Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693759

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693759

Europe Organic Fertilizer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 169 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

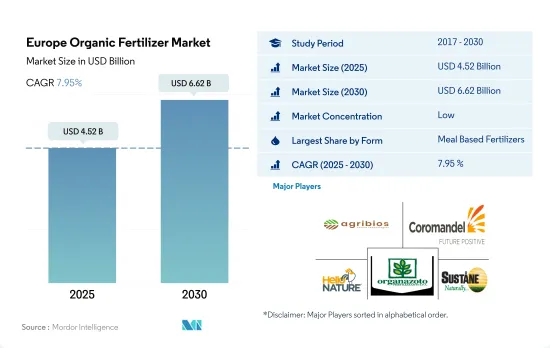

The Europe Organic Fertilizer Market size is estimated at 4.52 billion USD in 2025, and is expected to reach 6.62 billion USD by 2030, growing at a CAGR of 7.95% during the forecast period (2025-2030).

- The European organic fertilizers market in 2022 was primarily dominated by meal-based fertilizers, which accounted for 62.0% of the market. These fertilizers are highly beneficial to agricultural crops as they are rich in nitrogen, phosphorus, potassium, and calcium. Organic fertilizers based on meat and bone meal help reduce the demand for mineral fertilizers and provide an eco-friendly solution for disposing of large amounts of meat processing waste. Manures also contributed significantly to the European organic fertilizers market, registering a share of 38.3% in 2022. The segment's market value recorded an increase of 58.2% between 2017 and 2022.

- Row crops accounted for a significant portion of the organic fertilizer consumption in 2022 in Europe, with a share of 77.7%, followed by horticultural crops. This can be attributed to the large cultivation area of row crops in the region, which amounted to 82.3% of the total organic crop cultivation area in 2022.

- The development of a low-carbon economy is a primary goal of the EU's growth strategy, and organic fertilizers have the potential to make a significant contribution to this effort. Organic fertilizers help transfer atmospheric carbon dioxide into the soil, which prevents it from being released back into the atmosphere due to their high organic matter content. This approach is expected to drive the European organic fertilizers market, which is estimated to register a CAGR of 7.8% between 2023 and 2029.

- The European organic fertilizer market in 2022 was dominated by meal-based fertilizers and manures, with row crops being the primary consumers. As the European Union continues to push for a low-carbon economy, the demand for organic fertilizers is expected to increase, driving growth in the market.

- Europe has emerged as one of the major producers of organic crops, with 420,000 organic producers as of 2020. In 2022, Europe accounted for 41.7% of the global organic fertilizer market, a testament to the region's dominance in this field. The region's primary crops include wheat, maize, rye, barley, sugar beet, and potatoes, with row crops accounting for the majority of organic fertilizer consumption.

- Europe's organic agricultural acreage has been increasing steadily, with a growth rate of 7.1% from 4.9 million hectares in 2017 to 6.9 million hectares in 2022. This is largely due to the European Commission's objective of increasing the share of organic agriculture to a minimum of 25.0% of the EU's agricultural land by 2030.

- The European Union (EU) is currently revising its fertilizer Regulation for the first time since 2003, aiming to make it easier for new fertilizing products, particularly those containing nutrients or organic matter recycled from biowaste or other secondary raw materials, to enter the market. The new regulation will also establish safety and quality standards for fertilizing products sold in all EU countries. Organic-based fertilizers, with their circular and resource-efficient nature, are precisely the type of fertilizing products targeted by the new regulation.

- Europe's significant presence in the global organic fertilizers market, combined with the region's commitment to increasing the share of organic agriculture, presents a promising future for the organic fertilizers market in Europe. With the upcoming revision of the Fertilizer Regulation, the industry is expected to witness a surge in innovation and growth, providing opportunities for various stakeholders to expand their businesses.

Europe Organic Fertilizer Market Trends

European Green Deal is majorly contributing for increasing organic cultivation.

- European countries are increasingly promoting organic farming, and the amount of land categorized as organic has increased significantly over the last decade. In March 2021, the European Commission launched an organic action plan to achieve the European Green Deal target of ensuring that 25% of agricultural land is under organic farming by 2030. Austria, Italy, Spain, and Germany are among the leading countries for organic agriculture in the European region. In Italy, 15.0% of the agriculture area is under organic farming, which is higher than the EU average of 7.5%.

- In 2021, there were 14.7 million hectares of organic land in the European Union (EU). The agricultural production area is divided into three main types of use: arable land crops (mainly cereals, root crops, and fresh vegetables), permanent grassland, and permanent crops (fruit trees and berries, olive groves, and vineyards). The area of organic arable land was 6.5 million hectares in 2021, the equivalent of 46% of the EU's total organic agricultural area.

- The organic areas of cereals, oilseeds, protein crops, and pulses in the European Union increased by 32.6% between 2017 and 2021, reaching more than 1.6 million hectares. With 1.3 million hectares under cultivation, perennial crops like Olives, grapes, almonds, and citrus fruits accounted for 15% of the organic land in the region in 2020. Spain, Italy, and Greece are major growers of organic olive trees, with an area of 256,507, 208,212, and 56,507 hectares, respectively, in 2021. Both olives and grapes are crucial for the European economy as they can be turned into specialty products that generate demand locally and internationally. The growing organic acreage in the region is expected to further strengthen the European organic cultivation industry.

Growing demand for organic food, rising the per capita spending, will have a positive effect over organic fertilizer market

- Consumers in Europe are purchasing more goods made using natural materials and methods. Even though organic food only makes up a small fraction of the total EU agricultural production, it is no longer a niche industry. The European Union represents the second-largest single market for organic goods internationally, with an average per capita spending of USD 74.8 annually. The per capita spending on organic food in Europe has doubled in the last decade. In 2020, Swiss and Danish consumers spent the most on organic food (USD 494.09 and USD 453.90 per capita, respectively).

- Germany is the largest organic food market in the European region and the second largest in the world after the United States, with a market size of USD 6.3 billion and a per capita consumption of USD 75.6 in 2021, as per Global Organic Trade data. The country accounted for 10.0% of the global organic food demand, with its share estimated to record a CAGR of 2.7% between 2021 and 2026.

- The French organic food market witnessed strong growth, with a 12.6% rise in retail sales in 2021. The country's per capita spending on organic food was recorded at USD 88.8 in 2021, as per Global Organic Trade data. In 2018, as recorded by the Agence BIO/Spirit Insight Barometer, 88% of French people declared having consumed organic products. Preserving health, environment, and animal welfare are the primary justifications for consumers of organic foods in France. The organic food industry has begun to grow in several other nations, including Spain, the Netherlands, and Sweden, with the opening of organic stores. The growth in organic sales was triggered during and after the COVID-19 pandemic, as consumers began paying more attention to health issues and becoming aware of the adverse effects of conventionally grown food.

Europe Organic Fertilizer Industry Overview

The Europe Organic Fertilizer Market is fragmented, with the top five companies occupying 1.36%. The major players in this market are Agribios Italiana s.r.l., Coromandel International Ltd., HELLO NATURE ITALIA srl, ORGANAZOTO FERTILIZZANTI SPA and Sustane Natural Fertilizer Inc. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 500019

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Area Under Organic Cultivation

- 4.2 Per Capita Spending On Organic Products

- 4.3 Regulatory Framework

- 4.3.1 France

- 4.3.2 Germany

- 4.3.3 Italy

- 4.3.4 Netherlands

- 4.3.5 Russia

- 4.3.6 Spain

- 4.3.7 Turkey

- 4.3.8 United Kingdom

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Form

- 5.1.1 Manure

- 5.1.2 Meal Based Fertilizers

- 5.1.3 Oilcakes

- 5.1.4 Other Organic Fertilizers

- 5.2 Crop Type

- 5.2.1 Cash Crops

- 5.2.2 Horticultural Crops

- 5.2.3 Row Crops

- 5.3 Country

- 5.3.1 France

- 5.3.2 Germany

- 5.3.3 Italy

- 5.3.4 Netherlands

- 5.3.5 Russia

- 5.3.6 Spain

- 5.3.7 Turkey

- 5.3.8 United Kingdom

- 5.3.9 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Agribios Italiana s.r.l.

- 6.4.2 Angibaud

- 6.4.3 APC AGRO

- 6.4.4 Coromandel International Ltd.

- 6.4.5 Fertikal NV

- 6.4.6 HELLO NATURE ITALIA srl

- 6.4.7 Indogulf BioAg LLC (Biotech Division of Indogulf Company)

- 6.4.8 ORGANAZOTO FERTILIZZANTI SPA

- 6.4.9 Plantin

- 6.4.10 Sustane Natural Fertilizer Inc.

7 KEY STRATEGIC QUESTIONS FOR AGRICULTURAL BIOLOGICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.