry.

* According to the Indian Brand Equity Foundation, the capital investment in infrastructure is set to increase by 33%, amounting to about USD 122 billion, for the budget of 2023-24, and this accounts for 3% of GDP.

* Further, in order to attract private investment, the government of India has developed a number of ways, particularly for roads and highways, airports, business parks, and higher education and skills development sectors. Private Equity and Venture Capital Firms invested USD 3.5 billion in Indian companies between May 2023 with 71 deals.

* China has been the most extensive paper packaging and paperboard producer since 2008. According to a survey conducted by the China Paper Association, in 2023, the total number of paper and paperboard manufacturing enterprises in China stood at 2,500, with a nationwide paper and paperboard output of 129.65 Million tons, a 4.35% increase from the previous year.

* Thus, the above factors are expected to drive the hot-melt adhesives market in the region during the forecast period.

Hot-melt Adhesives Industry Overview

The global hot-melt adhesives market is fragmented in nature. Some of the major players in the market (not in any particular order) include 3M, Jowat SE, Henkel Corporation, Arkema, and H.B. Fuller, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from Packaging Industry

- 4.1.2 Rising Demand from Construction Sector

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Volatility in Raw Material Prices

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size by Value)

- 5.1 Resin Type

- 5.1.1 Ethylene Vinyl Acetate

- 5.1.2 Styrenic Block Co-polymers

- 5.1.3 Thermoplastic Polyurethane

- 5.1.4 Other Resin Types (Polyolefin, polyamide)

- 5.2 End-user Industry

- 5.2.1 Building and Construction

- 5.2.2 Paper, Board, and Packaging

- 5.2.3 Woodworking and Joinery

- 5.2.4 Automotive and Transportation

- 5.2.5 Footwear and Leather

- 5.2.6 Healthcare

- 5.2.7 Electrical and Electronic Appliances

- 5.2.8 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 ASEAN Countries

- 5.3.1.10 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Turkey

- 5.3.3.6 Spain

- 5.3.3.7 Russia

- 5.3.3.8 NORDIC

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Nigeria

- 5.3.5.4 Egypt

- 5.3.5.5 Qatar

- 5.3.5.6 UAE

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Alfa International

- 6.4.3 Arkema

- 6.4.4 Ashland

- 6.4.5 AVERY DENNISON CORPORATION

- 6.4.6 Beardow Adams

- 6.4.7 Dow

- 6.4.8 DRYTAC

- 6.4.9 Franklin International

- 6.4.10 H.B. Fuller Company

- 6.4.11 Henkel Corporation

- 6.4.12 Hexcel Corporation

- 6.4.13 Huntsman International LLC

- 6.4.14 Jowat SE

- 6.4.15 Mactac

- 6.4.16 Master Bond Inc.

- 6.4.17 Paramelt RMC B.V.

- 6.4.18 Pidilite Industries Limited

- 6.4.19 Sika AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Expansion in Automotive Manufacturing

- 7.2 Advancements in Construction Technologies