PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444516

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444516

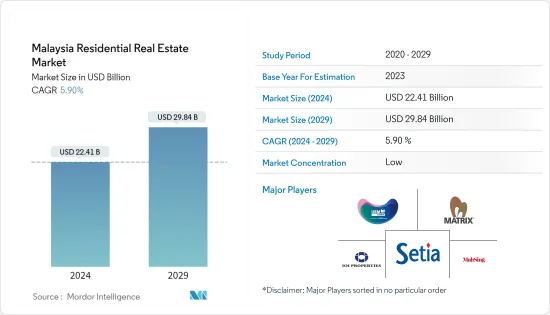

Malaysia Residential Real Estate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Malaysia Residential Real Estate Market size is estimated at USD 22.41 billion in 2024, and is expected to reach USD 29.84 billion by 2029, growing at a CAGR of 5.90% during the forecast period (2024-2029).

Key Highlights

- In 2022, Malaysia's residential real estate market recovered with increasing demand skewed toward cheap housing. Due to the possibility of strong demand for residences among the young generation, the developers are cautiously optimistic about property prospects in the medium to long term.

- Malaysia's residential real estate market performed less well than projected in the first quarter of 2021. The resurgence of COVID-19 infections and the reimposition of strict Movement Control Order (MCO 2.0) requirements are two significant factors for the decreased performance.

- According to the Malaysia Property Market Index, the total median asking price in four main Malaysian markets (Kuala Lumpur, Selangor, Penang, and Johor) fell by -1.79% Y-o-Y in Q1 2021. Subsale residential property market saw high Y-o-Y demand growth of +19.2% in the first half of 2021.

- Increased innovation and a stronger focus on digital solutions are two good outcomes of a pandemic-stricken property business. By engaging with buyers through online activities, key property players have expedited their efforts to advertise products.

- Due to the inability to inspect properties in person due to the COVID-19 induced lockdowns, property buyers have shifted their focus to online browsing, fueled by substantial discounts offered by Malaysian developers for newly launched properties.

- Furthermore, the government's Home Ownership Campaign (HOC) was extended until December 2021. During Q1 2021, the total property market had a -5% Y-o-Y reduction in median asking prices. However, demand for subsale properties in Kuala Lumpur increased by 8.1% Y-o-Y in Q1 2021.

Malaysia Residential Real Estate Market Trends

Increase in Urbanization Boosting Demand for Residential Real Estate

Malaysia is currently one of the most urbanized countries in East Asia and one of the most rapidly urbanized regions worldwide. People from rural areas are migrating to urban areas due to the economy and employment shifting from agriculture to industry and services.

The population of Malaysia is growing rapidly, giving rise to the demand for more housing, commercial buildings, social spaces, and infrastructure. Thus, the Malaysian government is dedicated to providing appropriate, high-quality, and affordable housing.

The government is dedicated to providing inexpensive housing for the younger generation and concentrating on building affordable housing in small towns and suburbs to boost the likelihood of people purchasing a property.

This statistic shows the growing urbanization in Malaysia from 2017 to 2021. Urbanization means the share of the urban population in the total population of a country. In 2021, 77.7% of Malaysia's total population lived in urban areas and cities.

Government Initiatives Driving the Market

Malaysia's property market is expected to rebound in 2022 as more demand will likely be skewed toward affordable housing. The 12th Malaysia Plan (12MP) will have nine areas of focus covering the economy, poverty, and income gaps.

Malaysian government policies and regulations have led to the increase in the development of new project units in the country. Several workers and on-site development projects and construction activities have been involved over time, leading to massive ongoing developments across the country.

The government plans to build 500,000 affordable homes for income earners in the bottom 40% (B40) and middle 40% (M40) groups, along with MYR 2.25 billion (USD 52.8 Million) allocations during the 12 MP period to build and repair 85,500 housing units for the poor under the Program Bantuan Rumah.

The Malaysian People's Housing Program (PPR) will be given a new direction by the National Affordable Housing Council (MPMMN), which may include additional components aimed at attaining the "Liveable Malaysia" agenda.

New developments in established and popular localities (which continue to command reasonable prices) like Bangsar, Mont Kiara, and Sri Hartamas are helping revive property interest in Kuala Lumpur, while government-led measures to provide more affordable housing options are also making an impact.

Malaysia Residential Real Estate Industry Overview

Malaysia's residential real estate market is fragmented with many players. The sales proportion of residential real estate properties through online channels consistently grows due to the rising internet penetration, growing demand, increasing personal disposable incomes, surging middle-class youth population, and opportunities offered by government infrastructure investments.

The major players include SP Setia, IOI Properties, UEM Sunrise, Mah Singh Group Bhd, and Matrix Concepts Holdings Bhd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Overview

- 4.2 Residential Real Estate Buying Trends - Socioeconomic and Demographic Insights

- 4.3 Government Initiatives and Regulatory Aspects for Residential Real Estate Sector

- 4.4 Insights on the Size of Real Estate Lending and Loan to Value Trends

- 4.5 Insights on Interest Rate Regime for General Economy and Real Estate Lending

- 4.6 Insights on Rental Yields in the Residential Real Estate Segment

- 4.7 Insights on Capital Market Penetration and REIT Presence in Residential Real Estate

- 4.8 Insights on Affordable Housing Support Provided by Government and Public-Private Partnerships

- 4.9 COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Drivers

- 5.2 Restraints

- 5.3 Opportunities

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Bargaining Powers of Buyers/Consumers

- 5.4.2 Bargaining Power of Suppliers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Apartments and Condominiums

- 6.1.2 Landed Houses and Villas

- 6.2 By Key Cities

- 6.2.1 Kuala Lumpur

- 6.2.2 Seberang Perai

- 6.2.3 George Town

- 6.2.4 Johor Bahru

7 COMPETITIVE LANDSCAPE

- 7.1 Overview

- 7.2 Company Profiles

- 7.2.1 S P Setia

- 7.2.2 IOI Properties

- 7.2.3 UEM Sunrise

- 7.2.4 Mah Sing Group Bhd

- 7.2.5 Matrix Concepts Holdings Bhd

- 7.2.6 IGB Berhad

- 7.2.7 Eco World Development Group Berhad

- 7.2.8 Sime Darby Property

- 7.2.9 Glomac Bhd

- 7.2.10 Platinum Victory*

8 FUTURE OF THE MARKET

9 APPENDIX