Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1430797

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1430797

Middle East Automotive Lubricants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2021 - 2026)

PUBLISHED:

PAGES: 80 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

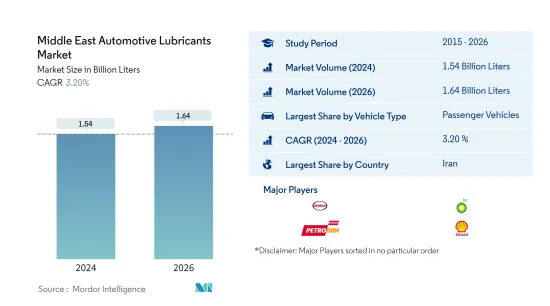

The Middle East Automotive Lubricants Market size is estimated at 1.54 Billion Liters in 2024, and is expected to reach 1.64 Billion Liters by 2026, growing at a CAGR of 3.20% during the forecast period (2024-2026).

Key Highlights

- Largest Segment by Vehicle Type - Passenger Vehicles : The Middle East has a large active passenger vehicle parc. As a result, lubricant consumption in this sector accounts for the largest share of the overall lubricant market.

- Fastest Segment by Vehicle Type - Motorcycles : Since 2020, there has been an upsurge in used motorcycle demand in Middle East countries such as Iran, which in turn is likely to drive motorcycle lubricant consumption.

- Largest Country Market - Iran : The high lubricant consumption in Iran can be attributed to the country's vehicle fleet and the increasing average age of vehicles that require significant lubricant usage.

- Fastest Growing Country Market - Turkey : Despite the COVID-19 pandemic, Turkey was the only country in the Middle East to see positive sales figures due to the government's push to support the automotive industry.

Middle East Automotive Lubricants Market Trends

Largest Segment By Vehicle Type : Passenger Vehicles

- In the Middle East region, passenger vehicles (PV) segment accounted for almost 67% share in the total number of on-road vehicles during 2020, followed by motorcycles and commercial vehicles with 18.49% and 14.45% shares, respectively.

- The passenger vehicles segment accounted for the highest share of 59.85% in the total automotive lubricant volume consumption in 2020, followed by the commercial vehicles segment with a share of 34.22%. During the same year, travel restrictions to curb COVID-19 significantly affected the usage of these vehicles and their lubricant consumption.

- During 2021-2026, motorcycles lubricants segment is expected to witness the highest CAGR growth at a CAGR of 3.63%. The recovery of passenger vehicle sales combined with the easing down of COVID-19 related travel restrictions are likely to be the key factors driving this trend.

Largest Country : Iran

- In the Middle Eastern automotive lubricant market, consumption is the highest in Iran, followed by Saudi Arabia and Turkey. In 2020, Iran accounted for about 36.5% of the total automotive lubricant consumption in the region, whereas Saudi Arabia and Turkey accounted for shares of around 27.15% and 14.03%, respectively.

- In 2020, the COVID-19 pandemic significantly affected automotive lubricant consumption in many countries in the region. The UAE was the most affected with a 12.47% drop during 2019-2020, whereas Turkey was the least affected with a 6.38% drop in its automotive lubricant consumption.

- During 2021-2026, Turkey is likely to be the fastest-growing lubricant market as the consumption is likely to grow, recording a CAGR of 6.29%, followed by the UAE and Qatar, which are expected to record a CAGR of 3.01% and 2.89%, respectively.

Middle East Automotive Lubricants Industry Overview

The Middle East Automotive Lubricants Market is moderately consolidated, with the top five companies occupying 47.35%. The major players in this market are Behran Oil Company, BP PLC (Castrol), Petromin Corporation, Royal Dutch Shell PLC and TotalEnergies (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 90260

TABLE OF CONTENTS

1 Executive Summary & Key Findings

2 Introduction

- 2.1 Study Assumptions & Market Definition

- 2.2 Scope of the Study

- 2.3 Research Methodology

3 Key Industry Trends

- 3.1 Automotive Industry Trends

- 3.2 Regulatory Framework

- 3.3 Value Chain & Distribution Channel Analysis

4 Market Segmentation

- 4.1 By Vehicle Type

- 4.1.1 Commercial Vehicles

- 4.1.2 Motorcycles

- 4.1.3 Passenger Vehicles

- 4.2 By Product Type

- 4.2.1 Engine Oils

- 4.2.2 Greases

- 4.2.3 Hydraulic Fluids

- 4.2.4 Transmission & Gear Oils

- 4.3 By Country

- 4.3.1 Iran

- 4.3.2 Qatar

- 4.3.3 Saudi Arabia

- 4.3.4 Turkey

- 4.3.5 UAE

- 4.3.6 Rest of Middle East

5 Competitive Landscape

- 5.1 Key Strategic Moves

- 5.2 Market Share Analysis

- 5.3 Company Profiles

- 5.3.1 ADNOC

- 5.3.2 Behran Oil Company

- 5.3.3 BP PLC (Castrol)

- 5.3.4 ExxonMobil Corporation

- 5.3.5 FUCHS

- 5.3.6 Iranol Oil Company

- 5.3.7 Petrol Ofisi

- 5.3.8 Petromin Corporation

- 5.3.9 Royal Dutch Shell PLC

- 5.3.10 Sepahan Oil Company

- 5.3.11 TotalEnergies

6 Appendix

- 6.1 Appendix-1 References

- 6.2 Appendix-2 List of Tables & Figures

7 Key Strategic Questions for Lubricants CEOs

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.