PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906989

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906989

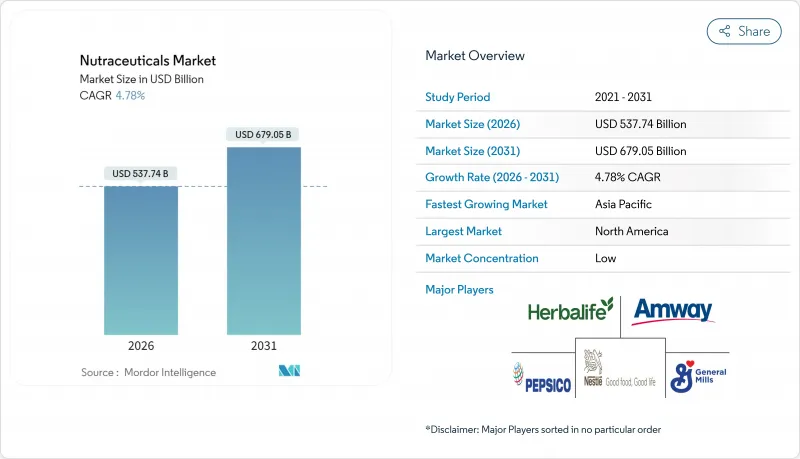

Nutraceuticals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The global nutraceuticals market is expected to grow from USD 513.20 billion in 2025 to USD 537.74 billion in 2026 and is forecast to reach USD 679.05 billion by 2031 at 4.78% CAGR over 2026-2031.

The market's expansion is driven by increasing consumer preference for preventive healthcare approaches and functional nutrition. Demographic factors, particularly the aging population in developed economies and health-conscious younger consumers, contribute significantly to market growth. The demand is further strengthened by the rising prevalence of health conditions such as cardiovascular disease, diabetes, and obesity, which nutraceuticals help manage through their antioxidants, probiotics, and polyunsaturated fatty acids content. The market is also shaped by growing consumer education and the trend toward personalized nutrition solutions, especially for individuals with specific medical conditions where conventional treatments may be less effective. Multivitamins and single vitamins constitute a substantial portion of consumer demand across regions. As consumers continue to prioritize preventive healthcare and wellness, the nutraceuticals market is positioned for sustained growth and innovation in the coming years.

Global Nutraceuticals Market Trends and Insights

Increasing Prevalence of Chronic Diseases Drives Demand

The global rise in non-communicable diseases (NCDs) has transformed healthcare approaches, establishing nutraceuticals as key components in preventive health strategies. According to WHO's Non-communicable Diseases Progress Monitor 2025, over 40 million people die annually from NCDs, including cardiovascular diseases, cancer, diabetes, and chronic respiratory diseases . This health crisis has led healthcare systems to incorporate nutritional supplementation into standard care protocols. The market now extends beyond basic vitamin and mineral supplements to include specialized formulations for metabolic disorders, cardiovascular health, and cognitive function. As clinical evidence supports the efficacy of nutraceuticals and consumer awareness grows, manufacturers are developing condition-specific formulations that address underlying health issues rather than just symptoms. This shift toward preventive healthcare through nutraceuticals is expected to continue driving market growth in the coming years.

Growth In Geriatric Population Requiring Preventive Healthcare

The aging population in developed economies is increasing the demand for age-specific nutraceutical products. The growing number of older adults globally is driving expansion in medical nutrition, consumer health, and active nutrition markets. This demographic change has expanded beyond traditional supplements to include functional foods targeting healthy aging, specifically for bone health, joint support, and cognitive function. The Population Reference Bureau 2024 reports that 10% of the global population is aged 65 and older, with regions in East Asia, Europe, and North America reaching 20% or higher . Companies such as Otsuka Pharmaceuticals, Baxter International, and Allergan are significant players in the elderly nutrition market. The increasing understanding of diet's role in aging has led to growth in active nutrition, particularly in protein and probiotic products for older consumers. Healthcare systems' focus on preventive care over treatment has strengthened this trend, establishing nutraceuticals as cost-effective options for managing age-related health issues.

Presence of Counterfeit Products

The rise of counterfeit nutraceutical products, especially in emerging markets with limited regulatory oversight, challenges market integrity and consumer trust. In 2024, Amazon implemented enhanced dietary supplement policies to address authenticity concerns . The new policies require sellers to submit testing data and certificates of analysis from accredited independent laboratories, replacing the previous practice of accepting manufacturer documentation. This pivotal change not only highlights Amazon's dedication to quality assurance but also establishes a new industry standard for online nutraceutical sales. With these heightened standards, Amazon seeks to shield consumers from unsafe or inaccurately labeled products, boost transparency, and enhance the credibility of its marketplace sellers. Additionally, these policies motivate manufacturers to prioritize rigorous third-party testing and compliance, bolstering trust among health-conscious consumers and promoting sustainable market growth.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Functional Food And Beverage Offerings Boosts Demand

- Increasing Fitness And Wellness Trends Among Millennials

- High Research and Development And Production Costs of Nutraceutical Products

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The functional foods segment commands a dominant 41.52% market share in 2025, as consumers increasingly favor health-enhancing products integrated into their daily dietary routines over standalone supplements. This leadership position reflects the segment's success in delivering targeted health benefits through familiar formats, from fortified cereals and bakery products to probiotic-enriched dairy items and nutrient-enhanced snacks. The category's strength lies in its ability to combine nutritional functionality with convenience, particularly evident in the development of portable snack formats incorporating bioactive compounds for on-the-go consumption.

Functional beverages are experiencing the most rapid expansion with a projected 7.35% CAGR from 2026-2031, while dietary supplements maintain steady growth through format innovation. The beverage segment's growth is primarily driven by energy drinks and sports beverages, which have expanded beyond athletic populations to mainstream consumers, alongside fortified juices and dairy alternatives that address specific nutritional needs. Meanwhile, the supplement category is evolving through non-traditional delivery formats such as gummies and liquids, reflecting industry-wide shifts toward personalization and multi-functional products that address multiple health concerns simultaneously.

Weight management applications hold a dominant 18.62% market share in 2025, driven by increasing consumer focus on obesity prevention and metabolic health optimization. This segment's strong performance is supported by clinical evidence validating nutritional interventions for weight control and growing consumer awareness of diet-related health risks. The category features products with advanced formulations targeting multiple aspects of weight management, including appetite regulation, metabolic enhancement, and fat oxidation support, while benefiting from healthcare provider endorsements and integration into comprehensive wellness programs.

Sports nutrition and performance applications are projected to achieve the highest growth rate at 9.25% CAGR from 2026-2031, expanding beyond traditional athletic markets into mainstream wellness. This growth is particularly strong among millennials and Generation Z, who view sports nutrition as an integral part of their lifestyle. The market demonstrates diversification across multiple segments, with general health applications maintaining broad appeal through preventive positioning, while immunity and digestive health categories benefit from increased awareness of gut-health connections. Women's health emerges as a growth segment with gender-specific formulations for hormonal, bone density, and reproductive wellness, while healthy aging applications targeting bone, joint, and cognitive health respond to demographic shifts and increased focus on longevity.

The Nutraceuticals Market is Segmented by Product Type (Functional Food, Functional Beverage, and Dietary Supplements), by Function (General Health, Weight Management, and More), by End User (Adults and Children), by Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, and More), and by Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America holds the largest market share at 38.20% in 2025, driven by well-established regulatory frameworks, robust healthcare infrastructure, and high consumer spending on wellness products. The region's market maturity is characterized by comprehensive consumer education and effective healthcare provider integration, creating an environment conducive to product innovation and market expansion.

Steady growth characterizes the European nutraceutical market. The region's stringent regulatory standards prioritize product safety and efficacy. Meanwhile, consumers show a pronounced preference for natural and organic formulations. Aging populations and a heightened emphasis on preventive healthcare bolster this growth. Furthermore, as consumers become more aware of lifestyle-related health issues, there's a surging demand for innovative, science-backed nutraceuticals tailored to specific health needs.

The Asia-Pacific region is projected to achieve a 7.45% CAGR from 2026-2031, making it the fastest-growing market globally. This growth is fueled by heightened health awareness and supportive government healthcare initiatives. The region's unique advantage lies in its successful integration of traditional medicine practices with modern nutraceutical approaches, as exemplified by Vietnam's expanding health supplement market. Furthermore, heightened investments in research and development are fueling innovation, leading to the launch of new products that culturally resonate with local consumers.

- Nestle S.A.

- PepsiCo, Inc.

- Herbalife Nutrition Ltd.,

- General Mills, Inc.

- Amway Corp.

- WK Kellogg Co

- Danone S.A.

- Abbott Laboratories

- Red Bull GmbH

- Now Health Group, Inc.

- Glanbia plc

- Archer-Daniels-Midland Company

- BASF SE

- Koninklijke DSM N.V.

- Bayer AG

- GNC Holdings LLC

- Suntory Holdings Ltd.

- Yakult Honsha Co., Ltd.

- The Coca?Cola Company

- Balchem Corp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Prevalence of Chronic Diseases Drives Demand

- 4.2.2 Growth In Geriatric Population Requiring Preventive Healthcare

- 4.2.3 Expansion of Functional Food And Beverage Offerings Boosts Demand

- 4.2.4 Increasing Fitness And Wellness Trends Among Millennials

- 4.2.5 Technological Advancements In Nutraceutical Formulations

- 4.2.6 Growing Adoption of Natural And Organic Ingredients

- 4.3 Market Restraints

- 4.3.1 Presence of Counterfeit Products

- 4.3.2 High Research and Development And Production Costs of Nutraceutical Products

- 4.3.3 Lack of Standardized Regulations Across Countries

- 4.3.4 Risk of Mislabeling And False Health Claims

- 4.4 Regulatory Outlook

- 4.5 Technology Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Functional Food

- 5.1.1.1 Cereal

- 5.1.1.2 Bakery and Confectionery

- 5.1.1.3 Dairy

- 5.1.1.4 Snack

- 5.1.1.5 Other Functional Foods

- 5.1.2 Functional Beverage

- 5.1.2.1 Energy Drink

- 5.1.2.2 Sports Drink

- 5.1.2.3 Fortified Juice

- 5.1.2.4 Dairy and Dairy-alternative Beverage

- 5.1.2.5 Other Functional Beverages

- 5.1.3 Dietary Supplements

- 5.1.3.1 Vitamins

- 5.1.3.2 Minerals

- 5.1.3.3 Botanicals

- 5.1.3.4 Enzymes

- 5.1.3.5 Fatty Acids

- 5.1.3.6 Proteins

- 5.1.3.7 Other Dietary Supplements

- 5.1.1 Functional Food

- 5.2 By Function

- 5.2.1 General Health

- 5.2.2 Weight Management

- 5.2.3 Sports Nutrition and Performance

- 5.2.4 Immunity and Digestive Health

- 5.2.5 Healthy Aging (Bone, Joint, Cognitive)

- 5.2.6 Women's Health

- 5.2.7 Other Applications

- 5.3 By End-User

- 5.3.1 Adults

- 5.3.2 Children

- 5.4 By Distribution Channel

- 5.4.1 Supermarkets/Hypermarkets

- 5.4.2 Convenience Stores

- 5.4.3 Specialty Stores

- 5.4.4 Drug Stores and Pharmacies

- 5.4.5 Online Retail Stores

- 5.4.6 Other Distribution Channels

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 Italy

- 5.5.2.4 France

- 5.5.2.5 Spain

- 5.5.2.6 Netherlands

- 5.5.2.7 Poland

- 5.5.2.8 Belgium

- 5.5.2.9 Sweden

- 5.5.2.10 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 Indonesia

- 5.5.3.6 South Korea

- 5.5.3.7 Thailand

- 5.5.3.8 Singapore

- 5.5.3.9 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Chile

- 5.5.4.5 Peru

- 5.5.4.6 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Nigeria

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Nestle S.A.

- 6.4.2 PepsiCo, Inc.

- 6.4.3 Herbalife Nutrition Ltd.,

- 6.4.4 General Mills, Inc.

- 6.4.5 Amway Corp.

- 6.4.6 WK Kellogg Co

- 6.4.7 Danone S.A.

- 6.4.8 Abbott Laboratories

- 6.4.9 Red Bull GmbH

- 6.4.10 Now Health Group, Inc.

- 6.4.11 Glanbia plc

- 6.4.12 Archer-Daniels-Midland Company

- 6.4.13 BASF SE

- 6.4.14 Koninklijke DSM N.V.

- 6.4.15 Bayer AG

- 6.4.16 GNC Holdings LLC

- 6.4.17 Suntory Holdings Ltd.

- 6.4.18 Yakult Honsha Co., Ltd.

- 6.4.19 The Coca?Cola Company

- 6.4.20 Balchem Corp.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK