PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910533

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910533

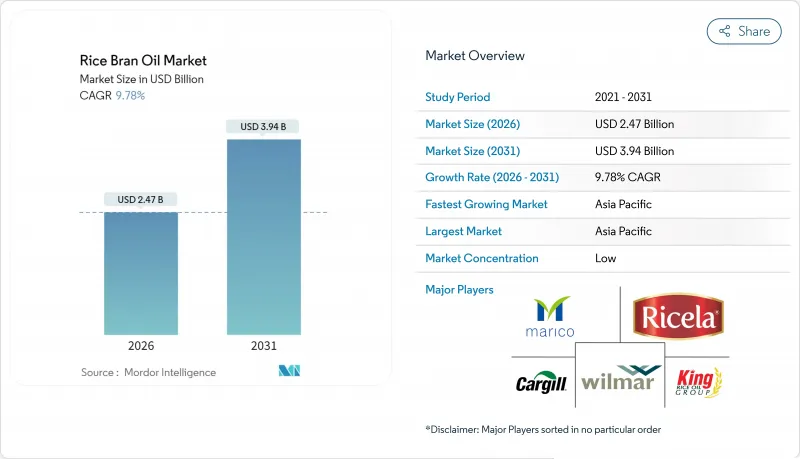

Rice Bran Oil - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The global rice bran oil market was valued at USD 2.25 billion in 2025 and estimated to grow from USD 2.47 billion in 2026 to reach USD 3.94 billion by 2031, at a CAGR of 9.78% during the forecast period (2026-2031).

This remarkable market transformation showcases how rice bran oil has successfully evolved from being an underutilized agricultural byproduct into a sought-after premium cooking oil. The market expansion is primarily attributed to extensive scientific research validating its cardiovascular health benefits and exceptional thermal stability characteristics, making it particularly suitable for high-temperature cooking applications. Consumer demand continues to strengthen as numerous clinical studies substantiate the oil's effectiveness in reducing total cholesterol and LDL levels, solidifying its position as a preferred choice among health-conscious consumers. However, the industry faces challenges as climate-related uncertainties affect rice crop yields, which directly impact bran availability. In response, processing companies are making strategic investments in advanced stabilization technologies and sophisticated cold-chain logistics infrastructure to safeguard their operational margins and ensure consistent supply.

Global Rice Bran Oil Market Trends and Insights

Increasing Preference for Low Trans-Fat and Cholesterol Oils in Diets

The increasing consumer understanding of heart health risks associated with trans fats has driven a notable shift towards healthier cooking oil alternatives, with rice bran oil emerging as a preferred choice. Rice bran oil's composition includes beneficial natural compounds called tocopherols and tocotrienols, which offer protective antioxidant properties and support overall health, particularly addressing metabolic health concerns common among older populations. Medical research through multiple clinical trials has demonstrated that incorporating rice bran oil as a replacement for saturated fats in daily meal preparation results in measurable reductions in blood triglyceride levels. In response to these findings, food manufacturing companies have begun reformulating their products to include rice bran oil in their premium cooking oil combinations. The Food and Drug Administration's official recognition of rice bran oil, derived from the rice plant Oryza sativa, has established a clear regulatory framework that enables wider adoption across the food industry .

Rising Demand for Natural, Clean-Label, and Organic Products

Rice bran oil has gained prominence due to the clean-label movement, as it requires minimal processing and contains no synthetic additives. While organic rice bran oil represents a smaller market segment, its production has increased due to consumer interest in regenerative agriculture practices. Advanced processing methods, including cold plasma and ultra-high pressure techniques, now preserve 95% of Y-oryzanol content and extend shelf life without chemical preservatives. The extraction of oil from rice bran, previously considered agricultural waste, aligns with circular economy principles. European markets show strong demand for specialty rice products, with organic rice imports reaching 90,000 tonnes annually, driving demand for organic rice bran oil . Quality standards established through USDA Organic and equivalent international certifications help differentiate premium rice bran oil products in the retail market.

Distribution and Storage Issues Affecting Product Quality

The high unsaturated fatty acid content in rice bran oil makes it susceptible to rancidity and quality degradation during storage and transportation, creating significant operational challenges, particularly in regions lacking proper cold chain infrastructure. When exposed to light, heat, and oxygen during distribution, the oil undergoes oxidative deterioration, impacting its market viability. This issue becomes more pronounced in developing markets, where limited refrigerated storage facilities and extended supply chains compound the preservation challenges. The oil demands specialized packaging solutions, including nitrogen flushing and UV-protective containers, substantially increasing distribution costs compared to conventional edible oils. Temperature variations during transport accelerate lipase activity, elevating free fatty acid levels that compromise both taste and nutritional value. Many suppliers across the supply chain find it challenging to implement and maintain the necessary rapid processing and distribution protocols consistently, affecting overall market efficiency and product quality.

Other drivers and restraints analyzed in the detailed report include:

- Growing Use of Rice Bran Oil as a Cooking Oil in High-Temperature Applications

- Shift Toward Plant-Based and Vegan Diets Boosting Edible Oil Demand

- Environmental Concerns Affecting Rice Cultivation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Conventional rice bran oil dominates the market with an 82.78% share in 2025, reflecting its strong market position built on well-established supply chains and competitive pricing. This significant market presence enables widespread adoption across various consumer segments, while manufacturers benefit from proven processing methods and economies of scale to maintain cost-effective production, particularly important for food service providers and industrial applications.

The organic segment, though smaller in volume, demonstrates robust growth with a 10.73% CAGR through 2031. This growth is supported by expanding certification infrastructure in key producing regions and increasing consumer preference for premium products. While organic variants currently command a 25-40% price premium over conventional alternatives, primarily attracting high-end consumers and specialty food manufacturers, this price differential is gradually reducing as organic production capacity expands and operational efficiencies improve.

The Rice Bran Oil Market Report is Segmented by Nature (Organic and Conventional), Type (Refined and Non-Refined), End Use (Food Processing, Foodservice/HoReCa, and Retail), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific maintains its market leadership in the global rice bran oil industry, commanding a substantial 35.82% market share in 2025. This dominance reflects the region's unparalleled position as the world's primary rice producer and its expanding middle-class consumer base. India and China represent the largest consumption markets, where traditional cooking methods requiring high-temperature oils remain deeply ingrained in culinary practices. The growing health consciousness among urban populations further strengthens market demand. Thailand's rice industry shows promising recovery signs for 2025-2026 following El Nino-related challenges, with improved rainfall patterns and higher prices encouraging farmers to expand cultivation, thereby ensuring steady bran availability. Japan's contribution through advanced processing technologies and stringent quality standards continues to elevate regional production practices, while Vietnam's strategic rice export policies significantly influence global supply dynamics.

North America driven by increasing consumer awareness of rice bran oil's health benefits, particularly among the aging population concerned with cardiovascular health. The region's growth trajectory is supported by robust U.S. rice production, reaching 222.1 million hundredweight in 2024/25, ensuring abundant bran availability for oil extraction. The projected record imports of 46.5 million hundredweight underscore the market's strong demand fundamentals . Clear FDA regulatory guidelines regarding rice bran oil specifications have fostered increased commercial adoption, while its premium positioning enables manufacturers to maintain higher margins compared to conventional cooking oils. The expanding health-conscious consumer base in Canada and Mexico, coupled with developing retail distribution networks, creates substantial opportunities for market expansion.

Europe demonstrates evolving market dynamics with increasing demand for specialized and organic rice bran oil variants. The UK leads import volumes, while France and Germany show strong preferences for sustainably produced alternatives. The region's significant organic rice imports, approximately 90,000 tonnes annually, generate consistent demand for certified organic rice bran oil products. Sustainability certifications have become a crucial requirement for market access across European countries, reflecting the region's commitment to environmental responsibility and product quality.

- Adani Wilmar Ltd.

- Ricela Group

- Cargill Incorporated

- King Rice Oil Group

- Marico Ltd.

- Emami Agrotech Ltd.

- Modi Naturals Ltd.

- AP Solvex Ltd.

- 3F Industries Ltd.

- Zhejiang Delekang Food Co. Ltd.

- Tsuno Group Co. Ltd.

- Oryza Oil & Fat Chemical Co.

- Fuji Oil Holdings

- BCL Industries Ltd.

- Vandana Global Ltd. (Vandana Oils)

- Wilmar International Ltd.

- Yihai Kerry Arawana Holdings

- Agro Tech Foods Ltd.

- Archer Daniels Midland Co.

- Conagra Brands Inc. (Mazola)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing preference for low trans-fat and cholesterol oils in diets

- 4.2.2 Rising demand for natural, clean-label, and organic products

- 4.2.3 Growing use of rice bran oil as a cooking oil in high-temperature applications

- 4.2.4 Shift toward plant-based and vegan diets boosting edible oil demand

- 4.2.5 Expanding presence in global retail stores and supermarkets facilitating market penetration

- 4.2.6 Use in processed foods applicaion encouraging inclusion of healthier oils

- 4.3 Market Restraints

- 4.3.1 Distribution and storage issues affecting product quality

- 4.3.2 Complex compliance requirements impacting trade

- 4.3.3 Need for special packaging to preserve quality

- 4.3.4 Environmental Concerns affecting rice cultivation

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE and GROWTH FORECASTS (VALUE)

- 5.1 By Nature

- 5.1.1 Organic

- 5.1.2 Conventional

- 5.2 By Type

- 5.2.1 Refined

- 5.2.2 Non-Refined

- 5.3 By End Use

- 5.3.1 Food Processing

- 5.3.2 Foodservice/HoReCa

- 5.3.3 Retail

- 5.3.3.1 Supermarkets and Hypermarkets

- 5.3.3.2 Convenience Stores

- 5.3.3.3 Online Retail

- 5.3.3.4 Others

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 Italy

- 5.4.2.4 France

- 5.4.2.5 Spain

- 5.4.2.6 Netherlands

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Adani Wilmar Ltd.

- 6.4.2 Ricela Group

- 6.4.3 Cargill Incorporated

- 6.4.4 King Rice Oil Group

- 6.4.5 Marico Ltd.

- 6.4.6 Emami Agrotech Ltd.

- 6.4.7 Modi Naturals Ltd.

- 6.4.8 AP Solvex Ltd.

- 6.4.9 3F Industries Ltd.

- 6.4.10 Zhejiang Delekang Food Co. Ltd.

- 6.4.11 Tsuno Group Co. Ltd.

- 6.4.12 Oryza Oil & Fat Chemical Co.

- 6.4.13 Fuji Oil Holdings

- 6.4.14 BCL Industries Ltd.

- 6.4.15 Vandana Global Ltd. (Vandana Oils)

- 6.4.16 Wilmar International Ltd.

- 6.4.17 Yihai Kerry Arawana Holdings

- 6.4.18 Agro Tech Foods Ltd.

- 6.4.19 Archer Daniels Midland Co.

- 6.4.20 Conagra Brands Inc. (Mazola)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK