PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1642068

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1642068

Vietnam Home Furniture - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

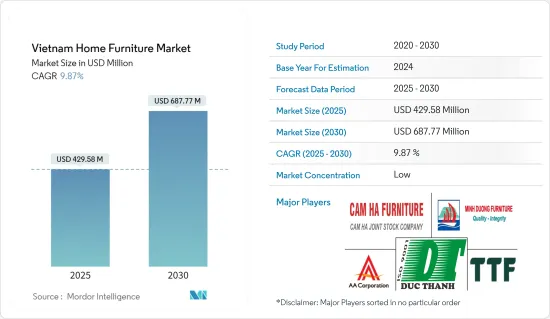

The Vietnam Home Furniture Market size is estimated at USD 429.58 million in 2025, and is expected to reach USD 687.77 million by 2030, at a CAGR of 9.87% during the forecast period (2025-2030).

Vietnam has emerged as a top choice for establishing furniture factories and serves as a key hub for furniture exports. The country's furniture is now shipped to more than 120 nations, with primary markets including the United States, the United Kingdom, Canada, Australia, and Japan. Additionally, Vietnamese furniture is in demand in China. The local consumers in Vietnam have a diverse selection of furniture items, with wooden furniture being the most popular choice. The indoor and outdoor furniture sector in Vietnam remains robust and is projected to maintain its strength in the years ahead. In comparison to other major players in the global furniture export market, Vietnam's furniture industry enjoys production advantages that position it well to expand its market share worldwide.

The home furniture industry in Vietnam is witnessing substantial growth, driven by the rapid urbanization and the expanding middle-class population in the country. This has led to an increased demand for residential furniture as more individuals are investing in home decor. Moreover, the growing popularity of e-commerce platforms for furniture retail is creating new distribution channels and reaching a broader customer base in Vietnam, thus boosting market expansion. Additionally, various government initiatives aimed at positioning the country as a manufacturing and export hub for furniture have attracted foreign investments. A significant factor in market growth is also the shift toward ecofriendly and sustainable furniture as a result of changes in consumer preferences for green products. The increasing focus on interior aesthetics and home improvement projects in Vietnam has led to a rise in furniture purchases, catalyzing market growth. Furthermore, continuous advancements in design, materials, and manufacturing techniques are enabling furniture manufacturers to produce innovative and competitively priced products, thereby fueling market growth. Other factors such as evolving lifestyle preferences towards modern and stylish furniture, the rapid growth of real estate development projects, and expanding export opportunities are expected to propel the market forward.

Vietnam Home Furniture Market Trends

Growing Urbanization is Propelling the Market Growth

The home furniture market is set to experience continuous growth as consumer demand for high-quality furnishings that cater to a variety of preferences and aesthetic values increases. There is a growing popularity for furniture that enhances comfort levels, driven by urbanization trends. Multi-purpose furniture pieces such as sofa beds, hydraulic beds, foldable tables, and storage beds are in high demand as homebuyers seek to maximize living spaces. This change in consumer behavior, particularly in urban areas, is expected to fuel the expansion of the home furniture market. Additionally, the trend of theme-based home decor and frequent home renovations is prevalent among middle and upper-middle-class consumers in urban areas, who prioritize style, comfort, and functionality when choosing furniture for their homes.

Rise in Sales of Bedroom Furniture is having a Positive Impact on Market Growth

Bedroom furniture comprises of cozy beds combined with matching bedside tables, drawers, and wardrobes, creating a peaceful haven that caters to the needs of individuals. Traditional homes have been transformed into luxurious modern dwellings due to the increase in disposable income and the adoption of modern lifestyle trends. The growing preference for airy, trendy, and comfortable walk-in closets or standalone wardrobes has become a crucial aspect in designing modern bedroom spaces. The increasing popularity of space-saving fixtures has led to a shift towards closet drawers, replacing traditional bedroom dressers and consequently freeing up more space in the bedroom. This trend is expected to drive the demand for wardrobes and storage furniture in the foreseeable future.

Vietnam Home Furniture Industry Overview

The Vietnam Home Furniture is fragmented with many players. The report covers significant manufacturers and Vietnamese players operating in the Vietnamese home furniture market. Regarding market share, some crucial players currently dominating the market are AA Corporation, Duc Thanh Wood Processing JSC, Truong Thanh Furniture Corporation, Bo Concept, and Ashley Furniture. However, with technological advancement and product innovation, mid-size to smaller companies are increasing their market presence by securing new contracts and tapping new markets. Local manufacturers face stiff competition from luxurious foreign brands entering the market, which might increase competition for existing players.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Home Renovation and Interior Design Services is Driving the Market

- 4.2.2 Shifting Consumer Preferences and Lifestyle Changes

- 4.3 Market Restraints/Challenges

- 4.3.1 Economic fluctuations can hamper the market growth

- 4.3.2 High Cost Of The Home Furniture To Hamper The Market Prospects

- 4.4 Market Opportunities

- 4.4.1 Technological Innovation Shaping The Future Of Furniture Designing

- 4.4.2 Rising Interest on Customized and Multipurpose Furniture

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Technological Innovations in the Vietnamese Home Furniture Market

- 4.7 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Kitchen Furniture

- 5.1.2 Living-room Furniture

- 5.1.3 Dining-room Furniture

- 5.1.4 Bedroom Furniture

- 5.1.5 Other Furnitures (outdoor home furniture, swing chairs, and study room furniture)

- 5.2 By Distribution Channel

- 5.2.1 Home Centers

- 5.2.2 Specialty Stores

- 5.2.3 Flagship Stores

- 5.2.4 Online

- 5.2.5 Other Distribution Channels(manufacturer retailers, warehouse clubs, discount retailers, distributors, and omnichannel selling companies)

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 AA Corporation

- 6.2.2 Duc Thanh Wood Processing JSC

- 6.2.3 Truong Thanh Furniture Corporation

- 6.2.4 BO Concept

- 6.2.5 Ashley Furniture Industries

- 6.2.6 Min Duong Furniture Corporation

- 6.2.7 Woodnet

- 6.2.8 Kaiser Furniture

- 6.2.9 Nitori Furniture

- 6.2.10 Hoang MOC Furniture

- 6.2.11 Cam Ha Furniture*

7 FUTURE MARKET TRENDS

8 DISCLAIMER