PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408749

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408749

ASEAN Satellite Imagery Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

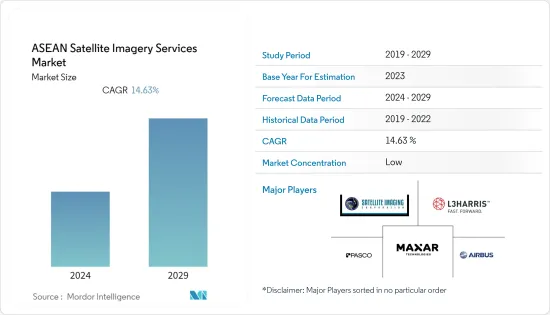

The ASEAN satellite imagery services market was valued at USD 0.10 billion in the previous year and is expected to register a CAGR of 14.63%, reaching USD 0.23 billion by the next five years.

Key Highlights

- The ASEAN satellite imagery services market. Benefits of satellite imageries in a wide range of applications such as monitoring large areas of dense forests, analyzing comparisons of land covers at different times, classifying the vegetation through spectral and texture analyses, and threat monitoring in military and defense sectors, bolstering the growth of the ASEAN satellite imagery services market growth.

- Growing demand for images with different spatial resolutions, from low to high, for use in environmental assessment, mapping, forestry management, disaster assessment, and urban monitoring bolstered the demand for low-resolution Satellite images. High-resolution imagery is growing for detailed information on small objects such as buildings, streets, rivers, and trees, which are useful for applications such as transportation network mapping, disaster management, urban planning, and farming.

- In ASEAN nations, Satellite images are utilized to study various elevations and topographical features across geographical areas. Satellite imagery helps to analyze agricultural fields where farmers can monitor their crops' health. Researchers are scientists across the ASEAN nation, adopting satellite imagery and data to monitor environmental changes to forecast weather or natural disasters. The rapid development of intelligent cities in Jakarta (Indonesia), Hanoi (Vietnam), Singapore (Singapore), and Kuala Lumpur (Malaysia), among others, have accelerated the demand for satellite imagery services for city planners to plan new residential areas for communities.

- Satellite imagery services are increasingly used in transportation, studying traffic, and facilitating the planning of new road networks in many ASEAN nations. The telecom sector is also witnessing rapid growth in satellite imagery services as broadband connectivity for users on airplanes, ships, and vehicles in stationary and moving locations is gaining a solid foothold. Requirements for constant connectivity throughout big cities and sparsely populated regions are surging the demand for research utilizing data from satellite imagery.

- However, regulatory hindrances and complex licensing procedures can hamper the growth of satellite imagery services in the ASEAN region. Different countries within ASEAN may have varying regulations and requirements for satellite imagery, making it difficult for companies to operate consistently across borders. Further, in some ASEAN countries, limited infrastructure, particularly in rural areas, can restrict the use and distribution of satellite imagery services. This limitation can affect the accessibility of such services to a wider audience.

- Space assets are crucial in enhancing monitoring and analysis across various areas post-COVID-19. Satellite imagery and the global positioning system technology assist in post-pandemic planning and the distribution of healthcare solutions in many low and middle-income countries. Telemedicine has served an essential role in mitigating the pandemic by providing constant medical care even in remote locations. In the space sector, satellite imagery and satellite-based communication have been at the forefront of enhancing telemedicine and expanding healthcare to rural and remote areas across many ASEAN countries.

ASEAN Satellite Imagery Services Market Trends

Military and Defense to drive the market growth

- Satellite imagery enhances defense and security programs by enabling local governments to understand situations and programs better to protect lives and property and enhance the economic stability of the nation. Threats such as terrorism and information attacks on critical infrastructure, potential use of weapons of mass destruction, and the spread of infectious diseases cause massive casualties and disruption to a country. Satellite images capture essential information about such criminal activities across the region.

- Satellite imagery increases a country's crime-fighting capabilities due to the efficiency and speed of data retrieval and crime analysis. High-resolution satellite imagery and GIS (geographic information system) data are witnessing a surge in demand as they allow analysts to identify hot spots and patterns for crime mapping.

- Demands for mapping applications have become necessary in law enforcement agencies worldwide. Thus, satellite imaging service providers are striving to provide geospatial products and services for government agencies for a wide range of defense and security mapping applications. Satellite imaging experts assist in feature extraction and manipulation of satellite image data through advanced remote sensing techniques.

- Satellite imagery services are critical to Homeland Security because they enable supervisors and emergency personnel to integrate multiple information types into a common visual application. Deep learning processing, such as convolutional neural network (CNN) algorithms, is suitable for temporal satellite imagery analysis and provides timely results. Advancements such as 3D terrain visualization models for geographical areas assist in flight training, battlefield management, mission rehearsal, research, and other activities.

- This year, the 16th Edition of the Langkawi International Maritime and Aerospace Exhibition (LIMA) conference officially commenced in Langkawi, Malaysia. The exhibition was focused on defense and military applications of aerospace and maritime, highlighting space technology development and innovation. The Langkawi International Space Forum (LISF) was introduced as part of the Ministry of Science, Technology, and Innovation of Malaysia (MOSTI) 's efforts to increase awareness of space within the region. The government of Malaysia supported the Space Industry Strategic Plan 2030 (SISP) and the Malaysia Space Exploration 2030 (MSE) blueprint to promote the growth of the space sector in Malaysia with a contribution of 1% of GDP in 2030, projected to be MYR 10 billion (USD 2.4 billion).

- Moreover, according to the Stockholm International Peace Research Institute (SIPRI), military expenditure across the Southeast Asia region significantly increased from USD 20.3 billion in 2020 to USD 4.62 billion in 2022. Furthermore, Singapore's government spending on the military was significant among other countries in the region registering around 16.91% in 2022. Such significant spending among countries in the region would substantially enhance the sector's adoption of satellite imagery services.

- Overall, the rising demand for satellite imagery in military and defense for intelligence gathering, as well as the utilization of high-resolution images to access valuable information about enemy troop movements, military installations, and other strategic assets, is expected to propel the market growth during the forecast period.

Thailand is Expected to propel the market growth

- The ASEAN nations are witnessing remarkable growth in space technology for applications such as disaster management, agriculture, and tourism. Advancements in Earth observation satellites are helping the ASEAN nations better monitor disputed areas and handle conflicts through accurate mapping.

- Vietnam is among the significant spenders in space programs within the ASEAN group, along with Indonesia, Thailand, and Malaysia. These countries are spending vast amounts of money on developing local space programs. The Indonesian Space Act focuses on space science, remote sensing, developing aerospace technology, and launching and commercializing space activities to attain self-sufficiency in the space sector.

- Thailand is another major contributor to the ASEAN space program concentrated on space communications applications, meteorological satellites, remote-sensing satellites, and space technology. The country has developed its space program with space powers like the US, China, and Japan. It is also one of the founding members of the China-led Asia-Pacific Space Cooperation Organization (APSCO).

- Moreover, according to the Electronic Government Financial Management System (GFMIS), Thailand's government budget allocation under the regular expenses section for the Ministry of Science and Technology is witnessing significant growth in the allocations. The government allocated THB 10.23 billion (USD 306.9 million) for regular expenses to the Ministry of Science and Technology in FY 2023, a 6.78% increase in budget from the previous year. Such a higher budget allocation to the Ministry of Science and Technology might indicate a commitment to advancing technology and innovation. This can lead to increased investments in satellite technology and infrastructure, which are essential for satellite imagery services.

- Last year, Thailand announced its plans to launch its primary satellite, Theos-2, with advanced capabilities to signify Thailand's commitment to space technology and national development. This satellite is an upgrade to the nation's earlier satellite, THEOS-1 (Thaichote), and can capture high-resolution imagery with a 50cm spatial resolution. The satellite imagery services are anticipated to support agriculture, disaster management, urban planning, and economic development.

- Thailand's announcement of a high-resolution imagery satellite marks a recognizable step in ASEAN's rapidly growing footprint in space dominance. With advanced high-resolution imaging capabilities, the satellite aligns itself with several crucial missions, including enhancing national security through monitoring, Disaster Management, and Economic Development.

- Thai Union Group PCL, a high-quality, healthy, tasty, and innovative seafood products provider, began piloting satellite imaging for shrimp farming operations in collaboration with Sea Warden and Wholechain last year. Thai Union is regarded as one of the largest producers of shelf-stable tuna products. The Thai Union aims to promote innovative technologies for sustainable seafood production. The data collected through satellite imaging, integrated with traceability technology, ensures a sustainable farming practice through insights into shrimp populations, farm health, and contamination. Such developments and initiatives are anticipated to strengthen Thailand's ASEAN satellite imagery market position.

ASEAN Satellite Imagery Services Industry Overview

The ASEAN satellite imagery services market is characterized by its fragmentation due to the presence of several companies. Some notable industry players include Maxar Technologies, AIRBUS, L3Harris Corporation Inc., Satellite Imaging Corporation, and PASCO CORPORATION, among others. These key players are actively introducing innovative solutions and forging partnerships and collaborations to secure a competitive edge.

In May 2023, Airbus underscored its collaboration with the Malaysian Space Agency (MYSA) in the realm of Earth observation satellites. Airbus specifically highlighted its most recent constellation of satellites, Pleiades Neo, which is fully funded, manufactured, owned, and operated by Airbus. The imagery generated by this constellation is readily accessible to MYSA. The services provided by Airbus to MYSA align with the objectives of NSP 2030 Thrust Two, which emphasizes technology, infrastructure, and space applications. MYSA has harnessed data from Airbus remote sensing satellites to create over 50 space-based applications.

In January 2023, The Philippine Space Agency (PhilSA) joined Sentinel Asia, an international collaborative initiative aimed at providing Earth observation satellite images to enhance disaster management across the Asia-Pacific region using space technology. Through this project, the Philippine Space Agency (PhilSA) seeks to reduce the impact of natural disasters by sharing disaster-related information, including Earth observation satellite images, via the Internet. PhilSA is poised to furnish Earth observation satellite images from the DIWATA-2 and NovaSAR-1 satellites.

In December 2022, satellite imagery providers Synspective and Thaicom forged a partnership to offer synthetic aperture radar (SAR) solutions for disaster response in Thailand. These companies have joined forces to provide solutions to various sectors in Thailand, including government, defense, agriculture, and finance, leveraging Synspective's SAR technology and Thaicom's satellite sector expertise. Synspective's satellite, "StriX-1," will capture images used for disaster response, environmental monitoring, assessing agricultural productivity, and planning infrastructure. This collaboration empowers governments and businesses to make informed decisions regarding sustainable development, facilitating effective maintenance and planning in Thailand.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing demand for geospatial information

- 5.1.2 Requirement for real time data access in Military applications

- 5.2 Market Restraints

- 5.2.1 High Initial Costs

- 5.2.2 Stringent Government regulatory and legal challenges

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Geospatial Data Acquisition and Mapping

- 6.1.2 Natural Resource Management

- 6.1.3 Surveillance and Security

- 6.1.4 Conservation and Research

- 6.1.5 Disaster Management

- 6.1.6 Intelligence

- 6.2 By End-User

- 6.2.1 Government

- 6.2.2 Construction

- 6.2.3 Transportation and Logistics

- 6.2.4 Military and Defense

- 6.2.5 Forestry and Agriculture

- 6.2.6 Other End-Users

- 6.3 By Country

- 6.3.1 Singapore

- 6.3.2 Malaysia

- 6.3.3 Thailand

- 6.3.4 Indonesia

- 6.3.5 Vietnam

- 6.3.6 Rest of ASEAN

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Maxar Technologies

- 7.1.2 Airbus

- 7.1.3 L3Harris Corporation Inc.

- 7.1.4 Pasco Corporation

- 7.1.5 Satellite Imaging Corporation

- 7.1.6 Maptogis

- 7.1.7 Ground Data Solutions R&D Sdn Bhd.

- 7.1.8 Sekala

- 7.1.9 Geocircle

- 7.1.10 Geoinfo Services Sdn. Bhd

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS