Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644991

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644991

Middle East And Africa Drill Collar - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 110 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

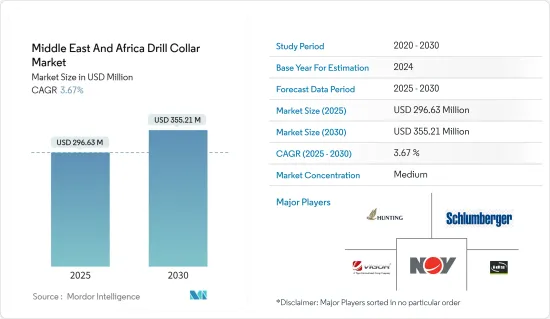

The Middle East And Africa Drill Collar Market size is estimated at USD 296.63 million in 2025, and is expected to reach USD 355.21 million by 2030, at a CAGR of 3.67% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, rising investments in the upstream sector aimed at increasing production capacity to maximize profits during the current high-price environment are expected to drive the market during the forecast period.

- On the other hand, the rising adoption of renewable energy across the globe and these regions is expected to curtail the demand for hydrocarbons in the region, restraining the market during the forecast period.

- Nevertheless, the development of smaller complex offshore gas fields remains in the Mediterranean, and the Red Sea remains a significant growth opportunity for the market during the forecast period.

- Saudi Arabia dominates the market and will likely register the highest CAGR during the forecast period. With the growing oil and gas production during the forecast period.

Middle East And Africa Drill Collar Market Trends

Offshore Segment to Witness Significant Growth

- In the aftermath of the COVID-19 pandemic, as demand for hydrocarbons rose due to a recovery in global demand, combined with the economic fallout of the Russia-Ukraine conflict, the price of hydrocarbons rose significantly in global markets. This has prompted many countries to accelerate the development of offshore projects, which were deemed economically unfeasible in the low-price environment.

- Additionally, to profit from the high prices, these countries are investing heavily in expanding production capacity to rake in higher oil revenues. This is expected to result in higher investments in the E&P sector, driving the offshore segment during the forecast period.

- According to Baker Hughes International Rig Count, as of October 2023, the cumulative offshore rig count stood at 44, which was nearly 115% higher than two years ago in October 2020 (20) when the effects of the pandemic started to intensify in the region.

- Due to this, several countries in the region are investing heavily in the development of offshore reserves. For instance, in August 2022, ADNOC Offshore awarded two major offshore drilling contracts totaling over USD 3.4 billion to ADNOC Drilling for the hire of 8 offshore jack-up rigs. Similarly, in June 2022, ADNOC Drilling was awarded two contracts worth USD 2 billion for the integrated drilling services at its Hail and Ghasha Gas Development Project (the world's largest offshore sour gas project), of which USD 1.3 billion was for integrated drilling services and fluids, while USD 711 million was for the provision of 4 Island Drilling Units.

- Such large investments in the sector demonstrate the fact that most countries in the region are trying to benefit from the global high-price environment, which is expected to accelerate investments in offshore projects to expand production capacity, driving the market during the forecast period.

Saudi Arabia to Dominate the Market

- Saudi Arabia is the largest crude oil producer in the MENA region, and the country has been a global leader in upstream technology. According to the Saudi Ministry of Energy, the country produced 9124.72 thousand barrels/day of crude last year, making it the 3rd largest producer of crude oil. Last year, the country produced 120.46 billion cubic meters of gas, making it the 8th largest producer globally.

- The country is the largest producer of crude oil in the MENA region and has the second-largest proven crude oil reserves globally. The country's E&P sector is dominated by the state-owned hydrocarbon utility Saudi Aramco, the world's largest exporter of crude oil.

- Saudi Arabia is one of the most influential members of the OPEC cartel, and since the COVID-19 pandemic decimated energy demand globally, the country has been slowly raising production quotas to keep oil prices stable globally.

- The country's upstream sector is focused on the development of massive limestone reservoirs in the country's onshore and offshore areas, such as the world's largest conventional onshore oil field (Ghawar) and the largest conventional offshore field (Safaniyah). These colossal fields have been producing for a long time and still have significant recoverable reserves. Additionally, Saudi Arabia has also started the development of the Jafurah Shale play, the country's largest unconventional shale play, estimated to hold nearly 200 Trillion cubic feet of shale gas.

- Drilling and completion of new wells is a significant investment; however, Saudi Arabia has one of the lowest costs of drilling globally. According to Saudi Aramco, the average upstream lifting cost was USD 3 per barrel produced in both 2021 and 2020.

- According to Baker Hughes International Rig Count, as of October 2023, Saudi Arabia's cumulative rig count stood at 86, which was nearly 8.9% higher than one years ago in October 2022.

- Saudi Aramco disclosed plans to boost its capital expenditure (CAPEX) to USD 40-50 billion this year, up by nearly 50% from last year, with further growth expected until 2025. The company plans to increase its crude production capacity to 13 million barrels/day by 2027 and aims to increase gas production by nearly 50% by 2030.

- Such ambitious expansion plans, coupled with new-age goals of complying with sustainability and environmental standards, are expected to attract significant investments and require major innovation in the sector, factors which are expected to drive the upstream market in the country and the demand for drill collars in the country during the forecast period.

Middle East And Africa Drill Collar Industry Overview

The Middle-East and African drill collar market is semi-consolidated. Some of the major players, in no particular order, include Hunting PLC, National Oilwell Varco Inc. (NOV), Schlumberger Limited, China Vigor Drilling Oil Tools and Equipment Co. Ltd, and International Drilling Services Ltd (IDS).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 5000248

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGEMENTATION

- 5.1 Type

- 5.1.1 Standard Steel Drill Collar

- 5.1.2 Non-magnetic Drill Collar

- 5.2 By Location of Deployment

- 5.2.1 Onshore

- 5.2.2 Offshore

- 5.3 By Geography

- 5.3.1 Saudi Arabia

- 5.3.2 United Arab Emirates

- 5.3.3 Iran

- 5.3.4 South Africa

- 5.3.5 Algeria

- 5.3.6 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Companies Profiles

- 6.3.1 Hunting PLC

- 6.3.2 National Oilwell Varco Inc. (NOV)

- 6.3.3 Schlumberger Limited

- 6.3.4 China Vigor Drilling Oil Tools and Equipment Co. Ltd

- 6.3.5 International Drilling Services Ltd (IDS)

- 6.3.6 Schoeller-Bleckmann Oilfield Equipment AG

- 6.3.7 American Oilfield Tools Inc.

- 6.3.8 Challenger International Inc.

- 6.3.9 Zhong Yuan Special Steel Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.