PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1440123

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1440123

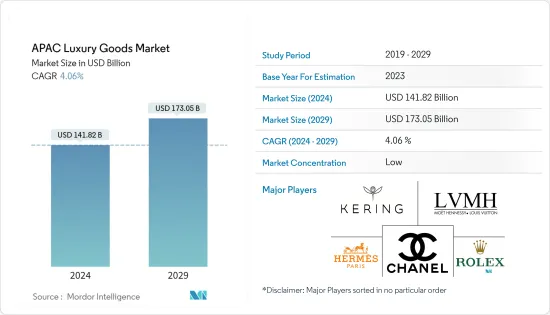

APAC Luxury Goods - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The APAC Luxury Goods Market size is estimated at USD 141.82 billion in 2024, and is expected to reach USD 173.05 billion by 2029, growing at a CAGR of 4.06% during the forecast period (2024-2029).

The Asia-Pacific region is the world's largest consumer of luxury products and has grown to be a significant market for international luxury brands. In the Asia-Pacific region, China and Japan rank among the top consumers of luxury goods and have the highest average per capita incomes. According to Alibaba, the sales of luxury goods in China increased from 11% to 20% in 2020 as compared to the overall share of the global industry.

The Asian luxury market is in flux, with consumers demanding luxury goods from different backgrounds and starting points. A steady economy, rapidly changing consumer trends, the growth of boutique luxury brands, and the massive shift from physical to digital channels are creating a new competitive landscape for the luxury goods market. Younger consumers are helping to drive changes in luxury consumption and attitudes. They are heavily fixated on sustainability, and most luxury consumers say they prefer brands that are socially responsible.

The COVID-19 epidemic had a big effect on the luxury goods market, especially in this part of the world where many people have been forced to stay home because of travel bans and lockdowns.

Asia Pacific Luxury Goods Market Trends

Rising Trend of Personalization and Customization of Goods

With the rising trend of personalization and customization, the players have started designing customized luxury goods to increase their customer base, resulting in an increase in sales volume. The key players in the Asia-Pacific region are using customer interaction platforms to get customers' feedback on a regular basis. For instance, XL Enterprises offers its customized leather goods under the name XL Fashions. XL Fashion's products are made using both traditional and modern manufacturing techniques. Specializing in customization and personalization, the company has developed working relationships with individuals and corporate customers. All leather goods are made to order, tailored to the customer's preferences, and can be personalized with their name, corporate logo, or monogram.

The majority of personalized luxury products are given as gifts on various occasions. Luxury handbag manufacturers continue to offer options for customers to customize the lining fabric, the colors of specific components, the hardware used on the bag, and even the pattern that the consumer wants to be displayed. Luxury goods customers appreciate being treated with the utmost care, and there are now more options to do it, particularly through digital channels, mobile apps, personalization in messages, and customer involvement. With the rising fashion consciousness, there is an increase in customer spending on personal goods. As a result, the key players operating in the market are focusing on offering a wide assortment of customized products in different styles, designs, and colors.

China Holds Largest Market Share

Spending in China's market is booming owing to solid consumer confidence and a willingness to buy, especially among the younger generations. These young consumers are well-informed about luxury and eager to embrace innovative trends, such as the convergence of high fashion and sportswear. The Chinese government's reduction in import duties and stricter controls over gray markets, combined with brands' efforts to narrow the price gap with overseas markets, have led more Chinese consumers to make their luxury purchases in China. According to a public survey, 46% of people preferred to buy smartphones in 2021, followed by 46% for clothing, 48% for shoes, and 31% for personal computers or laptops. Sustainability and digitalization are also factors augmenting the growth of the market. Chinese consumers are spending more on luxury goods as a result of an increase in disposable income. According to the National Bureau of Statistics, average annual income climbed nearly threefold from 37,000 yuan in 2010 to just under 100,000 yuan in 2020.

Asia Pacific Luxury Goods Industry Overview

The Asia-Pacific luxury goods market is fragmented with the presence of various companies. Some of the major players in the market are LVMH Moet Hennessy Louis Vuitton SE, Chanel SA, Rolex SA, Hermes International SA, and Kering SA. Emphasis is given to the merger, expansion, acquisition, and partnerships of the companies, along with the new product development, as a strategy adopted by the leading companies to boost their brand presence among consumers. Players in the market are diversifying their products and expanding their distribution circles, and they are experimenting through online channels to acquire a competitive edge in the market. For example, in May 2020, Alibaba Group Holding Ltd launched a new luxury platform aimed at young consumers, as well as assisting high-end brands in shedding excess inventory accumulated during the global COVID-19 pandemic. The company was piloting the new luxury Soho platform to run alongside its Tmall Luxury Pavilion flagship site. With Luxury Soho, brands can now move selected products and collections onto an online outlet store and bring them in front of a specific audience.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products and Services

- 4.3.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Clothing and Apparel

- 5.1.2 Footwear

- 5.1.3 Bags

- 5.1.4 Jewelry

- 5.1.5 Watches

- 5.1.6 Other Types

- 5.2 Distribution Channel

- 5.2.1 Single-branded Stores

- 5.2.2 Multi-brand Stores

- 5.2.3 Online Stores

- 5.2.4 Other Distribution Channels

- 5.3 Geography

- 5.3.1 China

- 5.3.2 Japan

- 5.3.3 India

- 5.3.4 Australia

- 5.3.5 South Korea

- 5.3.6 Rest of Asia-Pacific

6 Competitive Landscape

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 LVMH Moet Hennessy

- 6.3.2 Chanel SA

- 6.3.3 Hermes International SA

- 6.3.4 Kering SA

- 6.3.5 Rolex SA

- 6.3.6 Compagnie Financiere Richemont SA

- 6.3.7 Prada SpA

- 6.3.8 L'Oreal SA

- 6.3.9 The Estee Lauder Company

- 6.3.10 The Swatch Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS