Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1430783

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1430783

Uae Passenger Vehicles Lubricants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2021 - 2026)

PUBLISHED:

PAGES: 80 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

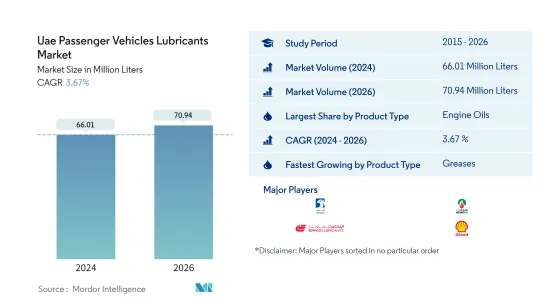

The Uae Passenger Vehicles Lubricants Market size is estimated at 66.01 Million Liters in 2024, and is expected to reach 70.94 Million Liters by 2026, growing at a CAGR of 3.67% during the forecast period (2024-2026).

Key Highlights

- Largest Segment by Product Type - Engine Oils : Engine oil is the leading product type due to its high volume requirements and shorter drain intervals, as it is used in high-temperature and high-pressure applications.

- Fastest Segment by Product Type - Greases : In Qatar, the predicted rebound in passenger vehicle imports and sales beginning in 2021 is expected to augment grease consumption at a healthy rate in near future.

UAE Passenger Vehicles Lubricants Market Trends

Largest Segment By Product Type : Engine Oils

- In UAE, passenger vehicles (PVs) is the largest vehicle type in terms of automotive lubricant consumption. During 2015-2019, the PV lubricant consumption grew with a CAGR of 1.76% primarily owing to the surge in the SUV car popualtion of the country.

- In 2020, PVs accounted for about 74% of the total automotive lubricant consumption in the country. Engine oil accounted for the largest share in the PV lubricant consumption, with a share of around 93% during the year. During 2020, PV lubricants consumption declined by almost 13% due to the lower usage of the vehicle fleet post COVID-19 outbreak.

- During 2021-2026 the grease segment is likely to be the fastest-growing lubricant type with a CAGR of 4.19%. This growth is likely to be driven by rise in sales of passenger cars and recovery in average distance travelled in the country.

UAE Passenger Vehicles Lubricants Industry Overview

The Uae Passenger Vehicles Lubricants Market is fairly consolidated, with the top five companies occupying 70.98%. The major players in this market are ADNOC, Emirates Lube Oil Co. Ltd, EPPCO Lubricants, Royal Dutch Shell PLC and TotalEnergies (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 90246

TABLE OF CONTENTS

1 Executive Summary & Key Findings

2 Introduction

- 2.1 Study Assumptions & Market Definition

- 2.2 Scope of the Study

- 2.3 Research Methodology

3 Key Industry Trends

- 3.1 Automotive Industry Trends

- 3.2 Regulatory Framework

- 3.3 Value Chain & Distribution Channel Analysis

4 Market Segmentation

- 4.1 By Product Type

- 4.1.1 Engine Oils

- 4.1.2 Greases

- 4.1.3 Hydraulic Fluids

- 4.1.4 Transmission & Gear Oils

5 Competitive Landscape

- 5.1 Key Strategic Moves

- 5.2 Market Share Analysis

- 5.3 Company Profiles

- 5.3.1 ADNOC

- 5.3.2 Emarat

- 5.3.3 Emirates Lube Oil Co. Ltd

- 5.3.4 EPPCO Lubricants

- 5.3.5 ExxonMobil Corporation

- 5.3.6 Gulf Oil International

- 5.3.7 Petromin Corporation

- 5.3.8 Royal Dutch Shell PLC

- 5.3.9 Sharjah National Lube Oil Co. LLC (SHARLU)

- 5.3.10 TotalEnergies

6 Appendix

- 6.1 Appendix-1 References

- 6.2 Appendix-2 List of Tables & Figures

7 Key Strategic Questions for Lubricants CEOs

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.