PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1440422

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1440422

Vietnam Luxury Residential Real Estate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

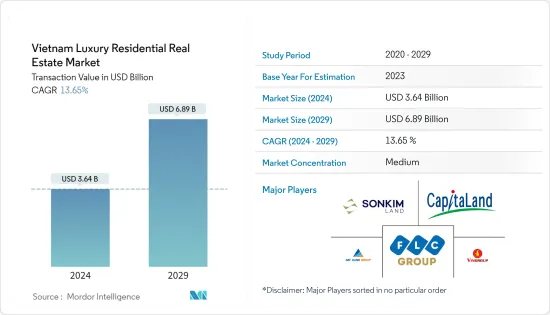

The Vietnam Luxury Residential Real Estate Market size in terms of transaction value is expected to grow from USD 3.64 billion in 2024 to USD 6.89 billion by 2029, at a CAGR of 13.65% during the forecast period (2024-2029).

Real estate prices, particularly rents, dropped much during the COVID-19 pandemic, pushing developers and agents to the limit. With travel restrictions, agents were forced to focus primarily on local buyers due to the few remaining foreigners. Despite the downturn, deals were made in the market for those who worked with experienced and credible partners with boots on the ground. Particularly high demand has been seen for distressed luxury units that can fetch prices that are 20% lower than usual.

Vietnam is emerging as a thriving real estate market in Southeast Asia, with HCMC (Ho Chi Minh City) being among the locations where housing prices are increasing rapidly. Vietnam is among the 10 fastest-growing property markets in the upscale segment. Vietnam is also emerging as a country with rapid growth in affluence and demand for upscale properties. However, the spurt in prices and supply, which shows no signs of stopping, is causing concern about luxury apartments and branded residences developing too fast, causing the market to overheat.

The number of local and international customers in the luxury apartment market is rising in Vietnam. Vietnam has begun to be seen as the next luxury property market hotspot, with a booming economy coupled with laws that recently have made it easier for foreigners to buy. As a result, wealthy international investors have been drawn to the country. The burgeoning middle-and upper-classes and the inflow of foreign talents emerging in Vietnam have stimulated the demand for high-quality residences. In the meantime, property prices in neighboring countries such as Hong Kong, Thailand, Taiwan, and Singapore are becoming too expensive. For example, a luxury apartment in a prime location in HCMC costs around USD 5,000 per square meter. In contrast, the same apartment can cost four times more in Singapore and Hong Kong, making Vietnam an ideal destination for investors.

In 2022, the Vietnamese real estate market saw ups and downs, and many businesses in the sector were compelled to restructure by reducing expenses and staff. The post-pandemic economic recovery in the nation and early indications of a recovery in the sector marked the beginning of the year. However, the market started to stall in the second quarter of 2022.

Only approximately 1,250 units were available during the third quarter, and trading decreased to under 52%. Only 450 units were up for main sale in the city in the last quarter, and only roughly 100 apartments were sold. The HCMC Real Estate Association reports that the cost of homes has increased over the previous five years (HoREA). The highest affordable housing unit pricing is around USD 84,620, roughly 20 times more than the average Vietnamese worker's yearly wage.

Vietnam Luxury Residential Real Estate Market Trends

Increasing Rich Population driving the Demand for Urban Branded Residences

In the latest New World Wealth 2021 Estate Trends report, high-net-worth people seek a private, secure place, lifestyle, community, facilities, and controlled traffic. These are the critical characteristics offered by urban branded residences. Therefore, the increase in the affluent population will boost the demand for urban branded residences in Vietnam.

In the future, with the rapid growth of the rich population in Vietnam and the need to improve the quality of life, the urban development of Ho Chi Minh City with the planning of the central area and the expansion to the East to Thu Duc City will contribute to the activation of branded products in the urban area, especially near Metro stations No. 1. These new urban branded residences will meet the strict requirements and standards from their wealthy residents.

According to The Wealth Report 2021, Vietnam will have 25,812 high-net-worth individuals (HNWI) with assets worth at least USD 1 million and 50 ultra-high-net-worth persons (UHNWI) with net worths of at least USD 30 million a piece by the year 2025. Asset values have soared due to falling interest rates and increased fiscal stimulus, increasing the global UHNWI population by 2.4% to over 520,000 over the past year. North America and Europe witnessed the process, but Asia experienced a true resurgence with its 12% increase.

Luxury Apartments in Ho Chi Minh City (HCMC) Showing a Record High Price Growth

The price of luxury apartments in prime HCMC locations like District 1 and the newly established Thu Duc City has hit VND 100-400 million (USD 4,300-17,400) per square meter. The initial price of a luxury apartment project in District 1's Da Kao Ward was around USD 6,500-8,000 per square meter in 2018, the highest price for an apartment project. As of April 2021, the price has surged to USD 7,500-9,800 per square meter.

At a recently launched luxury apartment project on Ton Duc Thang Street, which runs alongside the Saigon River in District 1, apartments are priced at USD 18,000 per square meter, the highest Q1 rate in the country. Luxury apartment prices in the Saigon riverside area have soared by around 50% in two years. The highest-priced apartment project in the erstwhile Thu Duc District, located on Vo Van Nghia Street, has a price tag of USD 4,000 per square meter. The average price of luxury apartment projects in HCMC hit USD 6,898 per square meter in Q1, up 4.7% year-on-year, according to real estate consultancy CBRE Vietnam.

Vietnam Luxury Residential Real Estate Industry Overview

Vietnam's luxury residential real estate market is relatively fragmented, with local and global players existing in the market. Key players in the market are leveraging partnerships, acquisitions, and mergers to capture the market share. Some of the major players in the market include SonKim Land, Dat Xanh Group, FLC Group, Vingroup, and CapitaLand.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Dynamics

- 4.2.1 Drivers

- 4.2.1.1 Incremental urbanization rate accelerates Vietnam's demand for luxury residential real estate

- 4.2.1.2 Growing middle-class buyers drive the market

- 4.2.2 Restraints

- 4.2.2.1 High imbalance in population versus real estate index

- 4.2.3 Opportunities

- 4.2.3.1 Increase in foreign demand and foreign investments

- 4.2.1 Drivers

- 4.3 Value Chain / Supply Chain Analysis

- 4.4 Industry Policies and Regulations

- 4.5 Technological Developments in the Sector

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Apartments and Condominiums

- 5.1.2 Villas and Landed Houses

- 5.2 By City

- 5.2.1 Ho Chi Minh City

- 5.2.2 Ha Noi

- 5.2.3 Other Cities

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 SonKim Land

- 6.2.2 Dat Xanh Group

- 6.2.3 Vingroup

- 6.2.4 CapitaLand

- 6.2.5 Hung Thinh Real Estate Business Investment Corporation

- 6.2.6 NovaLand

- 6.2.7 Phat Dat Real Estate Development Corporation

- 6.2.8 Phu My Hung

- 6.2.9 Nam Long Investment Corporation

- 6.2.10 Masterise Homes Real Estate Development Company Limited

- 6.2.11 Filmore Real Estate Development Corporation*

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 APPENDIX