Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687723

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687723

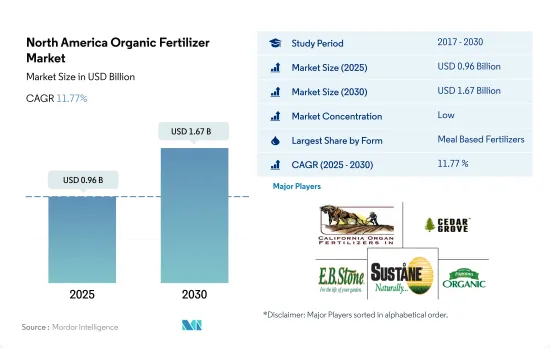

North America Organic Fertilizer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 150 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

The North America Organic Fertilizer Market size is estimated at 0.96 billion USD in 2025, and is expected to reach 1.67 billion USD by 2030, growing at a CAGR of 11.77% during the forecast period (2025-2030).

- Organic fertilizers emerged as a reliable and sustainable source of nutrients for plant growth, offering several advantages over synthetic fertilizers, leading to the increased usage of organic fertilizers by 56.5% between 2017 and 2022. These fertilizers are easily accessible, cost-effective, and provide a moderate concentration of vital elements required for plant growth while minimizing the drawbacks associated with synthetic fertilizers. The rise in adoption can be attributed to the gradual release of nutrients into the soil solution, which helps maintain soil fertility and nutrient balance, leading to proper plant growth.

- Meal-based fertilizers, such as blood meal, bone meal, and kelp meal, are the most consumed organic fertilizers in North America. They accounted for 49.1% of the market share in 2022. These fertilizers are popular due to their high nutrient content, with blood meal being rich in nitrogen, bone meal being high in phosphorus and calcium, and kelp meal being low in NPK but rich in minerals.

- Manures are the second largest organic fertilizers that improve the physiochemical properties of the soil, such as its structure and water-holding capacity. However, manures cannot provide all the necessary nutrients required for crops, as their nutrient content is significantly low. Farmers increasingly turn to other organic fertilizers, such as oilcake and fish guano, to address this issue.

- The growing adoption of organic farming and consumer interest in organic products following the COVID-19 pandemic is expected to drive further growth in the usage of organic fertilizers in North America. These fertilizers offer a sustainable and environmentally-friendly solution for maintaining soil fertility, improving crop yields, and ensuring food security.

- The North American organic fertilizers market is currently dominated by the United States, which accounted for approximately 40.7% of the market value in 2022. This domination is largely due to the country's large organic cultivation area, which accounted for 39.6% of the total North American organic crop area in 2022. In second place is Mexico, which accounted for 33.4% of the region's organic fertilizers market value in 2022. Mexico's total organic crop area is also increasing, with a projected growth of 10.9% to reach 610.0 thousand hectares by 2028.

- Canada accounted for approximately 25.5% of the total organic fertilizer market value in the region in 2022. The country has recently received an investment from the Ministry of Agriculture and Agri-Food to support the sustainability and expansion of its organics sector, which is anticipated to drive the Canadian organic fertilizer market and record a CAGR of 11.4% between 2023 and 2029

- The Rest of North America, which includes countries like Costa Rica, Cuba, Jamaica, and Guatemala, saw an increase in organic acreage by 10.3% between 2017 and 2022, reaching 5.5 thousand hectares in 2022. Cash crops such as coffee, sugar, cocoa, and spices are the major crops grown in these countries, and they accounted for 93.6% of total organic acreage in 2022.

- The North American organic fertilizer market is driven by the increasing demand for organic crops and the need for sustainable agriculture practices. As more countries and companies invest in the organic agriculture sector, the market is expected to grow in the coming years.

North America Organic Fertilizer Market Trends

Organic produce demand grows in major countries like the United States, increasing cultivation area with government support

- The area under organic cultivation of crops in North America was recorded at 1.5 million hectares in 2021, according to the data provided by FibL statistics. The organic area in the region increased by 13.5% between 2017 and 2022. Among the North American countries, the United States was dominant, with 623.0 thousand hectares of agricultural land under organic farming, with California, Maine, and New York being the major states practicing agriculture.

- The United States is followed by Mexico, with 531.1 thousand hectares of area under organic farming in 2021. Mexico is among the top 20 organic food producers in the world. Mexico is the largest exporter of organic coffee in the world, according to Global Coffee Masters data. The country has the largest area under organic coffee production and even in terms of the number of organic coffee producers in the country. The major organic food-producing states in the country include Chiapas, Oaxaca, Michoacan, Chihuahua, and Guerrero, which accounted for 80.0% of the total organic area in the country in 2021. Organizations such as National Association for Organic Agriculture promote organic agriculture in the country, which is expected to motivate more farmers to take up organic agriculture. In addition to financial assistance, the Mexican government supports research and development activities to help promote organic agriculture.

- Canada's area under organic crop cultivation increased from 0.40 million hectares in 2017 to 0.45 million hectares in 2021. Row crops occupied the maximum area with 0.42 million hectares in 2021. The Canadian government announced a sum of USD 297,330 in 2021 as Organic Development Fund to support organic farmers. These initiatives are expected to increase the organic area in the region.

Growing demand for organic produce in domestic and international markets, rise in per capita spending on organic food

- North America's average per capita spending on organic food products was USD 109.7 in 2021. The per capita spending in the United States is the highest among the North American countries, with average spending of USD 186.7 in 2021. The sales of organic products in the United States crossed USD 63.00 billion in 2021. Organic Tarde Association accounted for a 2.0% increase over the previous year, with organic food sales at USD 57.5 billion in 2021. Organic fruits and vegetables accounted for 15.0% of the total organic product sales, valued at USD 21.0 billion in 2021.

- Organic food sales in Canada reached a value of USD 8.10 billion in 2020, as per the data reported by the Organic Federation of Canada. It is reported that Canada is the 6th largest market in the world for Organic products, with the supply of organic products failing to keep up with the demand in the country. The average spending on organic food per person was USD 142.6 in 2021. Increasing government support to retailers is expected to increase the availability, accessibility, and affordability of organic products in the country. Organic Tarde Association estimated the organic products market in Canada to grow and register a CAGR of 6.3% between 2021 and 2026.

- In 2021, Mexico registered a market size of USD 63.0 million for organic products with a global rank of 35. It is estimated to grow and register a CAGR of 7.2% between 2021 and 2026. However, the per capita spending on organic products in the country is less than in other countries in the region, with a value of USD 0.49 in 2021. More players entering the market in Mexico are expected to increase the demand for organic products in the country.

North America Organic Fertilizer Industry Overview

The North America Organic Fertilizer Market is fragmented, with the top five companies occupying 8.74%. The major players in this market are California Organic Fertilizers Inc., Cedar Grove Composting Inc., E.B.Stone & Sons Inc., Sustane Natural Fertilizer Inc. and The Espoma Company (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 64644

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Area Under Organic Cultivation

- 4.2 Per Capita Spending On Organic Products

- 4.3 Regulatory Framework

- 4.3.1 Canada

- 4.3.2 Mexico

- 4.3.3 United States

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Form

- 5.1.1 Manure

- 5.1.2 Meal Based Fertilizers

- 5.1.3 Oilcakes

- 5.1.4 Other Organic Fertilizer

- 5.2 Crop Type

- 5.2.1 Cash Crops

- 5.2.2 Horticultural Crops

- 5.2.3 Row Crops

- 5.3 Country

- 5.3.1 Canada

- 5.3.2 Mexico

- 5.3.3 United States

- 5.3.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 BioFert Manufacturing Inc.

- 6.4.2 California Organic Fertilizers Inc.

- 6.4.3 Cascade Agronomics LLC

- 6.4.4 Cedar Grove Composting Inc.

- 6.4.5 E.B.Stone & Sons Inc.

- 6.4.6 Morgan Composting Inc.

- 6.4.7 Sustane Natural Fertilizer Inc.

- 6.4.8 The Espoma Company

- 6.4.9 The Rich Lawn Company LLC

- 6.4.10 Walts Organic Fertilizers Co.

7 KEY STRATEGIC QUESTIONS FOR AGRICULTURAL BIOLOGICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.