Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644556

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644556

US E-Commerce - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 100 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

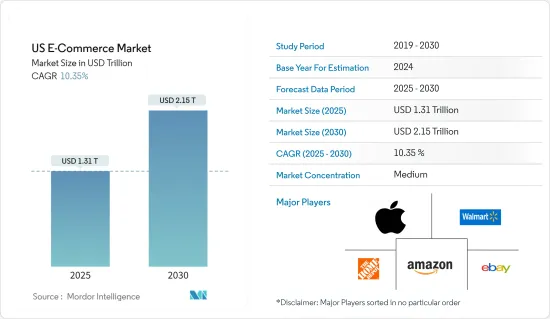

The US E-Commerce Market size is estimated at USD 1.31 trillion in 2025, and is expected to reach USD 2.15 trillion by 2030, at a CAGR of 10.35% during the forecast period (2025-2030).

Key Highlights

- The e-commerce market in the United States is highly developed owing to the presence of major market vendors and a growing number of online shoppers. In addition, Online shopping in the United States is gaining popularity owing to the growth in internet users shopping online, rising online shopping for beauty and fashion products, and the increase in mobile adoption and social media penetration.

- The country's e-commerce market is evolving rapidly, and one of the notable trends is the increasing use of digital payments for online shopping. This can be attributed to technological advancements, changing consumer preferences, and the overall growth of the e-commerce sector.

- Advanced technologies like artificial intelligence (AI) and machine learning (ML) are reshaping the US e-commerce market. For example, Brooks Brothers, the nation's oldest apparel brand, entered into a strategic collaboration with Metrical in November 2023. This partnership aims to bolster e-commerce sales by leveraging AI and ML to predict online shopper behavior. Metrical's AI/ML algorithms prioritize consumer privacy, operating anonymously without Personally Identifiable Information (PII).

- In the coming years, the growing presence of well-known and popular e-commerce companies in the country, coupled with technological innovation in the payment gateway landscape, will positively impact the e-commerce market by giving consumers a wide variety of products to purchase online and have them delivered to their address. The presence of various BNPL offering vendors in the country is expected to positively impact the growth of the e-commerce market, as these vendors offer consumers versatile payment methods such as Buy Now Pay Later (BNPL) for online shopping.

- According to the financial guidance platform NerdWallet, the popularity of Buy Now, Pay Later (BNPL) plans surged significantly. As per NerdWallet's '2024 State of Consumer Credit Report', BNPL plans rank as the second most utilized credit payment option among US consumers, with an adoption rate of nearly 25%. Such factors are expected to fuel market growth over the forecast period.

Us Ecommerce Market Trends

The B2C Segment is Expected to Hold a Significant Market Share

- The B2C segment is expected to hold a significant market share owing to the presence of major vendors offering products through this model. Notably, the fashion and apparel category is witnessing significant traction in the country, primarily from young consumers.

- The economy of the United States has become more diversified, consumers' lifestyles have improved, and the per capita income has increased. Global luxury companies, including Prada, Zara, and Louis Vuitton, have a significant presence in the country. A shift toward e-commerce is one of the most important shifts in the luxury market, as many consumers feel more at ease making purchases online. Further, high-end merchants provide omnichannel experiences, which combine online and offline channels and allow customers to transition between them without any hassle.

- The growing popularity of shopping online for clothing and fashion accessories among young consumers is expected to positively drive the sales of the fashion and apparel category over the forecast period. Moreover, various payment methods available on online B2C marketplaces in the country support the segment's growth by providing consumers with a wide variety of choices to pay for their online purchases.

- According to the survey by global payment firm Worldpay, e-wallets and digital/mobile wallets were the most popular payment method for online shopping in the United States, with a 37% market share in 2023. Further, E e-wallets and digital/mobile wallets are expected to hold a 52% market share by 2027. Credit and debit cards are other popular e-commerce payment methods in the United States.

High Internet Penetration and Smartphone Usage is Expected to Drive the Market

- The country has significantly high Internet and smartphone penetration. The rising popularity of mobile shopping in the US e-commerce market is a growing trend. Smartphones are the most popular platforms for online purchases in the United States.

- According to the data from GSMA Intelligence, there were 396.0 million cellular mobile connections in the United States at the start of 2024. Accordingly, mobile connection penetration was 116.2% of the total population in January 2024. Such high smartphone penetration is expected to positively impact the growth of the US e-commerce market over the forecast period.

- Mobile commerce has the potential to change consumers' shopping habits and establish itself as a significant commerce channel, and with high smartphone and Internet penetration in the country, the e-commerce market is witnessing significant growth. Consumers rely on digital devices such as smartphones more than ever before, and the growth in mobile commerce predicts that smartphones will become the preferred channel for online shopping in the country.

- Additionally, with the high Internet and smartphone penetration, consumer shopping behavior is rapidly changing, forcing e-commerce market vendors to offer innovative shopping apps and various digital payment transaction modes. Such factors are expected to drive the market's growth as consumers continue to opt for the ease and convenience of online shopping.

Us Ecommerce Market Leaders

The e-commerce market in the United States is semi-consolidated. Amazon, Walmart, and Best Buy are the top online retailers in the market. Amazon is the dominant player. Apple Inc. and Home Depot are some other major players in the market. These players are indulging in partnerships, acquisitions, and mergers to increase their market shares.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 90662

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness-Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Key market trends and share of E-commerce of total Retail sector

- 4.4 Impact of Macroeconomic Factors on the E-commerce sales

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand from Apparel and Footwear Industry

- 5.1.2 Rising Adoption of Advanced Technologies (IOT,ML)

- 5.1.3 High Penetration of Internet and Smartphone Usage

- 5.2 Market Challenges

- 5.2.1 High Cost of Internet

- 5.2.2 Data Privacy and Security Issues

- 5.3 Analysis of key demographic trends and patterns related to E-commerce industry in United States (Coverage to include Population, Internet Penetration, E-commerce Penetration, Age & Income etc.)

- 5.4 Analysis of the key modes of transaction in the E-commerce industry in United States (coverage to include prevalent modes of payment such as cash, card, bank transfer, wallets, etc.)

- 5.5 Analysis of cross-border E-commerce industry in United States (Current market value of cross-border & key trends)

- 5.6 Current positioning of country United States in the E-commerce industry in region North America

6 Market Segmentation

- 6.1 By B2C E-commerce

- 6.1.1 Market size (GMV) for the period of 2022-2029

- 6.1.2 Market Segmentation - by Application

- 6.1.2.1 Beauty & Personal Care

- 6.1.2.2 Consumer Electronics

- 6.1.2.3 Fashion & Apparel

- 6.1.2.4 Food & Beverage

- 6.1.2.5 Furniture & Home

- 6.1.2.6 Others (Toys, DIY, Media, etc.)

- 6.2 By B2B E-commerce

- 6.2.1 Market size for the period of 2022-2029

7 Competitive Landscape

- 7.1 Company Profiles

- 7.1.1 Amazon.com, Inc.

- 7.1.2 Walmart

- 7.1.3 eBay Inc

- 7.1.4 Apple Inc.

- 7.1.5 Home Depot

- 7.1.6 Shopify Inc.

- 7.1.7 Costco Wholesale Corporation

- 7.1.8 Target Corporaton

- 7.1.9 Best Buy

- 7.1.10 Wayfair

- 7.1.11 The Kroger Company

8 Investment Analysis

9 Future Outlook of the Market

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.