PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444746

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444746

Africa Compound Chocolate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

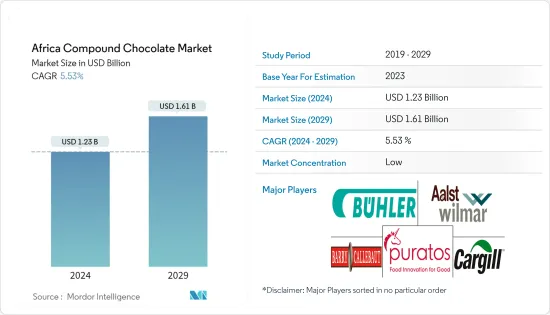

The Africa Compound Chocolate Market size is estimated at USD 1.23 billion in 2024, and is expected to reach USD 1.61 billion by 2029, growing at a CAGR of 5.53% during the forecast period (2024-2029).

Consumption of confectionery products like chocolates, assortment boxes, and other chocolate products is increasing in the region owing to increasing disposable income and increasing innovation. The millennial population in the region is more attracted to the consumption of different types and flavors of chocolates. According to United States Department of Agriculture data from 2021, Morocco imported USD 79 trillion worth of chocolate from the world. The demand for compound chocolate is growing among manufacturers owing to its application in different food products like bakeries, icecreams, frozen desserts, chocolate beverages, and many more.

Compound chocolate like dark chocolate is used in different bakery products like cakes and pastries as toppings or as the main flavor ingredient. Also, dark chocolate products like choco chips and choco thins are used as decorating ingredients in frozen desserts and icecreams. The market players are preparing new compound chocolate products from good quality cocoa in order to have better consistancy and taste in the products. Additionally, the demand for compound chocolate is increasing among manufacturers due to its low cost and use of vegetable oils in it instead of cocoa butter which makes the products look shinier and attractive. Over the medium term, the demand for compund chocolate is expected to increase owing to the increasing consumption of chocolate products among consumers and product innovation in the market.

Africa Compound Chocolate Market Trends

Growing Demand for Chocolate in Various Applications

The rise in popularity of compound chocolate is due to its application in different food products, with forms such as coatings, drizzles, chunks, and drops. Chocolate chips/drops/chunks can be used in cookies, pancakes, cakes, and various pastries. They are also found in many other retail food products, such as granola bars, ice cream, and trail mix, which is increasing the application of the same in these widely consumed product types. Unlike chocolate, compounds, and inclusions may be colored. This not only helps to add flavor but also creates the opportunity for seasonal and limited-edition innovations. The market players have been innovating and launching new chocolate products with the incorporation of compound chocolate. For instance, in September 2022, a South African Company Cape Roasters launched chocolate-coated products such as peanuts, raisins, and shortcakes with the addition of sustainably sourced cocoa.

Bakery holding the Major Share for Utilization of Compound Chocolate

Compound chocolate is the most commonly used chocolate in the baking industry in different products like cakes, pastries, desserts, cookies, and other products. Increasing demand for convenience and innovative products among consumers is driving the market players for the use of chocolate in different food products. The recent trend of using compound chocolate for decoration purposes is also driving the demand for it in the market. The shelf life of fresh baked goods enrobed with compound coating does not get affected because hard fat is used to adjust the melting point and carries enough seed to make necessary tempering. The market players are launching different types of processed bakery products like cookies and biscuits in the market with the addition of healthy ingredients along with chocolate which is grabbing consumer attraction. For instance, in November 2022, Mondelez International launched a range of Cadbury Bournvita Biscuits in Nigeria.

Africa Compound Chocolate Industry Overview

The African compound chocolate market is consolidated with major players competing for the market share. The major players in the market are focusing on new product launches, expansion, mergers and acquisitions, and partnerships to gain a competitive advantage in the market and therefore strengthen their hold in the market. The key players in the market are Cargill, Puratos, The Barry Callebaut Group, and Aalst Wilmar Pte Ltd among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

- 3.1 Market Overview

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Dark Chocolate

- 5.1.2 Milk Chocolate

- 5.1.3 White Chocolate

- 5.2 Form

- 5.2.1 Chocolate Chips/Drops/Chunk

- 5.2.2 Chocolate Slab

- 5.2.3 Chocolate Coatings

- 5.2.4 Other Types

- 5.3 Application

- 5.3.1 Bakery

- 5.3.2 Confectionery

- 5.3.3 Frozen Desserts and Ice-Cream

- 5.3.4 Beverages

- 5.3.5 Cereals

- 5.3.6 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Cargill, Incorporated

- 6.3.2 Puratos

- 6.3.3 The Barry Callebaut Group

- 6.3.4 The Buhler Holding AG

- 6.3.5 Mondelez International

- 6.3.6 Ferrero International SA

- 6.3.7 Fuji Oil Holdings Inc

- 6.3.8 Nestle SA

- 6.3.9 Cocoa Processing Company

- 6.3.10 Lindt & Sprungli AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS