PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444237

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444237

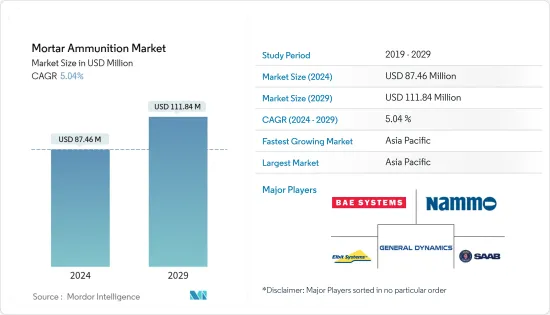

Mortar Ammunition - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Mortar Ammunition Market size is estimated at USD 87.46 million in 2024, and is expected to reach USD 111.84 million by 2029, growing at a CAGR of 5.04% during the forecast period (2024-2029).

The impact of COVID-19 on the overall market revenue was low. However, the lockdown imposed by the governments in major countries caused disruptions in the supply chain, leading to manufacturing delays in 2020. Although the overall global defense spending saw an increasing trend till 2020, developing countries facing an economic crisis may opt for a reduction in defense spending levels in the coming years, which may hamper the procurement of new mortar systems and related ammunition.

Several countries are expending significant resources toward augmenting their current military prowess by procuring new weapon systems or modernizing their existing deployed systems with advanced ammunition rounds. The growth in territorial issues has also propelled the procurement of mortar systems by the land forces over the years.

Mortars are now witnessing rejuvenated demand due to new technology integration and enhanced deployment scope by infantry and artillery units of global armed forces. Several new mortar development programs are underway to develop lighter but deadlier mortar ammunition with an enhanced range. Investments are being made to develop precision-guided mortar ammunition, which may open new prospects for the market in the coming years.

Mortar Ammunition Market Trends

Heavy Caliber Segment is Expected to Witness Highest Growth During the Forecast Period

The heavy-caliber segment of the market is expected to witness the highest growth during the forecast period. Mortar ammunition with a caliber size of 100 mm and above are classified as heavy caliber mortars. Conventional heavy-caliber mortars have a range of 7,200m to 9,500m and can carry an explosive payload of 1.2kg to 4.2kg, depending on the size of the mortar. Heavy mortars are generally used to level enemy strongholds and decommission armored vehicles. Several nations across the globe have procurement programs underway as part of their extensive weaponry modernization program. For instance, in November 2021, the Estonian National Defense Investment Centre announced that it has ordered an undisclosed number of 120mm mortar systems from the sole bidder Elbit Systems of Israel, under a framework agreement worth up to USD 17.27 million. As part of the contract, Elbit will also provide lifecycle support for the systems with the Estonian Army. The rise in demand has fostered extensive innovations in the heavy caliber mortar segment. For instance, in March 2021, Israel unveiled a laser-guided mortar system that could reduce civilian collateral damage, according to the company. The "Iron Sting" system, developed by the Israeli military with local firm Elbit Systems, will use laser and GPS technology to provide maximal accuracy to 120mm mortar rounds. Such developments and procurement orders of advanced munitions is expected to accelerate the growth of this segment during the forecast period.

Asia-Pacific Accounted for a Major Share in the Mortar Ammunition Market in 2021

The Asia-Pacific region is currently dominating the market and is expected to continue its dominance during the forecast period. Countries such as China, India, and South Korea have been rapidly increasing their military spending over the past few years due to the ongoing geopolitical tensions in the region. China and India increased their military expenditures by more than 25% and 30%, respectively, during 2015-2020. With such a growth in defense expenditure, these countries have been investing in developing and procuring newer generation mortar systems and related ammunition. In March 2021, the Indian Army decommissioned two of the longest-serving artillery systems, namely, the 130mm self-propelled M-46 catapult guns and 160mm Tampella Mortars from service, to make way for newer equipment employing the latest technologies. The procurement of new mortar systems is also expected to generate demand for related ammunition during the forecast period. The growing focus on indigenous development of mortar systems is projected to drive the market's growth in the region. In July 2021, the Republic of Korea Army (RoKA) began deploying an upgraded version of its locally developed 81mm mortar system. The mortar system uses advanced technologies, like laser and the global positioning system (GPS), to identify the target locations and calculate the mortar settings, thus increasing the speed and accuracy of the rounds delivered.

Along with the procurement of advanced mortar systems, countries are acquiring advanced ammunition for the mortar systems. In April 2019, Elbit Systems announced that it was awarded a contract worth USD 30 million to supply STYLET, a precise Guided Mortar Munition (GMM), to an undisclosed customer in Asia-Pacific. The deliveries of the munitions are expected to be completed in 2022. STYLET is a multimode GPS/INS guided 120mm GMM with a range of 1,000-8,500 m designed for tactical combat units and Special Forces. Such investments and procurement of advanced precision-guided mortar ammunition are anticipated to boost the market's growth in Asia-Pacific during the forecast period.

Mortar Ammunition Industry Overview

The major players in the mortar ammunition market are Elbit Systems Ltd, BAE Systems PLC, Nammo AS, General Dynamics Corporation, and Saab AB. Companies are collaborating to develop new ammunition and explore new market opportunities. For instance, recently, companies like Singapore Technologies Engineering Ltd, SAMI, and Hanwha Defense collaborated to produce different kinds of ammunition, including mortars. Such collaborations are expected to help them increase their market presence and share in global markets during the forecast period. Advancements in mortar ammunition capabilities, like range, precision, and lethality, are the major factors for manufacturers to attract new customers. On the other hand, partnerships with other manufacturers to locally produce munitions will allow them to enter new markets during the forecast period. Local players from several countries are expected to enter the market in the coming years, driven by the growing push for the localization of military equipment. This factor is expected to increase the competition in the market in the coming years.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of Study

- 1.3 Currency Conversion Rates for USD

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

- 3.1 Market Size and Forecast, Global, 2018 - 2027

- 3.2 Market Share by Caliber Type, 2021

- 3.3 Market Share by Geography, 2021

- 3.4 Market Drivers and Restraints

- 3.5 Structure of the Market and Key Participants

- 3.6 Expert Opinion on Mortar Ammunition Market

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Indicators

- 4.3 Market Drivers

- 4.4 Market Restraints

- 4.5 Market Trends

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Buyers/Consumers

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size and Forecast by Value - USD billion, 2018 - 2031)

- 5.1 Caliber Type

- 5.1.1 Light Caliber

- 5.1.2 Medium Caliber

- 5.1.3 Heavy Caliber

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.1.1 By Caliber Type

- 5.2.1.2 Canada

- 5.2.1.2.1 By Caliber Type

- 5.2.2 Europe

- 5.2.2.1 United Kingdom

- 5.2.2.1.1 By Caliber Type

- 5.2.2.2 France

- 5.2.2.2.1 By Caliber Type

- 5.2.2.3 Germany

- 5.2.2.3.1 By Caliber Type

- 5.2.2.4 Rest of Europe

- 5.2.2.4.1 By Caliber Type

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.1.1 By Caliber Type

- 5.2.3.2 India

- 5.2.3.2.1 By Caliber Type

- 5.2.3.3 South Korea

- 5.2.3.3.1 By Caliber Type

- 5.2.3.4 Japan

- 5.2.3.4.1 By Caliber Type

- 5.2.3.5 Rest of Asia-Pacific

- 5.2.3.5.1 By Caliber Type

- 5.2.4 Latin America

- 5.2.4.1 Mexico

- 5.2.4.1.1 By Caliber Type

- 5.2.4.2 Rest of Latin America

- 5.2.4.2.1 By Caliber Type

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.1.1 By Caliber Type

- 5.2.5.2 United Arab Emirates

- 5.2.5.2.1 By Caliber Type

- 5.2.5.3 South Africa

- 5.2.5.3.1 By Caliber Type

- 5.2.5.4 Rest of Middle-East and Africa

- 5.2.5.4.1 By Caliber Type

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Elbit Systems Ltd

- 6.2.2 General Dynamics Corporation

- 6.2.3 Nexter Systems SA

- 6.2.4 BAE Systems PLC

- 6.2.5 Rheinmetall AG

- 6.2.6 Saab AB

- 6.2.7 Nammo AS

- 6.2.8 Denel SOC Ltd

- 6.2.9 Hirtenberger Defence Systems GmbH & Co. KG

- 6.2.10 Singapore Technologies Engineering Ltd

- 6.2.11 Mechanical and Chemical Industry Company (MKEK)

- 6.2.12 ARSENAL JSCo.

- 6.2.13 Hanwha Corporation

7 MARKET OPPORTUNITIES