PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1440411

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1440411

APAC Banking-As-A-Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

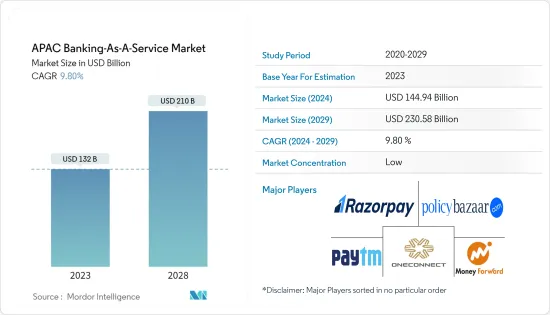

The APAC Banking-As-A-Service Market size is estimated at USD 144.94 billion in 2024, and is expected to reach USD 230.58 billion by 2029, growing at a CAGR of 9.80% during the forecast period (2024-2029).

Asia Pacific region is observing a sharp increase in its economic activities and is emerging as a leading digital transaction adoption market. With the rise in different services and businesses different models of payment are been adopted in the region of which BaaS is an upcoming market. Digital payment transaction volume in the region is observing a continuous increase in the region with digital commerce existing with more than half of the market share. This trend is resulting in different businesses adopting BaaS payment methods either directly through banks or by fintech companies.

BaaS as a system allows fintech companies and other third-party organizations to access the bank's system via APIs and provide its services to the users without having any bank license. Asia Pacific is an emerging market with a continuously rising value of investment in fintech companies. This increase in the number of fintech companies resulted in the creation of new financial products as well as an increase in partnerships between banks and fintech companies for the service. Fintechs and other third-party players running a digital platform are using APIs and the data which banks provides to create new and innovative financial solutions targeting specific customer needs.

BaaS services provided by banks are resulting in a reduction of their customer acquisition cost and expanding their customer base. India, Singapore, and China are emerging as fintech funding countries in the Asia Pacific region leading the fintech space. Local players such as Paytm and Razorpay in India are resulting in an expansion of financial services access to a large amount of unbanked population. These emerging digital payments, financial inclusion, and expansion of financial services are leading to a significant rise in the Asia Pacific Banking As Service market.

APAC Banking as a Service (BAAS) Market Trends

Increase In Digital Banking

Post-COVID, the value of Digital banking transactions in the Asia Pacific region is observing a continuous increase with the increase in the number of users preferring to make digital transactions while rendering a service. Banking as a Service (BaaS) enables rapid and effortless expansion of digital payment services by the fintech companies without any requirement for a banking license and infrastructure. Mobile Banking, Mobile payment, Blockchain, Insurtech, and Digital lending are among some of the services that can be offered using BaaS. India, China, Singapore, and Indonesia are among the emerging Asia-Pacific countries with an increasing share of digital transactions in the region. The rise in the number of digital payment users combined with an increase in digital payment providers is leading to a positive growth outlook for Banking as a Service in Asia Pacific.

Rising Value of Transaction in the Region

China, Japan, India, and Australia are emerging as the Asia Pacific countries with the leading value of GDP in the region. This rise is leading to a large number of financial transactions and economic activities occurring in these countries creating demand for an increase in financial services products. Alternative finance, i.e. funding available outside traditional banks. in the region is observing significant growth with India, Indonesia, South Korea, and China existing in the leading position. Rising payment volume in the region through digital commerce and Mobile POS systems has observed an increase, with demand for digital financial services by different payment facilitators leading to the expansion of the Banking as a Service (BaaS) market in the region.

APAC Banking as a Service (BAAS) Industry Overview

The APAC Banking-As-A-Service Market is fragmented with a large number of small and large players existing in the market. With technological advancement and service innovation, mid-size to large-size companies are increasing their market presence by securing new contracts and tapping new markets. Some of the major players existing in the market are One Connect, Du Xiaoman Financial, Money Forward, and Policy Bazar, etc.,

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise in Digital Banking in The Region

- 4.2.2 Rise in Volume of Financial Transaction

- 4.3 Market Restraints

- 4.3.1 Higher Cost of BaaS Technology for Some Banking Entities.

- 4.4 Market Opportunities

- 4.4.1 Rise in Government Initiatives Towards Digitizing Economy

- 4.4.2 Rise in Customized Financial Services Products by Businesses

- 4.5 Industry Attractiveness - Porters' Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Technological Innovations in the Asia Pacific Banking-As-A-Service Market

- 4.7 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 API Based BaaS

- 5.1.2 Cloud Based BaaS

- 5.2 By Service Type

- 5.2.1 Payment Process Services

- 5.2.2 Digital Banking Services

- 5.2.3 KYC Service

- 5.2.4 Customer Support Services

- 5.2.5 Others

- 5.3 By Enterprise

- 5.3.1 Large Enterprise

- 5.3.2 Small & Medium Enterprise

- 5.4 By Country

- 5.4.1 China

- 5.4.2 India

- 5.4.3 Japan

- 5.4.4 South Korea

- 5.4.5 Indonesia

- 5.4.6 Vietnam

- 5.4.7 Malaysia

- 5.4.8 Australia

- 5.4.9 New Zealand

- 5.4.10 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concetration Overview

- 6.2 Company Profiles

- 6.2.1 ZestMoney

- 6.2.2 MoneyTap

- 6.2.3 Paytm

- 6.2.4 OneConnect

- 6.2.5 Jiedaibao

- 6.2.6 Money Forward

- 6.2.7 Kyash

- 6.2.8 Moneycatcha

- 6.2.9 Policybazaar

- 6.2.10 Razorpay*

7 MARKET FUTURE TREND

8 DISCLAIMER AND ABOUT US