PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906040

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906040

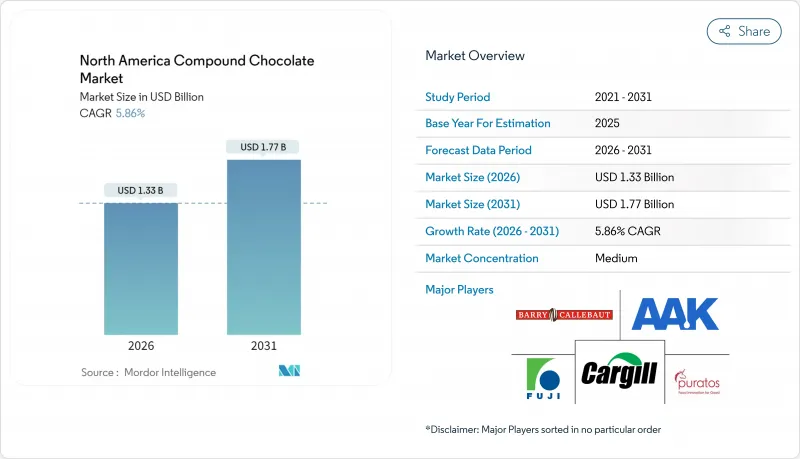

North America Compound Chocolate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The North American compound chocolate market is expected to grow from USD 1.26 billion in 2025 to USD 1.33 billion in 2026 and is forecast to reach USD 1.77 billion by 2031 at 5.86% CAGR over 2026-2031.

This growth trajectory highlights the market's ability to navigate cocoa price fluctuations effectively. The World Bank reported that in 2024, cocoa prices averaged USD 7.33 per kilogram, a significant increase from USD 3.28. This surge is attributed to manufacturers' growing preference for compound formulations, which replace cocoa butter with more stable vegetable fats. The foodservice sector, which has been rebounding steadily, is a key driver of this demand. The International Foodservice Manufacturers Association anticipates a 0.9% growth in 2024, followed by a 1.0% uptick in 2025. Compound chocolates boast functional advantages, including easier processing and superior heat resistance, making them popular among bakeries, confectioners, and quick-service restaurants. Moreover, as consumers increasingly seek flavor diversity and prioritize clean-label products, there has been a notable rise in the incorporation of botanical, protein, and plant-based elements in compound chocolates. To further bolster their market position, players are making strategic moves, investing in digital supply chains and sourcing certified sustainable fats, ensuring resilience against procurement challenges and tightening regulations.

North America Compound Chocolate Market Trends and Insights

Versatility and functional benefits for food manufacturers

Food processors are increasingly adopting compound chocolate, driven by the need for manufacturing flexibility. These processors are turning to cost-effective alternatives to traditional chocolate, seeking to eliminate tempering requirements and broaden processing windows. By utilizing fractionated palm kernel oil and coconut oil in their formulations, manufacturers can achieve sensory profiles similar to those of chocolate. This approach not only mirrors the desired taste but also curtails the need for hefty investments in temperature-controlled production lines. The advantages of compound chocolate extend beyond mere processing ease. It boasts superior heat resistance and is less susceptible to fat bloom. These traits are especially vital for products aimed at foodservice channels, where temperature control can be inconsistent. Furthermore, with the advent of advanced oleogel systems, manufacturers can now cut saturated fat content by up to 39% without sacrificing taste or texture. This innovation meets the rising demand for clean-label products while ensuring functionality remains intact. Given these technical advantages, compound chocolate is emerging as a strategic ingredient for manufacturers, enabling them to optimize costs and differentiate their products in a competitive market.

Growth of the foodservice industry

Despite broader economic pressures, certain segments of the foodservice industry are showing resilience, leading to a targeted demand for compound chocolate applications. The National Restaurant Association reported that in June 2025, the U.S. restaurant industry's performance index reached a score of 100. This segmentation is crucial for compound chocolate suppliers. Fast casual operators, for instance, often seek versatile coating and filling solutions. These solutions not only maintain quality over extended hold times but also support the rapid cycles of menu innovation. While the foodservice industry is projected to grow in 2025, it's essential to note the significant differences across various channels. Data from the US Census Bureau indicate that in 2024, sales from U.S. food service and drinking places reached approximately USD 1,121.3 billion, up from USD 1,094.08 billion the previous year. [3]. This trend indicates a growing demand for compound chocolate, particularly in the educational foodservice and hospitality sectors. As operators increasingly prioritize both operational efficiency and premium menu offerings, there's a growing opportunity for compound chocolate formulations. These formulations promise a chocolate-like indulgence while ensuring predictable cost management.

Competition from pure chocolate products

As consumers increasingly equate pure chocolate with quality and authenticity, the compound chocolate market faces hurdles in its expansion. While premium chocolate segments flourish, everyday chocolate sales remain stagnant, underscoring consumers' readiness to invest in perceived quality. This trend poses challenges for compound chocolate, often viewed as a budget-friendly substitute. Brands championing single-origin, bean-to-bar, and artisanal chocolates emphasize transparency and craftsmanship, inadvertently casting compound chocolate in a less favorable light, even though it boasts functional benefits in certain uses. The perception issue deepens with major players like Hershey making strategic moves, such as acquiring premium brands like Lily's Sweets for USD 425 million, hinting at a pivot towards the more lucrative pure chocolate market. Yet, compound chocolate holds its ground in industrial settings, where its functionality, consistency, and cost predictability take precedence over consumer perceptions. This dynamic points to a split market: one side catering to premium consumer segments and the other focused on B2B applications.

Other drivers and restraints analyzed in the detailed report include:

- Surge in home baking and cooking

- Innovation in flavor and inclusion

- Volatility in vegetable fat prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, milk chocolate commands a 43.85% market share, underscoring its entrenched consumer appeal and versatile applications. Meanwhile, dark chocolate, with a 5.91% CAGR projected through 2031, hints at shifting market dynamics, driven by its perceived health benefits and premium allure. Consumers are increasingly associating dark chocolate with its antioxidant properties and lower sugar content. This perception resonates with many North Americans who now expect their chocolate treats to offer health advantages. White chocolate finds its niche, predominantly in bakery and confectionery coatings, where its neutrality accentuates the visibility of other vibrant inclusions. The "Others" category showcases specialty offerings, from sugar-free and protein-enhanced to botanical-infused chocolates, catering to distinct market segments.

Compound chocolate formulations shine in dark chocolate applications, utilizing cocoa butter equivalents to achieve the desired snap and mouthfeel. This approach not only curbs costs but also enhances heat stability. The segment's upward trajectory is in sync with regulatory shifts, notably the FDA's updated definition of "healthy" food labeling, set for February 2025. This change could benefit dark chocolate formulations that align with the new nutritional benchmarks. Leveraging advanced oleogel technologies, dark compound chocolate formulations can now replace up to 50% of cocoa butter. This innovation retains sensory qualities, bolsters cost-efficiency, and champions clean-label strategies.

The North America Compound Chocolate Market is Segmented by Type (Dark, Milk, White, and More), Form (Chips/Drops/Chunks, Slabs and Blocks, Coatings, Fillings and Spreads, and More), Distribution Channel (Retail, Industrial, and Foodservice), and Geography (United States, Canada, and Mexico, and Rest of North America). The Market Forecasts are Given in Terms of Value (USD).

List of Companies Covered in this Report:

- Barry Callebaut

- Cargill

- Puratos

- Fuji Oil Holdings

- AAK AB

- Clasen Quality Chocolate

- Blommer Chocolate Company

- Hershey (Ingredients & Foodservice)

- Mars Inc. (Mars Wrigley)

- Mondelez International

- Nestle Professional

- Guittard Chocolate Company

- Aalst Chocolate

- Wilmar International (Cocoa & Fats)

- Valrhona

- Foley's Candies

- Santa Barbara Chocolate

- La Siembra Co-operative

- Bakels Group

- Alpezzi Chocolate

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Versatility and functional benefits for food manufacturers

- 4.2.2 Growth of the foodservice industry

- 4.2.3 Surge in home baking and cooking

- 4.2.4 Innovation in flavor and inclusion

- 4.2.5 Product diversity and customization

- 4.2.6 Advancements in fat crystallization technology

- 4.3 Market Restraints

- 4.3.1 Competition from pure chocolate products

- 4.3.2 Sustainability and ethical sourcing concerns

- 4.3.3 Volatility in vegetable fat prices

- 4.3.4 Stringent food labeling regulations

- 4.4 Consumer Analysis

- 4.5 Supply-Chain Analysis

- 4.6 Regulatory Landscape

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS

- 5.1 By Type

- 5.1.1 Dark

- 5.1.2 Milk

- 5.1.3 White

- 5.1.4 Others

- 5.2 By Form

- 5.2.1 Chips/Drops/Chunks

- 5.2.2 Slabs and Blocks

- 5.2.3 Coatings

- 5.2.4 Fillings and Spreads

- 5.2.5 Others

- 5.3 By Distribution Channel

- 5.3.1 Retail

- 5.3.1.1 Supermarkets/Hypermarkets

- 5.3.1.2 Convenience Stores

- 5.3.1.3 Online Retail Stores

- 5.3.1.4 Other Distribution Channels

- 5.3.2 Industrial

- 5.3.3 Foodservice

- 5.3.1 Retail

- 5.4 By Geography

- 5.4.1 United States

- 5.4.2 Canada

- 5.4.3 Mexico

- 5.4.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Barry Callebaut

- 6.4.2 Cargill

- 6.4.3 Puratos

- 6.4.4 Fuji Oil Holdings

- 6.4.5 AAK AB

- 6.4.6 Clasen Quality Chocolate

- 6.4.7 Blommer Chocolate Company

- 6.4.8 Hershey (Ingredients & Foodservice)

- 6.4.9 Mars Inc. (Mars Wrigley)

- 6.4.10 Mondelez International

- 6.4.11 Nestle Professional

- 6.4.12 Guittard Chocolate Company

- 6.4.13 Aalst Chocolate

- 6.4.14 Wilmar International (Cocoa & Fats)

- 6.4.15 Valrhona

- 6.4.16 Foley's Candies

- 6.4.17 Santa Barbara Chocolate

- 6.4.18 La Siembra Co-operative

- 6.4.19 Bakels Group

- 6.4.20 Alpezzi Chocolate

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK