PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1692492

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1692492

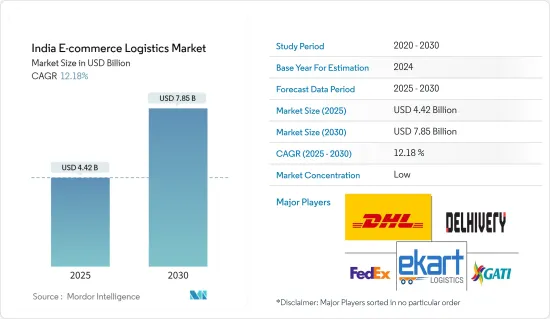

India E-commerce Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The India E-commerce Logistics Market size is estimated at USD 4.42 billion in 2025, and is expected to reach USD 7.85 billion by 2030, at a CAGR of 12.18% during the forecast period (2025-2030).

During the first wave of COVID-19, many retailers shut down their stores as their revenue was hit instantly. However, it started to adapt gradually. As per the India Brand Equity Foundation, an Indian government export promotion agency, online penetration of retail is expected to reach 10.7% by 2024 compared to 4.7% in 2019, due to which many retailers started working on click-and-collect services and started partnering with logistics companies to keep their business moving forward. As the demand for door deliveries has increased, retailers are facilitating order deliveries with logistics companies to comfort companies and retailers.

India's retail market is expected to witness an annual growth rate of 10% with USD 1.6 trillion by 2026, as per the Federation of Indian Chambers of Commerce & Industry (FICCI), a non-governmental trade association and advocacy group based in India. The Indian retail market accounts for 10% of the country's gross domestic product (GDP) and around 8% of employment. India is the world's fifth-largest global destination in retail, leading to several new players' entries. In the next five years, online stores are expected to grow drastically and become equal to physical stores.

Since online retailers depend more on 3PL service providers, it is expected to influence the Indian e-commerce logistics sector positively.

India E-commerce Logistics Market Trends

The Growth of E-commerce Sales is Driving the Expansion of the Market

The Indian e-commerce market is growing predominantly and is expected to surpass the United States to become the second-largest e-commerce market in the world by 2034, as per the India Brand Equity Foundation. The Indian e-commerce market is expected to reach USD 197 billion by 2027 from USD 102.75 billion in 2023.

The e-commerce business helps the sellers sell globally and market the business using marketing tools that help create, execute, and analyze campaigns on Facebook and Google. The sellers can use a single dashboard to manage orders, shipping, and payments, which is highly flexible. The improvement of consumer experiences in e-commerce stores is evident through the same-day delivery process and flexible options. Due to these efficiencies, there is continuous growth in e-commerce sales across the existing and upcoming years.

The number of players entering the e-commerce industry is gradually increasing due to the expectation of increased penetration on the internet and smartphone users. Online retailers are partnering with third-party logistics (3PL) providers to manage issues related to delivery, such as inventory, packaging, shipping, warehousing, and tracking. This is directly contributing to the revenue of the logistics industry.

The Number of Internet Users in India is Increasing

Statista expects the number of internet users to reach 1,232.33 million by 2027. It is estimated to increase in urban and rural regions, indicating dynamic growth in access to the Internet. India is the second largest online market globally, ranking only behind China, according to a report by the Internet and Mobile Association of India (IAMAI). Due to the increase in mobile connectivity, growth in the purchasing behavior of women, and penetration in rural areas, the number of users has increased gradually.

The Digital India program drove the number of internet users to 692 million in 2023, per the India Brand Equity Foundation data. Of the total internet connections, 55% were in urban areas, 97% were wireless. The number of smartphone users in India is expected to reach 887.4 million by 2030, which shows an increase in users. India has the highest data consumption rate worldwide, at 14.1 GB of data per person a month.

India E-commerce Logistics Industry Overview

The competitive landscape of the Indian e-commerce logistics market is fragmented; as the demand for logistics services is growing rapidly across the region, companies are becoming more competitive to capture the huge opportunity. Policy support from the Indian government has allowed 100% FDI in B2B e-commerce, and the recent rise in digital literacy has led to new international players setting up their bases in India. This has, in turn, led the international logistics players to make strategic investments by establishing a regional logistics network, such as opening new distribution centers and smart warehouses. Some of the leading players include FedEx Corporation, DHL, and Aramex.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Technological Trends in the Industry

- 4.3 Government Initiatives and Regulations

- 4.4 Insights into the E-commerce

- 4.5 Value Chain/Supply Chain Analysis

- 4.6 Demand and Supply Analysis

- 4.7 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Internet and Smart Phone Penetration

- 5.1.2 Urbanization and Lifestyle Changes

- 5.1.3 Government Initiatives

- 5.2 Market Restraints

- 5.2.1 Poor Infrastructure and Last Mile Delivery

- 5.3 Opportunities

- 5.3.1 Investments in the Logistic Infrastructure

- 5.3.2 Cross-Border E-commerce and Reverse Logistics

- 5.3.3 Collaborations with E-commerce Companies

- 5.4 Porter's Five Forces Analysis

- 5.4.1 Threat of New Entrants

- 5.4.2 Bargaining Power of Buyers/Consumers

- 5.4.3 Bargaining Power of Suppliers

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Service

- 6.1.1 Transportation

- 6.1.2 Warehousing and Inventory Management

- 6.1.3 Value-added Services (Labeling, Packaging )

- 6.2 By Business

- 6.2.1 By B2B

- 6.2.2 By B2C

- 6.3 By Destination

- 6.3.1 Domestic

- 6.3.2 International/Cross Border

- 6.4 By Product

- 6.4.1 Fashion and Appareal

- 6.4.2 Consumer Electronics

- 6.4.3 Home Appliances

- 6.4.4 Furniture

- 6.4.5 Beauty and Personal Care Products

- 6.4.6 Other Products (Toys, Food Products, Etc.)

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration Overview

- 7.2 Company Profiles

- 7.2.1 FedEx Corporation

- 7.2.2 Delhivery Pvt. Ltd

- 7.2.3 Ekart Logistics

- 7.2.4 Blue Dart Express Ltd

- 7.2.5 Shadowfax

- 7.2.6 Xpress Bees

- 7.2.7 DTDC

- 7.2.8 Ecom Express Logistics

- 7.2.9 Gati-Kintetsu Express Private Limited

- 7.2.10 DHL

- 7.2.11 Mahindra Logistics Ltd *

- 7.3 Other Companies

8 FUTURE OF THE MARKET

9 APPENDIX

- 9.1 Macroeconomic Indicators (GDP Distribution by Activity, Contribution of Transport and Storage Sector to Economy)?

- 9.2 Insights on Capital Flows (Investments in the Transport and Storage Sector)

- 9.3 E-commerce and Consumer Spending-related Statistics

- 9.4 External Trade Statistics - Exports and Imports, by Product and by Country of Destination/Origin