PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1637922

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1637922

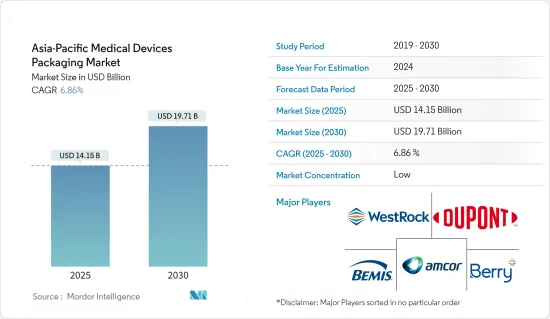

Asia-Pacific Medical Devices Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Asia-Pacific Medical Devices Packaging Market size is estimated at USD 14.15 billion in 2025, and is expected to reach USD 19.71 billion by 2030, at a CAGR of 6.86% during the forecast period (2025-2030).

The growing demand for medical devices due to increased healthcare expenditure in the public and private sectors and the stricter regulations are driving the Asia-Pacific medical devices packaging market.

Key Highlights

- Effective medical device packaging plays a pivotal role in safeguarding devices during distribution and their shelf life. Meticulous attention to the design of both the packaging material and type is paramount in the medical product development process. Proper packaging ensures that medical devices remain sterile, secure, and functional until they reach the end user. This involves selecting materials that can withstand various environmental conditions and handling processes, as well as designing packaging that is user-friendly and compliant with regulatory standards.

- The packaging for medical devices is broadly categorized into sterile packaging and non-sterile packaging. Sterile packaging is the type of packaging wherein the devices must also protect against contamination, in addition to protection against physical damage. Sterilization packaging must conform to standards and must guarantee sterility throughout the whole supply chain from production through to the operation room.

- Some medical devices, such as CT scanners, X-ray machines, surgical robots, cardiovascular equipment, and ultrasound devices, are sensitive and costly, thereby requiring appropriate packaging for proper distribution. More innovations are coming up in the packaging of these devices to make them tamper-evident and child-resistant. The industry is highly susceptible to government regulations, which vary with country.

- According to the United Nations, Asia-Pacific is home to some of the world's most populous countries and approximately 60% of the world's total population. The region is among the prime locations for the manufacturing and sourcing of medical devices. The presence of some of the key medical device manufacturers, such as Olympus, Sonic Healthcare, and Nipro, among others, is driving the demand for medical device packaging solutions in the region.

Asia-Pacific Medical Devices Packaging Market Trends

Plastic Segment Expected to Hold Significant Market Share

- Plastics, especially in the medical industry, serve a myriad of purposes, catering to both single-use and multi-use scenarios. Referred to as medical plastics, these materials offer a cost-effective avenue for producing crucial equipment, supplies, and tools in healthcare. The healthcare sector heavily leans on various medical-grade plastics, spearheading research into novel polymers and materials. This ongoing research is crucial for developing advanced medical solutions that can meet the ever-evolving demands of the healthcare industry.

- Given its durability and recyclability, medical plastics dominate in single-use items like syringes and tubes. Yet, their utility extends far beyond, encompassing applications such as prosthetics. Plastic, being versatile, sustainable, and cost-efficient, remains a cornerstone of the medical landscape, witnessing ongoing innovative applications. These innovations are not only enhancing the functionality of medical devices but also improving patient outcomes and operational efficiencies within healthcare facilities.

- Medical device packaging requires control over moisture, light barriers, and childproofing. The growth of polymers in medical devices has brought a considerable transformation to the medical device packaging industry. Plastic medical devices are steadily replacing other materials, such as glass, ceramics, and metals, owing to benefits such as greater flexibility and affordable price.

- Plastic has a long life and can be used for a wide range of applications, and the cost of the material used to make plastic products is less, thereby reducing the cost of manufacturing. Plastics are resistant to corrosion and shattering, and medical-grade plastics can be designed to handle repeated sterilizations. All these advantages allow the medical device manufacturers to significantly reduce their overhead costs, benefiting both the operations and the patients by offering services at a lower cost.

- PET, HDPE, PP, and vinyl are the most common plastics used in packaging medical devices. Medical device packaging providers are increasing their investments in developing sustainable packaging solutions due to the growing demand and stringent regulations. A similar approach is expected to be adopted by major packaging providers operating in Asia-Pacific to fulfill the growing demand for sustainable packaging solutions for medical devices.

- India's medical device exports, valued at USD 3.39 billion in 2022-23, are projected to surge to USD 10 billion by 2025, as per the India Brand Equity Foundation. To bolster these exports, the Ministry of Health and Family Welfare (MOHFW) and the Central Drugs Standard Control Organisation (CDSCO) have rolled out strategic initiatives. These efforts are poised to drive up the demand for advanced packaging solutions within the medical devices sector.

China is Likely to Occupy Maximum Market Share

- China is among the leading medical device manufacturers in the world. Traditionally, the Chinese medical devices market has been known for low-end consumables and mechanotherapy devices. The country was largely dependent on foreign imports to procure high-end medical devices. However, there has been a shift toward more domestically made high-value, high-risk devices in the country lately, owing to government-backed initiatives such as 'Made in China.'

- Along with the expanding base of the healthcare sector, China's medical devices market is developing at a significant pace. One of the driving factors for the increase in demand for high-end medical devices in China is the aging population.

- The United Nations Development Programme (UNDP) highlights China as one of the world's fastest-aging nations. In 2023, the country boasted 216.8 million individuals aged 65 or older, constituting 15.4% of its population. Projections from the ITA suggest that by 2025, China's population aged 60 and above will surpass 300 million. Moreover, the broadened medical insurance coverage has bolstered the demand for neurology and cardiovascular implants, especially as these sectors heavily rely on imported high-value consumables.

- The country also exports a major share of its locally manufactured devices across various regions, which is augmenting the demand for medical devices packaging in the country.

- Anticipated growth in both export volume and domestic consumption of medical devices is set to propel the country's medical device packaging market during the forecast period. The healthcare sector, often criticized for its plastic usage, faces a notable challenge with the substantial waste generated by single-use medical plastic items.

- Regional manufacturers are actively seeking ways to curb medical waste, focusing on designing single-use items that are more recyclable. Given the imperative to shield items like needles and medications from potential cross-contamination, medical plastics have emerged as the go-to choice for packaging. Plastic pouches can be hermetically sealed, offering protection to single-use items and negating the need for pre-use sterilization. Moreover, plastic bottles and containers are adept at safeguarding prescriptions from UV rays, humidity, and other damaging elements.

Asia-Pacific Medical Devices Packaging Industry Overview

The Asia-Pacific medical devices packaging market is fragmented, with a large number of players manufacturing varieties of packaging products for medical devices across the region. At the same time, the industry is witnessing mergers and acquisitions/consolidation of packaging players due to pressure on companies to reduce prices. Some of the major players operating in the region include Amcor PLC, Bemis Manufacturing Company, Berry Global Inc., and Mitsubishi Chemical Holdings.

- In February 2024, SK Chemicals, headquartered in South Korea, announced plans to enter the medical packaging market with the launch of a circular recycling initiative. MD&M, a prominent US exhibition for the medical device and manufacturing sector, serves as a platform for unveiling new technologies and products in medical device design and production. At MD&M, SK Chemicals will not only exhibit its traditional polyester, commonly found in medical essentials like PPE and medical device packaging, but will also showcase its latest materials, including SKYPET CR and ECOTRIA CR, which incorporate circular recycling principles.

- In May 2024, Oliver Healthcare Packaging began constructing its inaugural manufacturing plant in Johor, Malaysia, marking a significant expansion in the Asia-Pacific. This facility, set to become the company's largest in Asia, underscores its commitment to the region. Primarily focusing on innovative, flexible packaging, the plant aims to bolster Malaysia's burgeoning pharmaceutical and medical device sector. With an anticipated completion by the end of 2024, the facility is poised to play a pivotal role in the region's supply chain.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Industry Policies

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Medical Devices Market

- 5.1.2 Increasing Awareness Among the People About Better Packaging

- 5.2 Market Restraints

- 5.2.1 Market Pressure to Reduce Costs

- 5.3 Assessment of COVID-19 Impact on the Market

6 MARKET SEGMENTATION

- 6.1 By Packaging Type

- 6.1.1 Plastic Containers

- 6.1.2 Glass Containers

- 6.1.3 Lids

- 6.1.4 Pouches

- 6.1.5 Wrap Films

- 6.1.6 Paper Cans

- 6.1.7 Other Packaging Types

- 6.2 By Geography

- 6.2.1 China

- 6.2.2 Japan

- 6.2.3 India

- 6.2.4 Australia

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor PLC

- 7.1.2 Bemis Manufacturing Company

- 7.1.3 Berry Global Inc.

- 7.1.4 DuPont de Nemours Inc.

- 7.1.5 WestRock Company

- 7.1.6 SDG Pharma

- 7.1.7 Sonoco Products Company

- 7.1.8 Mitsubishi Chemical Holdings

- 7.1.9 3M

- 7.1.10 Technipaq Inc.

- 7.1.11 Steripack Group

- 7.1.12 CCL Industries Inc.

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET