Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1686602

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1686602

Asia-Pacific Dairy Alternatives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 239 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

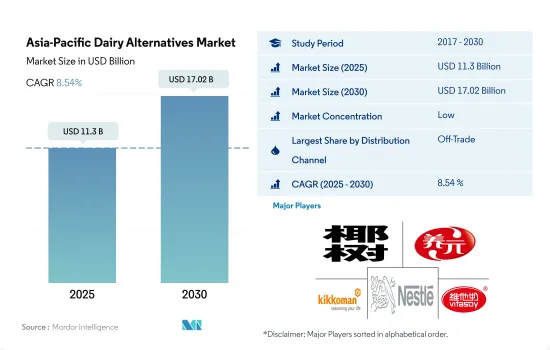

The Asia-Pacific Dairy Alternatives Market size is estimated at 11.3 billion USD in 2025, and is expected to reach 17.02 billion USD by 2030, growing at a CAGR of 8.54% during the forecast period (2025-2030).

Strong penetration of organized retail channels is fueling the market growth

- The off-trade channel plays a major role in the region's sales of dairy alternative products. In the off-trade channels segment, supermarkets and hypermarkets are the largest distribution channels in the Asia-Pacific dairy alternatives market. The proximity factor of these channels, especially in large and developed cities, gives them an added advantage of influencing the consumer's decision to purchase among the large variety of products available in the market. In 2022, the supermarkets and hypermarkets sub-segment accounted for 66.7% of the value share.

- The region does not have a considerable market for on-trade channels and is in the nascent stage. Consumers prefer dairy alternatives at home and are less likely to consume from a restaurant or foodservice outlet. Plant-based milk and non-dairy butter are increasing in popularity, and some regional restaurants use plant-based milk, particularly as an ingredient option in cocktails, smoothies, coffees, and espresso-based drinks. Thus, the sales value of plant-based milk through on-trade channels increased by 4.5% in 2022 compared to 2021.

- Plant-based milk accounted for the majority of share in off-trade channels among all dairy alternative products. In 2022, plant-based milk accounted for more than 85% of the value share.

- Online channel is expected to be the fastest-growing distribution channel in the off-trade segment. It is projected to register a Y-o-Y growth value of 4.6% during 2023-2025. Convenience is the primary motivation for shoppers who have transitioned to shopping for groceries online.

China, Japan, and Australia exhibit significant dairy alternative consumption compared to other Asian countries

- The rise in the vegan population as a result of the rising importance of plant-based nutrition drives the demand for dairy alternatives in the region. China, Japan, and Australia exhibit significant dairy alternative consumption compared to other Asian countries. In 2023, the countries collectively held a 79.77% share of the overall dairy alternative consumption in the region. Rising consumer interest in alternative protein is the key factor driving the consumption of dairy alternatives in China. The penetration of global brands through strategic partnerships with supermarkets and hypermarkets is influencing Chinese consumers to opt for alternative dairy milk and cheese.

- High consumer awareness about plant-based nutrition and favorable macroeconomic environments are the key factors shaping the Australian dairy alternative industry. Non-dairy butter and plant-based milk are essential products preferred by millennial consumers in Australia. In 2022, plant-based milk had an 84.76% share of the overall dairy alternatives consumed in Australia. Australians consumed around half a metric cup of milk substitutes every week. Almond and soy milk are becoming more popular in Australia. Over 50% of Australians aged two and older do not get enough calcium and other minerals, which is attracting customers toward plant milk with added nutrition.

- India is the fastest-growing country with an increasing number of vegetarian customers. In 2021, India had the world's third-highest number of participants, with around 60,000 people joining the campaign, Veganuary, an international organization. The sales value of dairy alternatives is estimated to record a CAGR of 9.83% during the forecast period.

Asia-Pacific Dairy Alternatives Market Trends

The consumption of dairy alternatives is on the rise across the region owing to a significant rise in the vegan population, coupled with a growing lactose-intolerant population

- The consumption of dairy alternatives is on the rise across the region owing to a significant rise in the vegan population, coupled with a growing lactose-intolerant population. In 2021, around 2.5 million people in South Korea followed a vegan diet. This has since increased significantly in the following two years and continues to grow. Similarly, Australia has the third-highest percentage of vegans per capita globally.

- Lactose intolerance is common in Asian countries, particularly in East Asia, where nearly 70-100% of the population has lactose intolerance. Cow milk allergy is one of the common food allergies in young children. Many Japanese consumers are lactose-intolerant and do not consume milk or milk products. As of 2022, in Australia, around one in 50 babies and young children showed signs of an allergy to cow's milk. Therefore, the demand for plant-based dairy products has increased gradually across the region.

- Among dairy alternatives, plant-based milk like soy and almond milk held the majority share across the regional market in 2022. China is the leading country across the region in terms of consumption of dairy alternatives milk. Among plant-based milk, soy drinks have traditionally been the most popular in China due to the country's long-standing tradition of soy consumption and its wide availability. In the Asia-Pacific region, the per capita consumption of non-dairy butter is estimated to increase by 3.45% in 2023-2024. The key motivations for consumers to adopt non-dairy butter are growing concerns for animals and sustainability, followed by a healthier change in dietary habits.

Asia-Pacific Dairy Alternatives Industry Overview

The Asia-Pacific Dairy Alternatives Market is fragmented, with the top five companies occupying 36.65%. The major players in this market are Coconut Palm Group Co. Ltd, Hebei Yangyuan Zhihui Beverage Co. Ltd, Kikkoman Corporation, Nestle SA and Vitasoy International Holdings Ltd (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 53117

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Per Capita Consumption

- 4.2 Raw Material/commodity Production

- 4.2.1 Dairy Alternative - Raw Material Production

- 4.3 Regulatory Framework

- 4.3.1 Australia

- 4.3.2 China

- 4.3.3 India

- 4.3.4 Japan

- 4.3.5 South Korea

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Category

- 5.1.1 Non-Dairy Butter

- 5.1.2 Non-Dairy Cheese

- 5.1.3 Non-Dairy Ice Cream

- 5.1.4 Non-Dairy Milk

- 5.1.4.1 By Product Type

- 5.1.4.1.1 Almond Milk

- 5.1.4.1.2 Cashew Milk

- 5.1.4.1.3 Coconut Milk

- 5.1.4.1.4 Hazelnut Milk

- 5.1.4.1.5 Hemp Milk

- 5.1.4.1.6 Oat Milk

- 5.1.4.1.7 Soy Milk

- 5.1.5 Non-Dairy Yogurt

- 5.2 Distribution Channel

- 5.2.1 Off-Trade

- 5.2.1.1 Convenience Stores

- 5.2.1.2 Online Retail

- 5.2.1.3 Specialist Retailers

- 5.2.1.4 Supermarkets and Hypermarkets

- 5.2.1.5 Others (Warehouse clubs, gas stations, etc.)

- 5.2.2 On-Trade

- 5.2.1 Off-Trade

- 5.3 Country

- 5.3.1 Australia

- 5.3.2 China

- 5.3.3 India

- 5.3.4 Indonesia

- 5.3.5 Japan

- 5.3.6 Malaysia

- 5.3.7 New Zealand

- 5.3.8 Pakistan

- 5.3.9 South Korea

- 5.3.10 Rest of Asia Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Blue Diamond Growers

- 6.4.2 Campbell Soup Company

- 6.4.3 Coconut Palm Group Co. Ltd

- 6.4.4 Danone SA

- 6.4.5 Hebei Yangyuan Zhihui Beverage Co. Ltd

- 6.4.6 Kikkoman Corporation

- 6.4.7 Nestle SA

- 6.4.8 Oatly Group AB

- 6.4.9 Sanitarium Health and Wellbeing Company

- 6.4.10 The Hershey Company

- 6.4.11 Vitasoy International Holdings Ltd

7 KEY STRATEGIC QUESTIONS FOR DAIRY AND DAIRY ALTERNATIVE CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.