PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910943

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910943

Artificial Intelligence - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

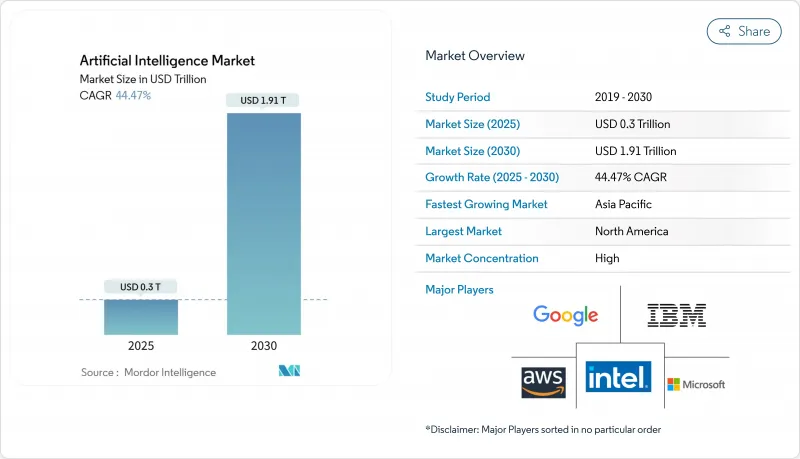

The artificial intelligence market is expected to grow from USD 306.04 billion in 2025 to USD 434.42 billion in 2026 and is forecast to reach USD 2,503.13 billion by 2031 at 41.95% CAGR over 2026-2031.

Sovereign AI programs, enterprise cost-optimization, and rapid hardware innovation are moving the technology from experimental pilots into core production workflows, fuelling sustained demand across every major sector. On-premise deployments are regaining traction because large organisations want direct control over total cost of ownership and data governance. At the same time, cloud hyperscalers are investing heavily in new capacity, ensuring that development environments remain easily accessible. GPU advances, energy-efficient architectures, and tighter integration between hardware and software stacks are shortening time to value and sharpening competitive differentiation.

Global Artificial Intelligence Market Trends and Insights

Sovereign AI and national compute programs

Government funding is shaping local ecosystems. India's IndiaAI Mission is channeling INR 10,372 crore (USD 124.5 million) into indigenous large language models that meet local language needs. Japan is mobilising JPY 10 trillion for AI and semiconductor capacity, signalling a long-term commitment to self-reliance. Such investments create protected demand for domestic hardware vendors and systems integrators that can comply with localisation rules.

Explosive growth in data volume and variety

Industrial IoT rollouts generate terabytes of sensor data daily, pushing enterprises to adopt AI-driven analytics. Siemens reports 90% touchless invoice processing and USD 5.65 million annual ROI after embedding machine learning into its finance operations. Healthcare imaging, autonomous vehicles, and real-time retail transactions all add to the data deluge, driving up demand for scalable storage, edge processing, and synthetic data generation tools.

GPU and power-grid supply bottlenecks

NVIDIA cited persistent H100 shortages in its FY 2026 outlook, a constraint that has inflated spot prices 30-50% above MSRP and slowed enterprise deployment cycles. Power utilities forecast that data-center electricity demand could hit 1,050 TWh by 2026, exceeding planned capacity additions in several major regions, which in turn pressures project timelines for new AI clusters.

Other drivers and restraints analyzed in the detailed report include:

- Surging adoption of cloud-based AI services

- Shift toward on-prem or private AI for TCO control

- High capex and talent shortages

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Software retained 61.35% revenue share in 2025, reinforcing its foundational role in the artificial intelligence market. Yet the Services segment is forecast to race ahead at 40.85% CAGR through 2031 as enterprises shift focus from experimentation to full-scale implementation. Many regulated industries now require vendors that can interpret compliance mandates and redesign workflows, rather than merely deliver licenses. The scarcity of qualified integrators, therefore, enables service providers to command premium pricing, especially for domain-specific projects in healthcare and financial services.

Across consulting, integration, and managed-services lines, vendors with vertical expertise are preferred. In radiology, service partnerships that combine data-governance, algorithm validation, and clinician workflow redesign are returning 451% ROI for hospital groups over five years. Specialists that package hardware, software, and advisory support into outcome-based contracts are moving up the value chain as customers measure projects against concrete productivity targets rather than abstract model accuracy.

Public Cloud held 43.72% of artificial intelligence market share in 2025, reflecting its role as the default development environment. Hybrid models, however, are projected to compound at 45.55% CAGR to 2031 as organizations seek latency optimization and cost visibility in production. Early adopters run training on hyperscale clusters then push inferencing to on-prem or edge devices for real-time response. Automotive OEMs validate this architecture by executing millisecond-level vision tasks on factory floors while retaining cloud elasticity for model retraining.

Edge rollouts are equally important in resource-constrained settings such as offshore rigs or retail outlets where bandwidth is expensive. On-prem deployments are resurging within finance and public-sector agencies that face strict data-residency mandates. Hardware suppliers now bundle orchestration software that migrates containers across clouds, on-prem racks, and edge devices based on policy rules, ensuring the artificial intelligence market size for hybrid solutions remains on an upward trajectory.

The AI Market Report Segments the Industry Into by Component (Hardware, Software, and Services), Deployment Mode (Public Cloud, On-Premise, and Hybrid), Technology (Machine Learning, Deep Learning, Natural Language Processing, Computer Vision, Generative AI, and Context-Aware Computing and Others), End-User Industry (BFSI, IT and Telecommunications, Healthcare and Life Sciences, Manufacturing, and More), and Geography.

Geography Analysis

North America remained the revenue leader with 37.12% share in 2025 thanks to deep venture capital pools, mature cloud ecosystems, and rapid enterprise adoption. Federal programs such as the CHIPS and Science Act funnel additional funding into AI-ready fabs, supporting domestic hardware supply and reinforcing the artificial intelligence market. High-performance computing clusters in Virginia, Texas, and Oregon continue to attract software start-ups that co-locate near cloud availability zones for lower latency.

Europe's growth profile is shaped by the twin forces of strict data-privacy regulation and sizable sovereign compute budgets. GDPR compliant architectures push vendors to localize inference workloads inside regional borders, creating demand for on-prem GPU appliances. France's public-private initiative around Mistral AI gained a €2 billion valuation in 2025 and aims to raise USD 1 billion to scale multilingual model training. Similar programs in Germany and the Nordics focus on green-data-center footprints that align with ambitious carbon-reduction targets, sustaining double-digit regional growth for the artificial intelligence market.

Asia-Pacific is projected to register a 40.75% CAGR through 2031, the fastest worldwide. China's National Semiconductor Mission allocates RMB 1 trillion by 2030 for chips and supporting infrastructure, while India earmarks INR10,372 crore for national AI compute, propelling domestic integrators into global rankings. Japan's multi-trillion-yen fund fast-tracks fab upgrades and light-touch AI regulation that accelerates time to commercial deployment. Southeast Asian economies, including Singapore and Malaysia, are introducing data-center tax incentives that entice hyperscalers to anchor regional hubs, further enlarging the artificial intelligence market size in the region.

- International Business Machines Corporation

- Intel Corporation

- Microsoft Corporation

- Google LLC (Alphabet Inc.)

- Amazon Web Services, Inc. (Amazon.com, Inc.)

- Oracle Corporation

- Salesforce, Inc.

- SAP SE

- SAS Institute Inc.

- Cisco Systems, Inc.

- Siemens AG

- NVIDIA Corporation

- Hewlett Packard Enterprise Company

- Accenture plc

- Baidu, Inc.

- Alibaba Cloud (Intelligent Cloud Business of Alibaba Group Holding Limited)

- Palantir Technologies Inc.

- OpenAI, Inc.

- Meta Platforms, Inc.

- Huawei Technologies Co., Ltd.

- Tencent Holdings Limited

- ServiceNow, Inc.

- Snowflake Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for predictive analytics

- 4.2.2 Explosive growth in data volume/variety

- 4.2.3 Surging adoption of cloud-based AI services

- 4.2.4 Sovereign AI and national compute initiatives

- 4.2.5 Shift toward on-prem/private AI for TCO control

- 4.2.6 Demand for energy-efficient AI hardware

- 4.3 Market Restraints

- 4.3.1 High capex and talent shortages

- 4.3.2 Data-privacy and compliance barriers

- 4.3.3 GPU / power-grid supply bottlenecks

- 4.3.4 Data-center carbon-emission caps

- 4.4 Evaluation of Critical Regulatory Framework

- 4.5 Value Chain Analysis

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Impact Assessment of Key Stakeholders

- 4.9 Key Use Cases and Case Studies

- 4.10 Impact on Macroeconomic Factors of the Market

- 4.11 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By Deployment Mode

- 5.2.1 Public Cloud

- 5.2.2 On-Premise

- 5.2.3 Hybrid

- 5.3 By Technology

- 5.3.1 Machine Learning

- 5.3.2 Deep Learning

- 5.3.3 Natural Language Processing

- 5.3.4 Computer Vision

- 5.3.5 Generative AI

- 5.3.6 Context-Aware Computing and Others

- 5.4 By End-user Industry

- 5.4.1 BFSI

- 5.4.2 IT and Telecommunications

- 5.4.3 Healthcare and Life Sciences

- 5.4.4 Manufacturing

- 5.4.5 Retail and E-commerce

- 5.4.6 Automotive and Transportation

- 5.4.7 Government and Defense

- 5.4.8 Energy and Utilities

- 5.4.9 Media and Entertainment

- 5.4.10 Construction

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Nordics

- 5.5.3.7 Rest of Europe

- 5.5.4 Middle East and Africa

- 5.5.4.1 Middle East

- 5.5.4.1.1 Saudi Arabia

- 5.5.4.1.2 United Arab Emirates

- 5.5.4.1.3 Turkey

- 5.5.4.1.4 Rest of Middle East

- 5.5.4.2 Africa

- 5.5.4.2.1 South Africa

- 5.5.4.2.2 Egypt

- 5.5.4.2.3 Nigeria

- 5.5.4.2.4 Rest of Africa

- 5.5.4.1 Middle East

- 5.5.5 Asia-Pacific

- 5.5.5.1 China

- 5.5.5.2 India

- 5.5.5.3 Japan

- 5.5.5.4 South Korea

- 5.5.5.5 ASEAN

- 5.5.5.6 Australia

- 5.5.5.7 New Zealand

- 5.5.5.8 Rest of Asia-Pacific

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 International Business Machines Corporation

- 6.4.2 Intel Corporation

- 6.4.3 Microsoft Corporation

- 6.4.4 Google LLC (Alphabet Inc.)

- 6.4.5 Amazon Web Services, Inc. (Amazon.com, Inc.)

- 6.4.6 Oracle Corporation

- 6.4.7 Salesforce, Inc.

- 6.4.8 SAP SE

- 6.4.9 SAS Institute Inc.

- 6.4.10 Cisco Systems, Inc.

- 6.4.11 Siemens AG

- 6.4.12 NVIDIA Corporation

- 6.4.13 Hewlett Packard Enterprise Company

- 6.4.14 Accenture plc

- 6.4.15 Baidu, Inc.

- 6.4.16 Alibaba Cloud (Intelligent Cloud Business of Alibaba Group Holding Limited)

- 6.4.17 Palantir Technologies Inc.

- 6.4.18 OpenAI, Inc.

- 6.4.19 Meta Platforms, Inc.

- 6.4.20 Huawei Technologies Co., Ltd.

- 6.4.21 Tencent Holdings Limited

- 6.4.22 ServiceNow, Inc.

- 6.4.23 Snowflake Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment