PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1430991

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1430991

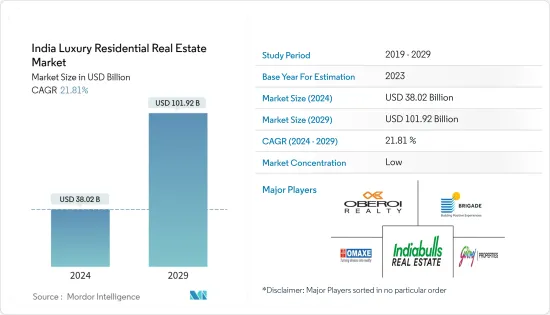

India Luxury Residential Real Estate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The India Luxury Residential Real Estate Market size is estimated at USD 38.02 billion in 2024, and is expected to reach USD 101.92 billion by 2029, growing at a CAGR of 21.81% during the forecast period (2024-2029).

Key Highlights

- Luxury real estate in India is booming in 2023 due to the growing demand from affluent buyers who are looking for high-end properties with modern amenities and beautiful designs.

- The trend towards a more modern, sophisticated, and luxurious lifestyle directly results from urbanization and rising disposable incomes. The luxury real estate market growth in India is also directly linked to the changing lifestyle trends of affluent buyers. According to the data, 17.5% (approximately 65.680 units) of the 365,000 units in the top 7 cities were luxury units in 2022.

- Luxury buyers want homes that reflect their styles and preferences, and they're willing to pay more for homes that stand out with unique designs, high-quality materials, and meticulous attention to detail.

- India's rapid urbanization has also played a role in this growth. More and more people are moving to urban areas in search of better jobs, better quality of life, and better infrastructure.

- This has led to a rise in disposable income for many people, especially in urban areas where most of the luxury properties are situated. As a result, more and more people can afford luxury properties, which has contributed to the growth of the Indian luxury real estate market.

India Luxury Residential Real Estate Market Trends

The growing presence of (HNIs) and (UHNIs) in major cities across the nation.

Luxury living in India is on the rise, and developers are capitalizing on this trend by constructing luxury properties with world-class facilities. The Arbour is a prime example of this, with DLF's success setting a new standard for luxury living. The luxury property market in India is set to continue to grow in the years to come, providing both developers and buyers with lucrative investment opportunities.

The number of high net-worth individuals (HNIs) in India is projected to increase by 63% from 2020 to 2025 to 1.02,000. With high disposable incomes, these individuals are ready to invest in high-end properties that provide a high quality of life.

Nowadays, more and more families are willing to shell out hundreds of thousands of dollars to purchase high-end homes that provide unrivaled comfort and convenience.

Rise in Smart Home Is Expected To Drive The Market

In today's world of cutting-edge technology, the term 'smart home' has come to mean 'connected home.' As IoT devices and smart automation systems become more commonplace, smart home technologies are playing an increasingly important role in transforming the real estate market.

Investing in smart home technology may seem like a no-brainer in today's market, where inflation rates are at an all-time high and interest rates are once again on the rise.

Nearly 13 million smart homes were installed in India in 2022. Another 12.84% of smart home solutions are expected to be in use by 2025. While the penetration rate of smart home devices is lower in India than in Western countries, the COVID-19 pandemic has helped shift the mindset from convenience to necessity when it comes to connected devices. This segment is further supported by the increasing popularity of Working Fixtures (WFH) and Hybrid Working Models (HWM).

India Luxury Residential Real Estate Industry Overview

India's luxury residential real estate market is competitive with the presence of private and government players. The Indian luxury residential Real estate market can be defined as a semi-consolidated market. Some of the top players in this market are Indiabulls Real Estate, Oberoi Realty, Brigade Group, Godrej Properties, and Oxame. The growing presence of international funds and foreign capital is increasingly attracting domestic developers to have joint ventures to gain a foothold in the country and enhance their financial strength and management expertise.

Post the pandemic, the luxury housing market has reported significant traction; buyers are responding favorably to residential purchases across segments as sale prices have corrected in the last few quarters, making real estate investment attractive, especially in the premium segment.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Dynamics

- 4.2.1 Market Drivers

- 4.2.1.1 Rapid Urbanization and Changing Lifestyle

- 4.2.1.2 Improved Infrastructure

- 4.2.2 Market Restraints

- 4.2.2.1 Rising Construction Cost

- 4.2.3 Market Opportunities

- 4.2.3.1 NRI boost the Luxury Property

- 4.2.1 Market Drivers

- 4.3 Insights into Technological Innovation in the Luxary Residential Real Estate Sector

- 4.4 Government Regulations and Initiatives

- 4.5 Value Chain / Supply Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Villas and Landed Houses

- 5.1.2 Apartments and Condominiums

- 5.2 By Cities

- 5.2.1 New Delhi

- 5.2.2 Mumbai

- 5.2.3 Kolkata

- 5.2.4 Bengaluru

- 5.2.5 Chennai

- 5.2.6 Other Cities

6 COMPETITIVE LANDSCAPE

- 6.1 Overview (Market Concentration and Major Players)

- 6.2 Company Profiles

- 6.2.1 Indiabulls Real Estate

- 6.2.2 Oberoi Realty

- 6.2.3 Godrej properties

- 6.2.4 Brigade Group

- 6.2.5 Omaxe

- 6.2.6 Sunteck Realty

- 6.2.7 The Pheonix Mills

- 6.2.8 Mahindra Lifespaces

- 6.2.9 Lodha Group

- 6.2.10 Prestige Group

- 6.2.11 Sotheby's International Reality

- 6.2.12 DLF India

- 6.2.13 Panchshil Realty*

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 APPENDIX