Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693639

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693639

India Two Wheeler - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 202 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

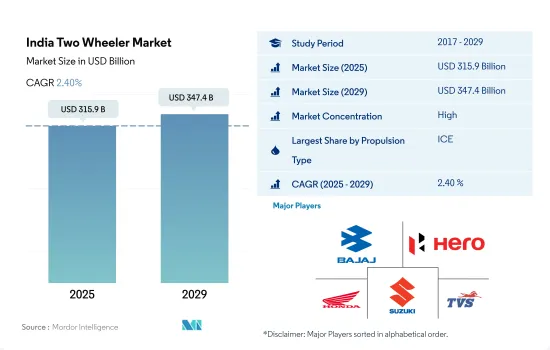

The India Two Wheeler Market size is estimated at 315.9 billion USD in 2025, and is expected to reach 347.4 billion USD by 2029, growing at a CAGR of 2.40% during the forecast period (2025-2029).

India's two-wheeler market growth from 2024 to 2030 reflects rising EV adoption, driven by tech, policy, and a shift in consumer preferences

- In 2023, the total sales for two-wheelers in India showed positive growth, reaching 16,999,920 units, an increase from 15,862,087 units in 2022. This growth demonstrates a rebound in the two-wheeler market, reflecting a recovering economy and an increasing consumer demand for personal mobility solutions. The projections for 2024 indicate a further increase to 17,843,445 units, hinting at a continued upward trend. This positive momentum is likely driven by a combination of factors, including urbanization, the need for affordable transportation, and a growing young population.

- The Indian government's support for sustainable transportation, particularly through incentives for electric vehicle (EV) purchases and infrastructure development, has significantly impacted the two-wheeler market. These initiatives, alongside the rising fuel prices, have accelerated the shift toward electric and hybrid two-wheelers, making them a more appealing option for consumers. The market's growth is also supported by the introduction of new models with advanced features, catering to a wide range of consumer preferences and needs.

- From 2024 to 2030, the Indian two-wheeler market is projected to witness consistent growth, with sales hitting 22,764,730 units by 2030. This forecast underscores the compounding impact of sustained economic growth, urbanization, and technological advancements in the market. The surge in electric two-wheelers will be a pivotal driver as hybrid and electric variants gain prominence due to their eco-friendly attributes, cost efficiency, and favorable government policies.

India Two Wheeler Market Trends

Government initiatives and stringent norms drive rapid growth in the electric vehicle market in India

- India's electric vehicle (EV) market is in a growth phase, with the government actively formulating strategies to combat pollution. The Fame India scheme, launched in 2015, has played a pivotal role in driving vehicle electrification. Building on its success, Fame Phase 2, active till April 2022, further bolstered EV sales, especially in 2021, with the government offering subsidies like INR 10,000 grants for electric cars with battery capacities up to 15 kWh.

- State governments across India are increasingly incorporating electric buses into their fleets, aiming to transition from internal combustion engine (ICE) buses. This move not only cuts operational costs but also curbs carbon emissions and improves air quality. In a notable move, the Delhi government greenlit the procurement of 300 new low-floor electric (AC) buses in March 2021, with 100 of them hitting the roads in January 2022. These initiatives contributed to a significant 62.58% surge in demand for electric commercial vehicles in India in 2022 over 2021.

- The demand for electric cars has surged in recent times, driven by the government's introduction of stringent norms. In August 2021, the Indian government unveiled the Vehicle Scrappage Policy, targeting the phasing out of polluting and unfit vehicles, irrespective of their age. This policy, set to be implemented by 2024, is steering consumers toward electric cars. Additionally, the government has set an ambitious target of having 30% of all cars in India electrified by 2030. These initiatives are poised to propel electric car sales during the 2024-2030 period in India.

India Two Wheeler Industry Overview

The India Two Wheeler Market is fairly consolidated, with the top five companies occupying 87.94%. The major players in this market are Bajaj Auto Ltd., Hero MotoCorp Ltd., Honda Motorcycle & Scooter India Pvt. Ltd., Suzuki Motorcycle India Pvt. Ltd. and TVS Motor Company Limited (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 93027

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 GDP Per Capita

- 4.3 Consumer Spending For Vehicle Purchase (cvp)

- 4.4 Inflation

- 4.5 Interest Rate For Auto Loans

- 4.6 Impact Of Electrification

- 4.7 EV Charging Station

- 4.8 Battery Pack Price

- 4.9 New Xev Models Announced

- 4.10 Fuel Price

- 4.11 Regulatory Framework

- 4.12 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Propulsion Type

- 5.1.1 Hybrid and Electric Vehicles

- 5.1.2 ICE

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 AMPERE VEHICLES PRIVATE LIMITED

- 6.4.2 Ather Energy Pvt. Ltd.

- 6.4.3 Bajaj Auto Ltd.

- 6.4.4 Hero Electric Vehicles Pvt. Ltd.

- 6.4.5 Hero MotoCorp Ltd.

- 6.4.6 Honda Motorcycle & Scooter India Pvt. Ltd.

- 6.4.7 India Kawasaki Motors Pvt. Ltd.

- 6.4.8 Mahindra Two Wheelers Ltd.

- 6.4.9 Okinawa Autotech Pvt. Ltd.

- 6.4.10 Ola Electric Mobility Pvt. Ltd.

- 6.4.11 Piaggio Vehicles Pvt. Ltd.

- 6.4.12 REVOLT Intellicorp Pvt. Ltd.

- 6.4.13 Royal Enfield

- 6.4.14 Suzuki Motorcycle India Pvt. Ltd.

- 6.4.15 TVS Motor Company Limited

- 6.4.16 Yamaha Motor India Pvt. Ltd.

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.