PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408420

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408420

Canada Data Center Rack - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2030

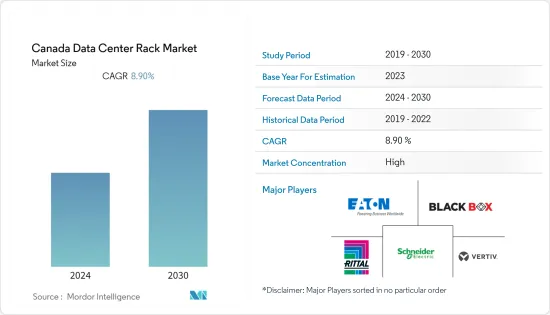

The Canadian data center rack market reached a volume of over 173,000 units in the previous year, and it is further projected to register a CAGR of 8.9% during the forecast period. The increasing demand for cloud computing among SMEs, government regulations for local data security, and growing investment by domestic players are some of the major factors driving the demand for data centers in the country.

Under Construction IT Load Capacity: The upcoming IT load capacity of the Canada data center rack market is expected to reach 1,150 MW by 2029.

Under Construction Raised Floor Space: The country's construction of raised floor area is expected to increase to 5.1 million sq. ft by 2029.

Planned Racks: The country's total number of racks to be installed is expected to reach 289,000 units by 2029. Quebec is expected to house the maximum number of racks by 2029.

Planned Submarine Cables: There are close to 16 submarine cable systems connecting Canada, and many are under construction.

Canada Data Center Rack Market Trends

Cloud segment to hold major share in the market

- The COVID-19 pandemic saw the economic impact of companies that entered the digital transformation early, either by offering digital products and services or by leveraging digital processes, more economically than their peers that gradually embraced digital transformation.

- In the early days of the pandemic, after years of increasing adoption, public cloud adoption became mainstream. Canada's public cloud market revenues will likely continue to total USD 5,213.5 million, projected to increase by 46.42% from 2023 to 2027. Revenue is expected to grow to USD 16.4 billion by 2027 for the fourth year in a row. It is worth noting that the public cloud market revenue has increased steadily in recent years.

- Cloud storage in Canada is growing due to the growing demand for cost-effective data backup, storage, and protection across all businesses and the need to manage data generated by the increasing use of mobiles.

- Cloud infrastructure offers capabilities such as increased scalability and flexibility to better serve your customers with minimal downtime. Enterprises are migrating from traditional complex infrastructures to cloud infrastructures, and data center usage is expected to increase during the forecast period.

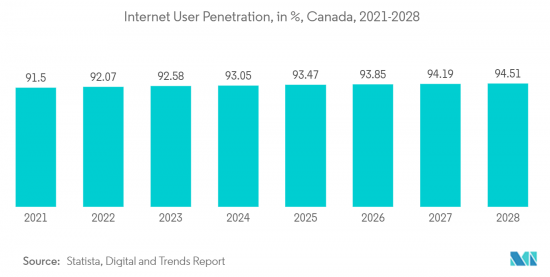

- With the rise of the digital economy and increased internet usage in Canada, the need for data storage and processing has increased. The proliferation of hybrid cloud service providers has increased demand for colocation services and increased rack utilization.

Full rack segment to hold major share in the market

- In Canada, full racks hold a large share of the market due to the growing space shortage between various companies.

- Increased use of IoT platforms by varying sectors, such as manufacturing, agriculture, and cities, has contributed to the growing data consumption, which has triggered the demand for full-rack data centers in Canada.

- With the rise of business continuity services 24 hours a day, tier-3 and tier-4 data centers have increasingly become more popular due to the ever-growing number of conglomerates. This increases the use of a number of racks and indicates the use of full racks to incorporate such data.

- In order to better serve their customers, clients have to raise their rack capacities as a result of the population's adoption of other devices. In addition, they have to ensure the availability of the appropriate speeds owing to the 5G launch. As a result, the nation adopted cloud computing, internet penetration, and fiber technologies.

- In January 2023, 93.8% of the Canadian population accessed the internet. Online penetration among individuals in Canada has increased over the past periods, as in 2019, the percentage of people accessing the internet in the country was around 91%. This corresponds to the use of a data center with full racks.

Canada Data Center Rack Industry Overview

The Canadian Data center racks market is relatively low in terms of competition and has a few players in the market, such as Eaton Corporation, Black Box Corporation, Rittal GMBH & Co.KG, Schneider Electric SE, Vertiv Group Corp. These major players focus on expanding their customer base in the country. These companies leverage strategic collaborative initiatives to increase their market share and profitability. The increase in the data center construction corresponds to increasing demand for the number of racks in the data centers.

In June 2022, Cologix announced its continued strategic partnership with Console Connect by PCCW Global by deploying the Console Connect Software-Defined Interconnection platform at Cologix's TOR1 data center in Toronto. This marked Console Connect's second PoP within Cologix's Canadian market and interconnection ecosystem. The first was available in December 2021 at Cologix's MTL7 data center in Montreal.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Dynamics

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increased Migration to Cloud-based Business Operations

- 4.2.2 Internet Adoption and Information Technology Services to Boost Market Progress

- 4.3 Market Restraints

- 4.3.1 Low Availability of Resources

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Buyers/Consumers

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of COVID-19 Impact

5 MARKET SEGMENTATION

- 5.1 Rack Size

- 5.1.1 Quarter Rack

- 5.1.2 Half Rack

- 5.1.3 Full Rack

- 5.2 End-User

- 5.2.1 IT & Telecommunication

- 5.2.2 BFSI

- 5.2.3 Government

- 5.2.4 Media & Entertainment

- 5.2.5 Other End-Users

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Eaton Corporation

- 6.1.2 Black Box Corporation

- 6.1.3 Rittal GMBH & Co.KG

- 6.1.4 Schneider Electric SE

- 6.1.5 Vertiv Group Corp.

- 6.1.6 Dell Inc.

- 6.1.7 nVent Electric PLC

- 6.1.8 Hewlett Packard Enterprise

- 6.1.9 Tevelec Limited

- 6.1.10 Sysracks.com

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS