PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911345

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911345

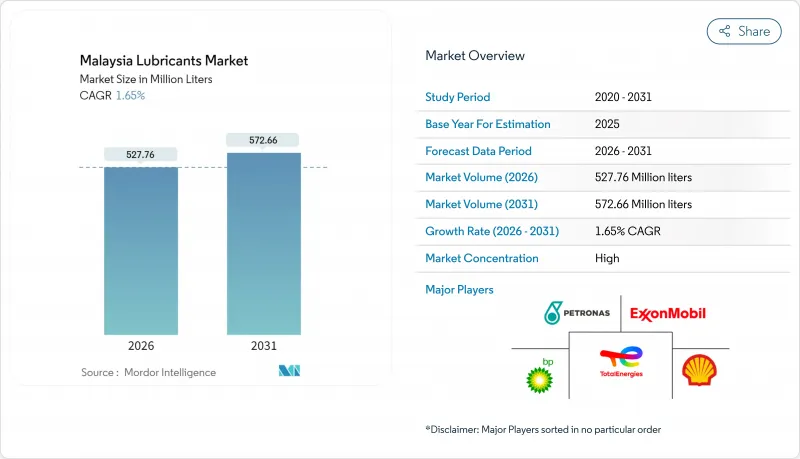

Malaysia Lubricants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Malaysia Lubricants Market size in 2026 is estimated at 527.76 million liters, growing from 2025 value of 519.19 million liters with 2031 projections showing 572.66 million liters, growing at 1.65% CAGR over 2026-2031.

Growth remains steady rather than spectacular because the market is already mature, yet it benefits from a wider vehicle parc, new manufacturing capacity, and infrastructure spending that require dependable fluid performance. Passenger cars dominate the national fleet, making Malaysia the only ASEAN country where four-wheelers outnumber two-wheelers, which lifts demand for premium engine oils. Government execution of the 12th Malaysia Plan and the National Industrial Master Plan 2030 (NIMP 2030) adds incremental volume in industrial, construction, and high-tech manufacturing applications. Meanwhile, the electric-vehicle (EV) rollout, longer drain intervals, and rising equipment efficiency limit total volume growth, prompting suppliers to shift toward higher-value synthetic and specialty formulations rather than bulk mineral grades.

Malaysia Lubricants Market Trends and Insights

Rising Vehicle Parc and New-Car Sales Drive Sustained Demand

Total vehicle sales reached 816,747 units in 2024, a 2.1% gain that supports lubricant volume growth despite market maturity. Passenger cars already outnumber two-wheelers, so demand shifts toward higher-grade automotive engine oils rather than motorcycle lubricants. The implementation of Euro 5 fuel standards prompts workshops and motorists to switch to low-sulfur, full-synthetic formulations that protect catalytic after-treatment systems. Commercial vehicles also contribute because larger sump capacities and stricter fleet maintenance schedules offset slower passenger-car sales growth. Industry associations expect continuous parc expansion through 2030, particularly in the Klang Valley, Penang, and Johor, anchoring base-level consumption.

Industrial and Infrastructure Expansion Under 12th Malaysia Plan

Malaysia aims to create 700,000 high-skill manufacturing jobs by 2030 and double its high-tech export share to 6%. Semiconductor, electronics, and petrochemical projects require reliable hydraulic fluids, metalworking fluids, and process oils that withstand stringent clean-room or high-temperature environments. Manufacturing investments reached RM152 billion in 2023, with foreign investors accounting for nearly 70% of the chemical sector's capital inflows, indicating confidence in continued industrial growth. Infrastructure projects, such as the Johor-Singapore Special Economic Zone, East Coast Rail Link, and Pengerang Integrated Complex, increase lubricant demand for construction machinery, heavy-duty engines, and petrochemical equipment throughout the build-out phase and in routine plant operations.

Longer Oil-Drain Intervals Constrain Volume Growth

Modern synthetics enable drain intervals of 15,000-20,000 kilometers on a single fill, compared with 5,000-10,000 kilometers for older mineral formulations. This sharply lowers annual liter consumption per vehicle, even though the number of kilometers driven continues to rise. Fleet managers rely on in-service oil analysis to extend drains without compromising warranty coverage. Consequently, volume erosion within entry-level mineral categories offsets gains from the rising car population, and producers bolster revenues by marketing higher-margin full synthetics. Workshops adapt by offering bundled services-such as filter changes, alignment, and cabin-air filtration-to compensate for reduced lubricant frequency.

