PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1692489

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1692489

MEA Management Consulting Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

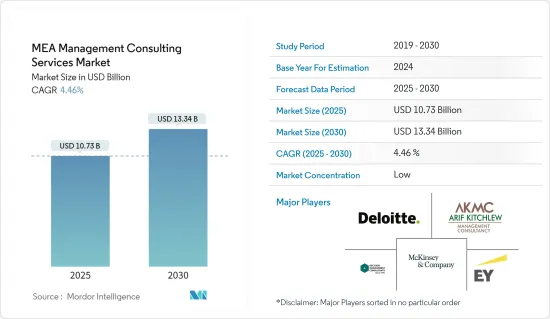

The MEA Management Consulting Services Market size is estimated at USD 10.73 billion in 2025, and is expected to reach USD 13.34 billion by 2030, at a CAGR of 4.46% during the forecast period (2025-2030).

Key Highlights

- Management consulting firms provide services that help organizations improve their efficiency. The firms analyze the operations and understand the existing organizational inefficiencies ranging from the high cost of raw materials to HR policies in the organization, after which the firm uses its expertise to develop a plan to tackle all the issues in the best possible way.

- With growing competition in the market in various industries, profit margins are shrinking, and one of the ideal ways to improve profits is through increasing organizational performance. Considering the wealth of experience these consulting firms bring to competing businesses; these organizations need access to management consulting services.

- There is an increased need for management consulting services due to the market's strong economic development and regulatory changes in the financial sector in countries like Saudi Arabia and the United Arab Emirates. Faster economic growth due to the diversification of the economy, the introduction of digital consulting owing to the growing digital transformation initiatives in the MEA region, and the increase of globalization are expected to accelerate the market's growth.

- Growing investments in emerging technologies are boosting companies' growth strategies, which is a primary driver for the management consulting market in the region. These technological advancements in end-user industries such as energy, financial services, telecom, government, and healthcare are driving the demand for management consulting firms to support these companies by offering operations, technology, and strategy services to help them with their growth strategy and provide value.

- As organizations in the MEA region embrace digital technologies, management consulting firms must keep pace with these changes and develop new expertise and skills in areas such as AI, big data, and automation, which are expected to drive the demand for management consulting services at a rapid pace during the forecast period.

- Growing investments in innovative technologies, adoption of business intelligence and sophisticated data management methods by various organizations, economic change, government-led diversification projects, and digitalization, among others, are the key driving factors in the Middle East and African management consulting services market. However, a shift in the consulting marketplace may hamper growth as new virtual business models with advanced technologies adopted from emerging consulting firms offer more value. In addition, faster service delivery with added value may increase the complexity for management consulting firms.

- The COVID-19 pandemic negatively impacted multiple industries, including the management consulting services market in the region. During the pandemic, the management consulting services industry witnessed a fall in revenue. The primary cause of this fall was cautious clients cutting discretionary expenditures to reduce expenses by putting projects on hold or canceling non-strategic projects entirely. However, the growth in digitalization across industries and the public sector due to the COVID-19 pandemic has spurred the demand for strategy and operations consulting in the MEA region.

MEA Management Consulting Services Market Trends

Financial Services to be the Fastest Growing End-user Industry

- Financial service companies in the Middle East & Africa, including banks, insurance companies, and fintech companies, have a growing interest in the opportunities and risks of decentralized finance. Competition in the region's banking sector intensifies as customer demands and expectations increase.

- The financial services in the management consulting services include financial strategy and planning, financial risk management, financial performance improvement, financial transformation, merger and acquisition (M&A) advisory, capital markets and financing, treasury, cash management, financial compliance and regulatory advisory, and financial technology (FinTech) consulting.

- Among countries, the United Arab Emirates may hold significant management consulting activity owing to its strategic location, thriving economy, and emphasis on economic diversification. The UAE, particularly Dubai and Abu Dhabi, has been a significant hub for business and finance in the MEA region.

- Moreover, the UAE banking sector is set for further vibrant growth in 2024 despite global headwinds, with the total assets of banks operating in the country surging by 11% Y-o-Y to a record AED 4.1 trillion (USD 1.12 trillion) in 2023, the Central Bank of the UAE (CBUAE) report.

- In the last quarter of 2023, banks' total assets increased by 3.1% Q-o-Q while total deposits of resident and non-resident customers with UAE banks rose by 4.2% Q-o-Q and 13.5% Y-o-Y to reach AED 2.5 trillion (USD 0.68 trillion) at the end of December 2023. Such significant growth would indicate the adoption of substantial management consulting services.

- Under Vision 2030, the Financial Sector Development Program (FSDP) issued new initiatives and responsibilities to be achieved by 2025 to bring the Kingdom closer to its 2030 goals. A central strategic pillar is to enable financial organizations to support the growth of the private sector. Such initiatives are expected to create potential opportunities for various management consulting firms in the country, thereby propelling market growth in the coming years.

- The growth of fintech startups and the increasing adoption of financial technology solutions are expected to offer opportunities for management consultants to assist traditional financial institutions in partnering with or integrating fintech solutions into their operations. This can involve advising on strategic partnerships, assessing technology infrastructure, and developing innovation strategies.

- AI, machine learning, and automation trends will increase in the financial services sector. These technologies can enhance operational efficiency, streamline processes, enable personalized customer experiences, and improve risk management. Management consultants can assist organizations in implementing AI and automation solutions, optimizing processes, and managing the associated organizational and workforce changes.

Saudi Arabia is Expected to Hold Significant Market Share

- The management consulting services market in Saudi Arabia is driven by the government and business strategies to diversify the economy. The consulting vendors in the region have contributed significantly to these businesses by providing strategic advice, operational improvements, and technology deployments, which presents an opportunity for market vendors in the country.

- The Saudi Vision 2030 is a comprehensive strategy to minimize the country's dependency on oil and build new economic sectors. The Saudi management consulting firms are developing strategies to support the planned initiatives to enhance infrastructure expansion, public services, renewable energy, and digital transformation.

- The life sciences and healthcare segment is observing a solid demand for management consulting services in Saudi Arabia owing to the advancing patient experience, care quality, and digitization of the healthcare system, creating opportunities for local vendors in strategic consulting and technology advising in healthcare.

- The MEA region has a growing population and increasing healthcare needs. There is a demand for improved healthcare infrastructure, access to quality healthcare services, and better healthcare outcomes. Management consulting firms are crucial in advising healthcare organizations on strategic planning, operational efficiency, and process optimization to meet the rising demand effectively.

- Among countries, Saudi Arabia is expected to register significant growth rates during the forecast period. Saudi Arabia has been investing heavily in its healthcare sector and has ambitious plans for its development. According to WHO, in 2023, Saudi Arabia's expenditure on healthcare totaled USD 63.8 billion. Further, it was estimated to be around USD 77.1 billion by 2027.

- Saudi Arabian businesses require management consulting services to create plans for expanding into new areas, streamlining operations, and increasing market competitiveness. Businesses are growing their market share by developing new offices, partnerships, acquisitions, and mergers of companies.

- Management consulting firms are expanding their business in the country to address the demand for strategic consultancy services, which shows the market's growth potential in the coming years. Management consulting firms are accelerating their expansion rate in the Saudi market to help government agencies achieve Vision 2030's goals by creating specific strategic priorities and initiatives. They are further working with corporate and government leaders on transformation programs across various industries, including human capital development, enhanced sustainability, and the launch of new firms.

- Therefore, the economy of Saudi Arabia has been going through a significant revolution, and several industries are poised to boom significantly in the next few years. Numerous industries, including healthcare, retail, energy, and manufacturing, have received significant investments and are expected to grow in the future, accelerating the growth of the service requirements of the management consulting market vendors in the country.

MEA Management Consulting Services Industry Overview

The Middle East and Africa management consulting services market is fragmented with the presence of major players like Ernst & Young Global Limited, Deloitte Touche Tohmatsu Limited, Mckinsey & Company, Arif Kitchlew Management Consultancy (AKMC), and Decision Management Consultants LLC. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

March 2024: PwC is investing heavily in its managed services business in the Middle East. The company plans to add over 1,000 staff to the arm's current headcount in the region, building on the significant expansion of its managed services business globally. PwC will invest in its existing delivery centers in Dubai (UAE), Khobar (Saudi Arabia), Amman (Jordan), and Cairo (Egypt) and will also establish several new facilities over the next three years.

March 2024: Deloitte, one of the leading global professional services firms, announced its plans to establish the ServiceNow Public Sector Innovation Center at the Deloitte Digital Center in Riyadh, Saudi Arabia. The announcement was made on the opening day of LEAP, the flagship technology event in the Kingdom of Saudi Arabia.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Investments in Emerging Technologies are Boosting Companies Growth Strategy

- 5.1.2 Adoption of BI and Advanced Data Management Strategies Across Multiple End-user Domains

- 5.2 Market Restraints

- 5.2.1 Shift in the Consulting Marketplace is Hampering New Business Strategy

- 5.3 Trend Analysis of the Various Sectors of Financial Advisory Services

- 5.4 Analysis of the Growing Use of Data Analytics in Management Consultancy Services Globally

- 5.5 Analysis of the Impact of Industry 4.0 and Digital Transformation-related Practices on the Market

6 MARKET SEGMENTATION

- 6.1 By Service Type

- 6.1.1 Operations Consulting

- 6.1.2 Strategy Consulting

- 6.1.3 Financial Advisory

- 6.1.4 Technology Advisory

- 6.1.5 Other Service Types

- 6.2 By End-user Industry

- 6.2.1 Financial Services

- 6.2.2 Life Sciences And Healthcare

- 6.2.3 IT and Telecommunications

- 6.2.4 Government

- 6.2.5 Energy

- 6.2.6 Other End-user Industries

- 6.3 By Country

- 6.3.1 Saudi Arabia

- 6.3.2 United Arab Emirates

- 6.3.3 Qatar

- 6.3.4 South Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Ernst & Young Global Limited

- 7.1.2 Deloitte Touche Tohmatsu Limited

- 7.1.3 Mckinsey & Company

- 7.1.4 Arif Kitchlew Management Consultancy (AKMC)

- 7.1.5 Decision Management Consultants LLC

- 7.1.6 Proclipse Consulting

- 7.1.7 Alpha Equity Management Consultancy

- 7.1.8 Varri Consultancy

- 7.1.9 Kaizen Consulting Group DMCC

- 7.1.10 A&Z Management Consultants

- 7.1.11 Affility Consulting

- 7.1.12 NH Management

- 7.1.13 Pricewaterhousecoopers LLP

- 7.1.14 KPMG

8 VENDOR RANKING ANALYSIS

9 INVESTMENT ANALYSIS

10 MARKET OPPORTUNITIES AND FUTURE TRENDS