PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644442

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644442

United States Home Office Furniture - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

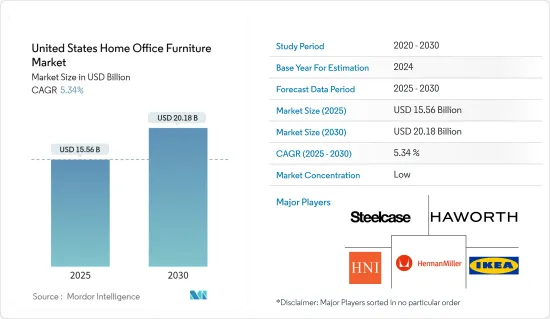

The United States Home Office Furniture Market size is estimated at USD 15.56 billion in 2025, and is expected to reach USD 20.18 billion by 2030, at a CAGR of 5.34% during the forecast period (2025-2030).

The rise in the number of people working from home /remote places is driving the demand for home office furniture's category for various retailers and manufacturers alike. Smart, comfortable, and flexible furniture designs attract customers with easy and fast delivery options. Some market trends include ergonomics in furniture with multiple functions and designs that blend well with interiors. Desks with technological innovations, such as adjustable sit and stand functions, wireless charging tables, chairs, and shelving units, are major selling points.

Demand for home furniture has increased due to people's need to move around and settle down. The demand for smart home furniture is also expected to grow significantly. The deterioration of furniture quality has caused people to buy home furniture in the United States. With low lending rates and online stores opening up in emerging economies, the market share of home furniture is likely to grow quickly. The US market is adapting to changing trends and is seeing more competition from new players. Consumers are looking for modern and contemporary furniture, eco-friendly furniture, and smart furniture with integrated features. People are also looking for multi-purpose and foldable furniture that is technology-driven, especially in small spaces. Personalization options are also important for meeting the needs of individual consumers. Home Office Furniture is important in today's family and work environment. They serve various purposes, such as kids doing school projects, families working on a home budget or researching online, and people working from home in the office.

US Home Office Furniture Market Trends

Desks and Chairs Furniture Industry Expanding Continuously

Office chairs are an integral part of the home office workspace and can be a matter of balancing style with the support features that make it more comfortable for sitting over a length of time. With employees spending more than 8-10 hours a day being occupied at work, proper seating becomes very crucial. Chairs must be built on scientific lines to avoid ill health and fatigue, as office chairs greatly influence correct posture while at work and consequently influence health. In the United States, there is also an increasing demand for ergonomic chairs, which helps in enhancing employee productivity, efficiency, and aesthetics of the workplace. American customers prefer to buy high-quality furniture that not only possesses a great look but is made up of high-quality materials.

Ecommerce is Driving the Market

Increased penetration of the internet and a rise in the use of smartphones and consumer banking systems have led to the growth of e-commerce. Therefore, most furniture manufacturers feel encouraged to sell their products online as e-commerce is gaining traction in the country. Manufacturers are offering their products through various leading e-commerce giants such as Amazon, Wayfair, and others. Also, the benefits of online stores, such as low pricing and availability of a variety of products, are believed to impetus the growth of home office furniture products through online stores.

US Home Office Furniture Industry Overview

The United States home office furniture industry is fragmented in nature. The report covers major international players operating in the United States home office furniture market. Regarding market share, some of the major players currently dominate the market. However, with technological advancement and product innovation, mid-size to smaller companies are increasing their market presence by securing new contracts and by tapping new markets. Some major players are Herman Miller, Inc., Steelcase, Inc., IKEA, Haworth, Inc., and HNI Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Tech-Integrated Furniture are Helping to Grow the Market

- 4.3 Market Restraints

- 4.3.1 Raw Material Cost Barrier to Growth

- 4.4 Market Opportunities

- 4.4.1 Demand for Versatile and Multi-functional Pieces

- 4.5 Value Chain / Supply Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Technological Innovations

- 4.8 Impact of COVID-19 on the Market

- 4.9 Consumer Behavior Analysis

5 MARKET SEGMENTATION

- 5.1 Product

- 5.1.1 Seating

- 5.1.2 Storage Units

- 5.1.3 Desks and Tables

- 5.1.4 Other Home Office Furniture

- 5.2 Distribution Channel

- 5.2.1 Flagship Stores

- 5.2.2 Specialty Stores

- 5.2.3 Online

- 5.2.4 Other Distribution Channels

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Herman Miller, Inc.

- 6.2.2 Steelcase Inc.

- 6.2.3 IKEA

- 6.2.4 Haworth Inc.

- 6.2.5 Knoll, Inc

- 6.2.6 Ashley Home Stores, Ltd.

- 6.2.7 HNI Corporation

- 6.2.8 Kimball International

- 6.2.9 Krueger International, Inc.

- 6.2.10 Teknion Corporation*

7 FUTURE TRENDS OF THE MARKET

8 DISCLAIMER