Other drivers and restraints analyzed in the detailed report include:

- Synthetic and High-Performance Lubricant Adoption Accelerates

- Government Mega-Projects Create Infrastructure Lubricant Demand

- Electric Vehicle Adoption Reshapes Long-Term Demand Patterns

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Automotive engine oil accounted for 50.60% of the Malaysia lubricants market share in 2025. A large and growing car population sustains baseline demand, while stricter OEM specifications accelerate the migration from API SN to SP and ILSAC GF-6 categories, which offer higher oxidative stability. Transmission fluids are the fastest-growing product, registering a 2.50% CAGR as automatic, dual-clutch, and continuously variable gearboxes proliferate. Hybrid vehicles further expand this need due to dedicated e-transmission lubrication circuits. The Malaysian lubricants market size, linked to hydraulic fluids, metalworking fluids, and process oils, also rises because semiconductor plants, precision machining centers, and chemical complexes require contamination-free operations and extended fluid life.

The Malaysia Lubricants Market Report is Segmented by Product Type (Automotive Engine Oil, Industrial Engine Oil, Transmission Fluids, Gear Oil, Brake Fluids, Hydraulic Fluids, Greases, and More), End-User Industry (Automotive, Marine, Aerospace, Heavy Equipment, and Industrial), and Base Stock Type (Mineral Oil-Based, Synthetic, Semi-Synthetic, and Bio-Based). The Market Forecasts are Provided in Terms of Volume (Liters).

List of Companies Covered in this Report:

- Advance Lube Enterprise Sdn Bhd

- BP Plc (Castrol)

- Chevron Corporation

- Excelube Marketing Sdn Bhd

- Exxon Mobil Corporation

- FUCHS

- Idemitsu Kosan Co., Ltd.

- Liqui Moly Malaysia

- MSB Global Group Sdn. Bhd.

- Petroliam Nasional Berhad (PETRONAS)

- Petron

- Shell plc

- SINOPEC

- TotalEnergies

- UMW Lubetech Sdn Bhd

- Valvoline (Saudi Arabian Oil Co.)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising vehicle parc and new-car sales

- 4.2.2 Industrial and infrastructure expansion

- 4.2.3 Shift toward synthetic/high-performance lubricants

- 4.2.4 Government mega-projects under 12th Malaysia Plan

- 4.2.5 E-commerce emergence for lubricant retail (Tier-2 cities)

- 4.3 Market Restraints

- 4.3.1 Longer oil-drain intervals and engine efficiency gains

- 4.3.2 Accelerating electric-vehicle adoption

- 4.3.3 Crude-oil price volatility pressuring margins

- 4.4 Value Chain Analysis

- 4.5 Regulatory Framework

- 4.6 End-User Trends

- 4.6.1 Automotive Industry

- 4.6.2 Manufacturing Industry

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Product Type

- 5.1.1 Automotive Engine Oil

- 5.1.2 Industrial Engine Oil

- 5.1.3 Transmission Fluids

- 5.1.4 Gear Oil

- 5.1.5 Brake Fluids

- 5.1.6 Hydraulic Fluids

- 5.1.7 Greases

- 5.1.8 Process Oil (Including Rubber Process Oil and White Oil)

- 5.1.9 Metalworking Fluids

- 5.1.10 Turbine Oil

- 5.1.11 Transformer Oil

- 5.1.12 Other Product Types

- 5.2 By End-user Industry

- 5.2.1 Automotive

- 5.2.1.1 Passenger Vehicles

- 5.2.1.2 Commercial Vehicles

- 5.2.1.3 Two-Wheelers

- 5.2.2 Marine

- 5.2.3 Aerospace

- 5.2.4 Heavy Equipment

- 5.2.4.1 Construction

- 5.2.4.2 Mining

- 5.2.4.3 Agriculture

- 5.2.5 Industrial

- 5.2.5.1 Power Generation

- 5.2.5.2 Metallurgy and Metalworking

- 5.2.5.3 Textiles

- 5.2.5.4 Oil and Gas

- 5.2.5.5 Other End-Use Industries

- 5.2.1 Automotive

- 5.3 By Base Stock Type

- 5.3.1 Mineral Oil-Based Lubricants

- 5.3.2 Synthetic Lubricants

- 5.3.3 Semi-Synthetic Lubricants

- 5.3.4 Bio-Based Lubricants

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Advance Lube Enterprise Sdn Bhd

- 6.4.2 BP Plc (Castrol)

- 6.4.3 Chevron Corporation

- 6.4.4 Excelube Marketing Sdn Bhd

- 6.4.5 Exxon Mobil Corporation

- 6.4.6 FUCHS

- 6.4.7 Idemitsu Kosan Co., Ltd.

- 6.4.8 Liqui Moly Malaysia

- 6.4.9 MSB Global Group Sdn. Bhd.

- 6.4.10 Petroliam Nasional Berhad (PETRONAS)

- 6.4.11 Petron

- 6.4.12 Shell plc

- 6.4.13 SINOPEC

- 6.4.14 TotalEnergies

- 6.4.15 UMW Lubetech Sdn Bhd

- 6.4.16 Valvoline (Saudi Arabian Oil Co.)

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment

8 Key Strategic Questions for CEOs