Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1430960

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1430960

India Lubricants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2021 - 2026)

PUBLISHED:

PAGES: 80 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

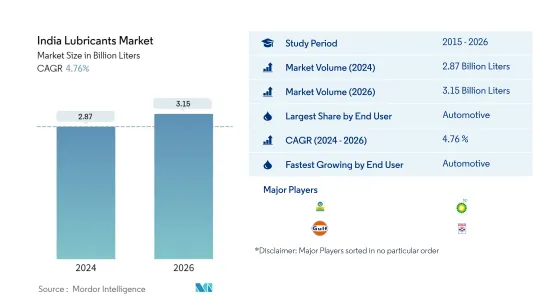

The India Lubricants Market size is estimated at 2.87 Billion Liters in 2024, and is expected to reach 3.15 Billion Liters by 2026, growing at a CAGR of 4.76% during the forecast period (2024-2026).

Key Highlights

- Largest Segment by End-user Industry - Automotive : Due to the higher volume of engine & gear oil used in motor vehicles compared to any other industrial application, automotive was the largest end user among all categories.

- Fastest Segment by End-user Industry - Automotive : Automotive is likely to be the fastest-growing end-use segment of lubricants in India due to consumers' rising purchasing power resulting in increasing vehicle ownership.

- Largest Segment by Product Type - Engine Oils : Engine oil is the highest consumed product category in India owing to the enormous engine size of cars, motorcycles, trucks & buses and their high oil changing frequencies.

- Fastest Segment by Product Type - Engine Oils : Engine oil consumption in India is likely to grow at a faster rate than other product types due to the growing presence of gasoline- and diesel-run vehicles in the country.

India Lubricants Market Trends

Largest Segment By End User : Automotive

- In 2020, the automotive industry dominated the Indian lubricants market, accounting for 58% of the total lubricant consumption in the country. During 2015-2019, lubricant consumption in the automotive industry increased by 35% due to the rapidly growing vehicle usage, sales, and outputs.

- In 2020, COVID-19-related restrictions led to declined maintenance requirements from several industries. The major impact was observed in the automotive industry, which recorded a dip of 15.7% during the year, followed by heavy equipment (11.3%).

- Automotive is likely to be the fastest-growing end-user industry of the Indian lubricants market during 2021-2026, with a CAGR of 6.31%, followed by heavy equipment (3.98%). A recovery in the average mileage of vehicles and an increase in new vehicle sales will likely drive lubricants consumption from the automotive industry during 2021-2026.

India Lubricants Industry Overview

The India Lubricants Market is fairly consolidated, with the top five companies occupying 67.13%. The major players in this market are Bharat Petroleum Corporation Limited, BP Plc (Castrol), Gulf Oil International, Hindustan Petroleum Corporation Limited and Indian Oil Corporation Limited (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 90309

TABLE OF CONTENTS

1 Executive Summary & Key Findings

2 Introduction

- 2.1 Study Assumptions & Market Definition

- 2.2 Scope of the Study

- 2.3 Research Methodology

3 Key Industry Trends

- 3.1 Automotive Industry Trends

- 3.2 Manufacturing Industry Trends

- 3.3 Power Generation Industry Trends

- 3.4 Regulatory Framework

- 3.5 Value Chain & Distribution Channel Analysis

4 Market Segmentation

- 4.1 By End User

- 4.1.1 Automotive

- 4.1.2 Heavy Equipment

- 4.1.3 Metallurgy & Metalworking

- 4.1.4 Power Generation

- 4.1.5 Other End-user Industries

- 4.2 By Product Type

- 4.2.1 Engine Oils

- 4.2.2 Greases

- 4.2.3 Hydraulic Fluids

- 4.2.4 Metalworking Fluids

- 4.2.5 Transmission & Gear Oils

- 4.2.6 Other Product Types

5 Competitive Landscape

- 5.1 Key Strategic Moves

- 5.2 Market Share Analysis

- 5.3 Company Profiles

- 5.3.1 Bharat Petroleum Corporation Limited

- 5.3.2 BP Plc (Castrol)

- 5.3.3 ExxonMobil Corporation

- 5.3.4 Gulf Oil International

- 5.3.5 Hindustan Petroleum Corporation Limited

- 5.3.6 Indian Oil Corporation Limited

- 5.3.7 Royal Dutch Shell Plc

- 5.3.8 Savita Oil Technologies Ltd

- 5.3.9 TIDE WATER OIL CO. (INDIA) LTD

- 5.3.10 Valvoline Inc.

6 Appendix

- 6.1 Appendix-1 References

- 6.2 Appendix-2 List of Tables & Figures

7 Key Strategic Questions for Lubricants CEOs

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.