PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1438260

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1438260

Europe Biofertilizers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

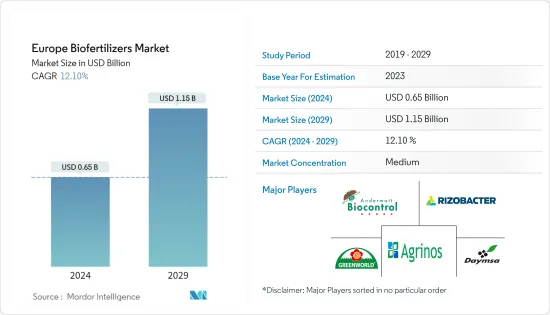

The Europe Biofertilizers Market size is estimated at USD 0.65 billion in 2024, and is expected to reach USD 1.15 billion by 2029, growing at a CAGR of 12.10% during the forecast period (2024-2029).

Key Highlights

- The European Union is continuously encouraging biofertilizers since they are cost-effective, advising the farmers to optimize the application of chemical fertilizers or replace them wholly or partly with eco-friendly ones to result in better economic returns. The EU Common Agricultural Policy promotes the adoption and use of bio-based products and organic farming. It provides up to 30% of the budget as direct green payments to farmers to maintain sustainable agricultural practices. The existing challenges, such as low nutrient and moisture presence in the soils and the growing environmental concerns, are paving the way for biofertilizers in the region. They are emerging as a potential solution to synchronize nutrient release as per the requirement of plants.

- Recently, the European Commission unveiled the European Green Deal, a roadmap for Europe to become a climate-neutral continent by 2050. These plans lead to sustainable practices, such as precision agriculture, organic farming, agroecology, agroforestry, and stricter animal welfare standards, which will positively influence the market. The accomplishment of the objectives of rural development, which contribute to Europe's 2020 strategy for smart, sustainable, and inclusive growth by improving soil management, preserving biodiversity, fostering knowledge transfer and innovation, and promoting resource efficiency, is also contributing to developing a favorable environment for biofertilizers.

- Furthermore, several players in the market are launching new products which are further fueling the biofertilizers growth in the region. For instance, Symborg launched a new biofertilizer product called Qlimax, an innovative soil energizer that performs as a prebiotic. Therefore, with the increasing adoption of modern techniques of agriculture and the increase in government and company initiatives in the region toward the adoption of sustainable agricultural practices and considering the aforementioned factors the Biofertilizers Market in Europe is expected to grow during the forecast period.

Europe Biofertilizer Market Trends

Adoption of Organic Farming Practice

A growing movement for sustainable agriculture emerged in recent years, promoting practices that reduce social and environmental concerns over agricultural practices. Over the last three decades, organic food and farming have grown year by year across Europe. In May 2020, the European Commission's Farm to Fork Strategy mentioned organic as a key sector to achieve the European Green Deal's food ambitions. The strategy states, "The market for organic food is set to continue growing, and organic farming needs to be further promoted.' As part of this strategy, the commission published the 2021-2027 Organic Action Plan, which aims to boost organic demand and supply.

Furthermore, increased institutional support is encouraging farmers to adopt organic farming. For instance, according to the Research Institute of Organic Agriculture (FiBL), the area under organic farming was 15.6 million hectares in 2018 which increased by approximately 9.6% and reached 17.1 million hectares in 2020. Moreover, the increasing concerns over food and environmental safety led to safer field application products such as Biofertilizer. Thus, the growing awareness of sustainable production across the regions led to increased adoption of biofertilizers in the region. Therefore, the market is anticipated to grow significantly over the forecast period. In addition to this, increasing incomes, along with improved farming practices, make organic yields more robust. Thus, the increasing demand for organic food has increased the area under organic farming, resulting in increased demand for biofertilizers.

Soil Treatment Dominates the Market

Europe has a great diversity of agricultural soils due to large variations in climate, geology, land uses, and crops. Inappropriate farming techniques have resulted in nitrogen losses, polluting soil, and surface and underground waters in most of its territory. In some regions, soil salinization is also a problem. As a result, several sustainable agricultural practices (SAPs) have been recommended to address these issues, including biofertilizers, as they would improve soil's physical qualities and biodiversity, potentially enhancing crop output.

The demand for high-quality food, export-based agriculture sector, and highly mechanized agricultural practices in the region propels farmers to opt for soil treatment products to maintain soil conditions. Stringent regulatory structures about the environment may help boost the sales of biofertilizers for soil treatment in the European markets.

According to the Joint Research Centre, European Commission, in Germany, more than 100 soil treatment plants are in operation, providing a total treatment capacity of almost 4 million metric ton per year. The country invests considerably toward treating the soil well for crop production by adopting soil remediation measures, the adaptation of usage of microbial biofertilizer, sustainable soil stress management, and other practices.

The use of biofertilizers for soil treatment is increasing in the region, as farmers are shifting to biological products to replace chemical fertilizers. Owing to this, biofertilizer companies in Europe are launching new and innovative products in the market. For instance, in March 2021, Daymsa, a Spanish agri-input manufacturing company, launched EnerPlus in Portugal. This is a new biofertilizer that promotes plant nutrition through the biological activation of the soil.

Therefore, the growing demand for the enhancement of soil quality in the region along with new product launches by players is boosting the growth of soil treatment using biofertilizers over the forecast period.

Europe Biofertilizer Industry Overview

The European biofertilizer market is fairly consolidated. Companies are adopting various strategies, such as product launches, partnerships, and acquisitions, to gain a larger share of the market. Investments in R&D and the introduction of new products are the primary strategies adopted by all major companies involved in the biofertilizer market. Some of the notable players in the market include ASB Greenworld, Agrinos AS, Rizobacter Argentina SA, and Andermatt Biocontrol AG.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Microorganism

- 5.1.1 Rhizobium

- 5.1.2 Azospirillum

- 5.1.3 Azotobacter

- 5.1.4 Blue-green Algae

- 5.1.5 Phosphate Solubilizing Bacteria

- 5.1.6 Mycorrhiza

- 5.1.7 Other Microorganisms

- 5.2 Application

- 5.2.1 Soil Treatment

- 5.2.2 Seed Treatment

- 5.2.3 Other Applications

- 5.3 Crop Type

- 5.3.1 Grains and Cereals

- 5.3.2 Pulses and Oilseeds

- 5.3.3 Commercial Crops

- 5.3.4 Fruits and Vegetables

- 5.3.5 Other Crop Types

- 5.4 Technology

- 5.4.1 Carrier-enriched Biofertilizers

- 5.4.2 Liquid Biofertilizers

- 5.4.3 Other Technologies

- 5.5 Geography

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 France

- 5.5.4 Spain

- 5.5.5 Italy

- 5.5.6 Russia

- 5.5.7 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Ficosterra SL

- 6.3.2 ASB Greenworld

- 6.3.3 Biocorrection AS

- 6.3.4 UAB Bioenergy

- 6.3.5 Symborg SL

- 6.3.6 Agrinos AS

- 6.3.7 Biomax Naturals

- 6.3.8 Rizobacter Argentina SA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS