PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693970

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693970

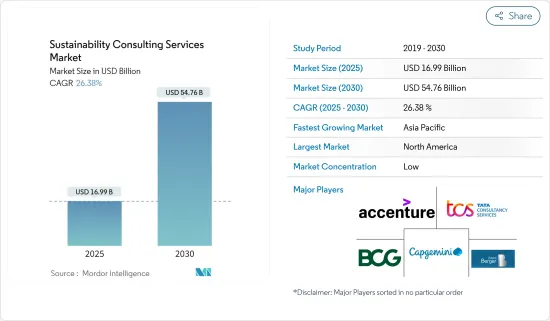

Sustainability Consulting Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Sustainability Consulting Services Market size is estimated at USD 16.99 billion in 2025, and is expected to reach USD 54.76 billion by 2030, at a CAGR of 26.38% during the forecast period (2025-2030).

The expansion of the sustainability consulting services market is driven by several factors. These include increased awareness of environmental, social, and governance (ESG) issues, a stronger focus on reducing carbon footprints, heightened stakeholder pressures, more stringent regulatory compliance requirements, and the necessity for businesses to adopt sustainable practices to meet customer expectations and enhance their reputation.

Key Highlights

- Moreover, this growth signifies a pivotal transformation in the business landscape, with sustainability taking center stage in corporate strategies and decision-making. As companies increasingly adapt to evolving climate conditions, aim to reduce greenhouse gas emissions, and strive to meet global sustainability benchmarks, the global sustainability consulting services market is poised for continued expansion. Consequently, consulting firms play a vital role in assisting governments, businesses, and nonprofit entities in creating strategies, adopting sustainable practices, and navigating the increasing complexities of the changing climate.

- The rising focus on carbon footprint reduction and the growing need to fulfill businesses' net zero targets drive the demand for sustainability consulting services. Companies worldwide increasingly commit to achieving "net zero" greenhouse gas emissions, aligning with initiatives to combat climate change. This positively drives businesses' demand for sustainability consulting services to achieve their net-zero targets efficiently.

- Countries worldwide are setting national goals to combat climate change, significantly boosting the demand for sustainability consulting services. Governments are implementing measures to achieve net-zero emissions, fueling the demand for sustainability consulting services, which are pivotal in guiding governments and formulating strategies toward their net-zero targets.

- Lower levels of adoption, with large gaps in reality, are a major factor hindering the growth of the global sustainability consulting services market. Environmental consulting firms face challenges in promoting sustainability due to the sluggish adoption of sustainability initiatives across various nations. Organizations frequently struggle with limited financial, technical, and human resources, making addressing intricate and contentious issues such as climate change adaptation difficult. Consequently, this dynamic results in diminished uptake of sustainability consulting services, both in the private sector and among public sector enterprises.

- The ongoing Russia-Ukraine War significantly impacts the global sustainability consulting services market. It has profoundly affected global economic growth and labor markets, intensifying inflationary pressures and causing significant supply chain disruptions. The war has disrupted supply chains, especially for materials and goods vital to sustainability projects. Notably, nickel and palladium, essential for electric vehicle batteries, have faced significant supply chain challenges.

Sustainability Consulting Services Market Trends

Climate Change Consultancy Services Type Holds Major Market Share

- Climate change consultancy services considered under the scope include Carbon Footprint and Mitigation Analysis, Alternative Energy Development and Energy Efficiency, Climate Adaptation and Strategy, Emergency Management, Carbon Offset/Net Zero Services, Environmental Regulatory Compliance Services, Waste Management and Circularity, and Other Services.

- The increasing demand for climate change consultancy services is driven by businesses and organizations seeking expert advice on reducing environmental impact, lowering carbon footprints, adapting to climate change, managing risks, ensuring regulatory compliance, and implementing sustainable practices.

- Across the globe, businesses are grappling with the repercussions of climate change. As a result, managing climate-related risks, such as physical, transitional, or liability-based, has become paramount for firms eager to maintain their competitive edge and thrive in the emerging Net Zero paradigm. This evolving landscape has spurred a heightened demand for various consultancy services centered on climate change, aiding businesses in navigating these complexities.

- According to the 2024 report on GHG emissions from all world countries, published by 'The Emissions Database for Global Atmospheric Research/Joint Research Centre (EDGAR/JRC)'' global greenhouse gas (GHG) emissions hit a record high in 2023, reaching 52.96 billion metric tons of carbon dioxide equivalent (Gt CO2e), marking a two percent year-over-year increase.

- Moreover, companies that take the initiative in confronting climate change issues bolster their reputation and position themselves as leaders in sustainability. Such a proactive stance can translate into a significant competitive advantage, drawing in customers, top talent, and valuable partnerships.

- Vendors in the sustainability consulting market are acquiring climate change consulting firms. This strategy aims to broaden their service offerings, bolster their market presence, and cater to the rising demand for climate change consultancy services.

- For instance, in June 2024, ERM, a sustainability advisory firm, announced its agreement to acquire Energetics, a climate risk and energy transition consultancy based in Australia. This move aims to bolster ERM's growth in the Asia Pacific region. Energetics specializes in tailored services, such as crafting climate resiliency strategies, offering insights on climate risks and renewable energy transitions, guiding companies towards net-zero goals, and monitoring power purchase agreements (PPAs) for renewable energy transactions. ERM asserts that this acquisition will bolster its capacity to provide clients with both strategic advice and hands-on implementation across Australia and the broader Asia Pacific region.

- Overall, climate change consultancy services are expected to hold the largest share of the global sustainability consulting market. As businesses and organizations become more aware of climate impacts, face regulatory pressures to reduce their carbon footprints, and witness a global surge in climate action initiatives, there's a rising demand for climate change consultancy services. This demand is further fueled by businesses seeking a competitive edge through proactive climate change risk management.

Asia Pacific to Register Major Growth

- Diverse regulatory frameworks and swift industrialization shape the sustainability consulting market in the Asia-Pacific region. The region's expansion is largely fueled by heightened government regulations on environmental standards, especially in energy-intensive sectors such as manufacturing, oil and gas, and construction. In response, sustainability consulting firms in the Asia-Pacific help businesses meet compliance targets, adopt green strategies, and weave sustainable practices into their operations.

- Countries like China and India, witnessing rapid urbanization and industrialization, face environmental degradation. This has led their governments to enforce stricter environmental standards. In this context, sustainability consulting firms play a pivotal role, guiding companies to craft business models that harmonize growth with environmental stewardship, all while ensuring adherence to both national and international sustainability benchmarks.

- For instance, driven by rising urbanization and its national "Dual Carbon" targets-aiming for peak carbon emissions by 2030 and full carbon neutrality by 2060-China is intensifying its efforts to green its building and construction sector. Government data reveals that in 2020, a significant 77% of China's new urban construction projects were classified as green buildings.

- In October 2023, Shanghai unveiled a three-year initiative aimed at bolstering the ESG capabilities of foreign businesses in the city. Thereby, the plan encourages companies to ramp up Research and Development investments and embrace digital, green, and low-carbon technologies, enhancing their innovation and competitiveness, and heightening the demand for sustainability consulting solutions.

- In the Asia-Pacific region, companies are increasingly adopting ESG principles to draw in global investors and bolster their brand reputation. Sustainability consulting firms assist these businesses by pinpointing areas for enhancement, executing ESG strategies, and gearing up for international sustainability reporting standards.

Sustainability Consulting Services Market Overview

The sustainability consulting services market is characterized by a diverse mix of both established and emerging players. Some of the major players in the market are Accenture PLC, The Boston Consulting Group, Inc., Tata Consultancy Services Limited, Capgemini SE, and Roland Berger GmbH, among others.

Moderate exit barriers in the market incentivize new entrants while allowing established firms to exit during low-profit periods. Leading industry players are increasingly focusing on integrated solutions to attract customers. In contrast, smaller and newer market entrants are expected to adopt cost-benefit strategies to vie with their larger counterparts, intensifying competition.

Furthermore, a notable surge in joint ventures and acquisitions recently underscores the global business community's heightened emphasis on sustainability. As a result, competitive rivalry in the global sustainability market remains pronounced.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Focus on the Reduction of Carbon Footprint and Fulfilment of Net Zero Targets

- 5.1.2 National Goals Across the Globe to Combat Climate Change

- 5.2 Market Challenges

- 5.2.1 Lower Levels of Adoption with Large Gaps in the Realistic Scenario

6 MARKET SEGMENTATION

- 6.1 By Service Type

- 6.1.1 Climate Change Consultancy Services

- 6.1.2 Green Building Consultancy Services

- 6.1.3 ESG Consultancy Services

- 6.1.4 Other Sustainability Consultancy Services

- 6.2 By End User

- 6.2.1 Construction and Real Estate

- 6.2.2 Energy and Power

- 6.2.3 Public Sector

- 6.2.4 Other End Users

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 Benelux

- 6.3.2.4 Spain

- 6.3.2.5 France

- 6.3.2.6 Nordics

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Accenture PLC

- 7.1.2 The Boston Consulting Group, Inc.

- 7.1.3 Tata Consultancy Services Limited

- 7.1.4 Capgemini SE

- 7.1.5 Roland Berger GmbH

- 7.1.6 Bain & Company, Inc.

- 7.1.7 KPMG International Limited

- 7.1.8 Ernst & Young Global Limited

- 7.1.9 Deloitte Touche Tohmatsu Limited

- 7.1.10 PricewaterhouseCoopers LLP

- 7.1.11 McKinsey & Company

- 7.1.12 Kearney

- 7.1.13 Godrej & Boyce Mfg. Co. Ltd (Godrej Industries Limited)

- 7.1.14 RPS Group (Tetra Tech Inc.)

- 7.1.15 SEA Energy

8 INVESTMENT ANALYSIS

9 FUTURE OUTLOOK OF THE MARKET