PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408498

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408498

Antibiotic Resistance - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

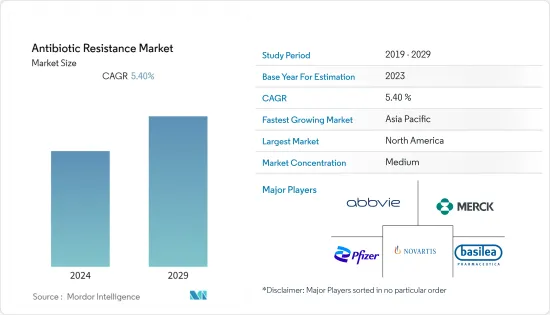

The antibiotic resistance market was valued at USD 8.5 billion in the base year and is expected to be valued at USD 10.5 billion, registering a CAGR of 5.4 over the forecast period.

The COVID-19 pandemic had an impact on the antibiotic resistance market. As per an article published in March 2022 by the Pan American Health Organization, the COVID-19 pandemic fueled the ongoing antimicrobial resistance (AMR) global crisis due to the increase in the use of antibiotics to treat COVID-19 patients. Moreover, disruptions to infection prevention and control practices in overwhelmed health systems and diversion of human and financial resources away from monitoring and responding to AMR threats. Therefore, the market witnessed high growth during the pandemic. However, as per the study published in March 2023 by the National Library of Medicine, emerging data from the United States Centers for Disease Control and Prevention suggests the pandemic has resulted in rising rates of AMR, including carbapenem-resistant Acinetobacter and extended-spectrum beta-lactamase-producing Enterobacterales. Therefore, it is expected to observe high growth after the pandemic.

The increasing burden of antibiotic-resistant infections across developed & developing regions and a shift in prescription patterns to newly launched therapies are the key drivers of the market. Moreover, the increasing involvement of Government and non-government bodies in developing novel therapies is anticipated to drive market growth. The high burden of antibiotic-resistant infections is a major concern globally. For instance, as per the CDC's data published in October 2022, in the United States, more than 2.8 million antimicrobial-resistant infections occur each year. More than 35,000 people die as a result of antibiotic resistance.

Moreover, in February 2023, the Australian Government raised USD 6 million in funds for research into antimicrobial resistance and reducing the incidence of hospital infections. This grant opportunity was announced as part of the Medical Research Future Fund (MRFF) under the Global Health Initiative. Thus, such initiatives taken by the Government are expected to boost the market's growth over the forecast period.

Some major companies operating in the AMR are adopting several strategies, such as collaboration and acquisition, along with various launches to strengthen their positions in the market. For instance, in January 2023, Alkem Laboratories launched an antibiotic, Zidavi, for multiple drug-resistant (MDR) infections. Moreover, in January 2023, Molbio Diagnostics launched Truenat MTB-INH for testing the presence of isoniazid resistance in Mycobacterium tuberculosis in infection (MDR-TB). The test is validated by ICMR and approved by CDSCO, which can provide sample-to-test results in an hour.

However, strict safety guidelines and the high cost of AMR therapeutics are expected to hinder the market's growth.

Antibiotic Resistance Market Trends

Complicated UTIs Segment Expected to Hold a Major Share in the Market

The prevalence of complicated UTIs is expected to hold a major share in the market, owing to the rise in drug-resistant bacteria and excessive use of antibiotics. A complicated UTI is any urinary tract infection other than a simple UTI. Therefore, all urinary tract infections in immunocompromised patients, males, and those associated with fevers, stones, sepsis, urinary obstruction, catheters, or involving the kidneys are considered complicated infections.

As per the study published in May 2023 in the National Library of Medicine, morbidity and mortality associated with UTI were shown to be 150 million cases globally per year. Moreover, per the study published in February 2021, triple resistance occurs in 1 in 8 patients hospitalized with cUTI. Overall, the burden of complicated UTIs is set to increase during the forecast period, mainly owing to the increasing bacterial resistance in UTI cases and the rise in the recurrence rate.

In October 2021, Spero Therapeutics Inc. submitted a new drug application (NDA) to the US Food and Drug Administration (FDA), seeking approval for tebipenem HBr tablets for the treatment of complicated urinary tract infections (cUTI), including pyelonephritis, caused by susceptible microorganisms.

Therefore, owing to factors such as the rising burden of complicated UTIs and increasing pipeline activities to treat complicated UTIs, the segment is expected to witness significant growth in the future.

North America Would Hold a Significant Market Share Over the Forecast Period

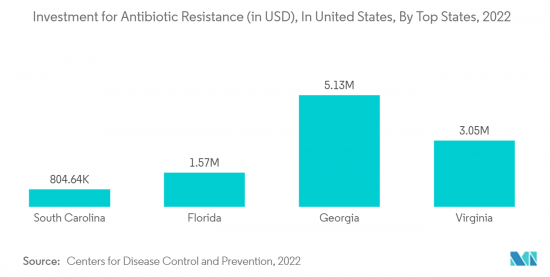

North America is expected to dominate the antibiotic resistance market over the forecast period. The market is growing in the region due to the high population resistant to antibiotics, high consumption of antibiotics, and increasing funding for research and development.

The increasing burden of antibiotic resistance in the region is expected to increase the demand for its therapy, which is expected to boost the market's growth over the forecast period. For instance, as per an article published in Global News in November 2022, in Canada, about 26% of infections that occur are resistant to first-line antibiotics. Resistance is expected to grow exponentially in the coming years, from 40% to 100% resistance to first-line antibiotics and antifungals by 2050. Thus, the increasing burden of antibiotic resistance in the country is expected to drive the growth of the antibiotic resistance market over the forecast period.

Moreover, increased funding and awards for AMR projects are expected to boost the market's growth in the region. For instance, in December 2021, the CDC awarded USD 22 million to 28 organizations in more than 50 countries by establishing the Global Action in Healthcare Network (GAIHN) and the Global Antimicrobial Resistance (AR) Laboratory and Response Network. The networks will focus on preventing and limiting the spread of drug-resistant infections in healthcare settings, building laboratory capacity to detect and understand emerging resistant organisms in the community and the environment, and developing methods to identify and respond to resistant pathogens more quickly. Thus, such initiatives are expected to boost the market's growth over the forecast period.

Therefore, the studied market growth is anticipated in the North American region due to the factors above.

Antibiotic Resistance Industry Overview

The antibiotic resistance market is moderately consolidated. Increased innovation and investment for various public and private organizations are expected to intensify industry rivalry worldwide. They are also collaborating with other players to develop and promote their products and thus gain recognition in the market. The major players in the studied market are AbbVie, Merck & Co. Inc., Pfizer Inc., Novartis AG, Basilea Pharmaceutica Ltd., and others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 High Burden of Antibiotic Resistant Infections

- 4.2.2 Increase in Global Initiatives Drives New Drug Development

- 4.3 Market Restraints

- 4.3.1 Strict Safety Guidelines

- 4.3.2 High Cost of AMR Therapeutics

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers/Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD)

- 5.1 By Disease

- 5.1.1 Clostridioides Difficile Infection (CDI)

- 5.1.2 Complicated Intra-Abdominal Infection (cIAI)

- 5.1.3 Acute Bacterial Skin and Skin Structure Infections (ABSSSI)

- 5.1.4 Hospital-Acquired and Ventilator-Associated Bacterial Pneumonias (HABP)

- 5.1.5 Complicated Urinary Tract Infection (cUTI)

- 5.1.6 Community-Acquired Pneumonia (CABP)

- 5.1.7 Bloodstream Infection (BSI)

- 5.2 By Pathogen

- 5.2.1 Acinetobacter baumannii

- 5.2.2 Staphylococcus aureus

- 5.2.3 Pseudomonas aeruginosa

- 5.2.4 Haemophilus influenzae

- 5.2.5 E. Coli

- 5.2.6 Other Pathogens

- 5.3 By Drug Class

- 5.3.1 Tetracyclines

- 5.3.2 Oxazolidinones

- 5.3.3 Cephalosporins

- 5.3.4 Lipoglycopeptides

- 5.3.5 Combination therpaies

- 5.3.6 Other Drug Classes

- 5.4 By Mechanism of Action

- 5.4.1 Cell Wall Synthesis Inhibitors

- 5.4.2 Protein Synthesis Inhibitors

- 5.4.3 DNA Synthesis Inhibitors

- 5.4.4 RNA synthesis inhibitors

- 5.4.5 Other Mechanisms of Action

- 5.5 By Distribution Channel

- 5.5.1 Hospital Pharmacies

- 5.5.2 Retail Pharmacies

- 5.5.3 Online Pharmacies

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East and Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 AbbVie

- 6.1.2 Merck & Co. Inc.

- 6.1.3 Pfizer Inc

- 6.1.4 Novartis AG

- 6.1.5 Basilea Pharmaceutica Ltd.

- 6.1.6 MELINTA THERAPEUTICS

- 6.1.7 Theravance Biopharma

- 6.1.8 WOCKHARDT

- 6.1.9 Entasis therapeutics

- 6.1.10 Paratek Pharmaceuticals, Inc.

- 6.1.11 Seres Therapeutics

7 MARKET OPPORTUNITIES AND FUTURE TRENDS