PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644277

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644277

United Kingdom Office Furniture - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

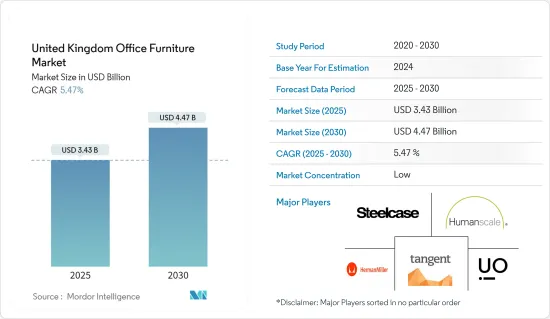

The United Kingdom Office Furniture Market size is estimated at USD 3.43 billion in 2025, and is expected to reach USD 4.47 billion by 2030, at a CAGR of 5.47% during the forecast period (2025-2030).

The United Kingdom ranks as the second-largest furniture market in Europe, with non-specialist retailers playing a dominant role in the distribution system. As the economy improves and business confidence rebounds, the demand for office furniture is growing, driven by increased expenditure on additional office space and furniture by expanding businesses in the country.

Office furniture is a significant segment of the UK furniture industry, characterized by a wide range of products catering to different office settings, including corporate offices, government buildings, educational institutions, and healthcare facilities. The UK office furniture market caters to the changing nature of workspaces. As companies move toward more flexible and collaborative work environments, there is a growing demand for office furniture that can adapt to these changes, including modular furniture that can be easily reconfigured and ergonomic furniture that promotes employee health and well-being.

United Kingdom Office Furniture Market Trends

Growing Flexible Office Spaces in the Country

The rise of flexible office spaces in the United Kingdom is reshaping the office furniture market. These spaces cater to evolving work styles, incorporating features like hot-desking, collaborative zones, and casual meeting areas. As a result, there is a growing demand for modular office furniture that is easily reconfigurable for diverse layouts and functions.

Moreover, with a focus on employee comfort and well-being, there is a surge in demand for ergonomic furniture. Items like height-adjustable desks, ergonomic chairs, and other furniture that promote movement and good posture are increasingly popular in these environments. This trend is driven by the recognition that a comfortable and adaptable workspace can enhance productivity and employee satisfaction.

The adoption of flexible office spaces is also influencing the supply chain dynamics within the office furniture market. Manufacturers and suppliers are now focusing on creating versatile and sustainable furniture solutions to meet the evolving needs of modern workplaces. The shift is also encouraging innovation in materials and design, leading to the development of furniture that is not only functional but also aesthetically pleasing and eco-friendly.

Rising Imports of Office Furniture in the United Kingdom

The UK market is witnessing a surge in office furniture imports, driven by an escalating demand for diverse and innovative offerings. As businesses increasingly prioritize ergonomic and visually appealing workspaces, the influx of imported furniture broadens the spectrum of styles, materials, and designs available, catering to a wide array of consumer preferences. Competitive pricing and the allure of high-quality international products further fuel this trend. The country's strong trade relationships and streamlined supply chains ensure a consistent influx of office furniture, adeptly addressing the dynamic needs of both traditional and adaptable office settings. As a result, these rising imports are expanding the market and intensifying competition among local manufacturers, prompting them to innovate and adapt to global trends. This competitive pressure encourages domestic producers to enhance their product offerings, invest in new technologies, and adopt sustainable practices to meet the high standards set by international products.

Additionally, the global supply chain for furniture has become more efficient, making it easier and more cost-effective for UK businesses to import furniture from abroad. This efficiency has led to a wider variety of furniture options being available in the UK market, including products that may need to be more readily available from domestic manufacturers. The streamlined supply chain processes reduce lead times and lower transportation costs, allowing businesses to respond quickly to market demands and consumer preferences. The integration of advanced logistics and inventory management systems ensures that imported furniture meets quality standards and regulatory requirements, providing consumers with reliable and diverse choices. This enhanced supply chain efficiency also supports the growth of e-commerce platforms, enabling consumers to access a broader range of office furniture products online, further driving market expansion.

United Kingdom Office Furniture Industry Overview

The UK office furniture market is fragmented with the presence of many players. Some businesses are broadening their product portfolios to include complementary items like office accessories or interior design services, thus increasing their clientele and revenue opportunities. Expanding into new geographic markets or targeting new customer segments can help companies grow their businesses and reduce dependence on any single market. The key players include Urban Office, Herman Miller, Steelcase, and Knoll.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Emergence of Flex Offices and Co-working Spaces

- 4.2.2 Rapid Setup of Business Parks and Commercial Areas

- 4.3 Market Restraints

- 4.3.1 Fluctuations in Raw Material Prices and Supply Chain Disruptions

- 4.3.2 A Shift Toward Remote and Flexible Working Practices

- 4.4 Market Opportunities

- 4.4.1 Rise in Online Retail Integration

- 4.4.2 Smart Office Furniture with Built-in Charging Points

- 4.5 Value Chain/Supply Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights of Technology Innovations in the Market

- 4.8 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Seating

- 5.1.2 Tables

- 5.1.3 Storage

- 5.1.4 Other Office Furniture

- 5.2 By Distribution Channel

- 5.2.1 Home Centers

- 5.2.2 Flagship Stores

- 5.2.3 Specialty Stores

- 5.2.4 Online Stores

- 5.2.5 Other Distribution Channels

6 COMPETITIVE LANDSCAPE

- 6.1 Market Competition Overview

- 6.2 Company Profiles

- 6.2.1 Herman Miller

- 6.2.2 SteelCase

- 6.2.3 HumanScale

- 6.2.4 Margolis Furniture

- 6.2.5 Flexiform Office Furniture

- 6.2.6 Knoll

- 6.2.7 Tangent Office Furniture

- 6.2.8 Metric Office Furniture

- 6.2.9 The Frem Group

- 6.2.10 Verve Workspace

- 6.2.11 Lee & Plumpton

- 6.2.12 Verco Office Furniture

- 6.2.13 Urban Office*

7 FUTURE MARKET TRENDS

8 DISCLAIMER AND ABOUT US