PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1445844

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1445844

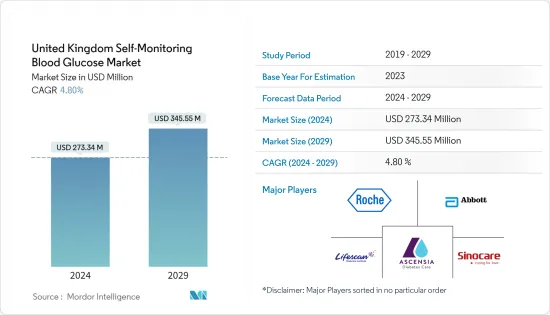

United Kingdom Self-Monitoring Blood Glucose - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The United Kingdom Self-Monitoring Blood Glucose Market size is estimated at USD 273.34 million in 2024, and is expected to reach USD 345.55 million by 2029, growing at a CAGR of 4.80% during the forecast period (2024-2029).

The COVID-19 pandemic showed that diabetes needs a lot more attention if we don't want the infection to cause problems that aren't necessary or fair. According to Diabetes UK, in adults with diabetes, there were certain factors that increased the risk of serious illness, like being older, having a high HbA1c, or having a history of diabetes-related complications, along with BMI and ethnicity. According to the 2021 article "Assessment of the effect of the COVID-19 pandemic on UK HbA1c testing: implications for diabetes management and diagnosis," there was evidence that people with prediabetes, obesity, and other causes of dysglycemia were also more likely to have worse outcomes after getting SARS-CoV-2.

Blood glucose monitoring increases patients' awareness of glucose values, which supports healthy lifestyle choices. Blood Glucose Monitoring values help in providing feedback and guidance on how to make health behavior changes when needed. Continued elevation in blood glucose levels in diabetes patients can contribute to progressive complications such as renal, nerve, and ocular damage. Appropriate and timely monitoring of blood glucose allows the successful management of out-of-range blood glucose levels, minimizing diabetic-related health complications.

Innovative technologies, such as digital health apps that show and summarize each person's blood glucose readings and add other relevant data like insulin doses, meals or snacks, and physical activity, can help people better manage their own diabetes while reducing the burden of the disease and improving care overall. Integration of blood glucose monitoring with insulin calculators, automated insulin titration software, and remote coaching are all new developments that give patients with poorly controlled diabetes the extra help they need to improve critical outcomes, which will improve the market's prospects in the years to come.

UK Self-Monitoring Blood Glucose Market Trends

Rising Diabetes Prevalence in the United Kingdom

According to a survey of 10,000 patients by Diabetes UK, there are currently around 4.9 million people living with diabetes in the UK. More than 60% of diabetics say that this is partly because they don't have access to healthcare, which can prevent serious illness and early death from diabetes-related heart problems. In the poorest parts of the country, this number goes up to 71%.

People with diabetes can live healthy lives, but if the condition is not managed well, high blood sugar levels, high blood pressure, and high cholesterol can cause problems with the vascular system that can lead to serious complications. To lower the risk of complications, people with diabetes must always take care of their condition on their own with help from doctors and nurses. This includes measuring blood sugar, checking their feet, and keeping an eye on their blood pressure. Research shows that these regular checks are linked to better health outcomes, such as fewer deaths, less time in the hospital, and fewer amputations and emergency room visits.

The National Health Service (NHS) in England is one of four National Health Service systems in the United Kingdom. It is paid for by the government.By investing in the technology, the NHS can give patients advice on treatment and care, as well as teach them how to eat and exercise in healthy ways.This remote support complements patients' appointments, whether through video consultations or via telephone. People living with diabetes can access websites such as Digibete and MyType1Diabetes for a wide range of awareness, education, training, and support resources. The Healthier You NHS Diabetes Prevention Programme, also known as the Healthier You program, identifies people at risk of developing type 2 diabetes and refers them to a nine-month, evidence-based lifestyle change program. It is a joint service of NHS England and Diabetes UK.

Therefore, it is anticipated that the studied market will witness growth over the analysis period due to rising prevalence and increasing awareness through government initiatives.

The Glucometer Devices Segment is expected to witness the highest CAGR over the forecast period

The glucometers segment is expected to account for the highest CAGR of about 6.3% in the market over the forecast period, owing to the increasing adoption of glucometers in home care settings, growing preference for home-based self-monitoring, and recent product launches of advanced glucometers.

Glucometers are simple, portable, and easy-to-use devices that are used to check blood sugar at the point-of-care.A drop of blood from the finger of the patient is dropped onto a paper test strip, which is impregnated with a glucose-specific enzyme that reacts with the glucose in the blood. The strip is put into the blood glucose meter, and the level of glucose in the blood is read by either reflectance photometry or electrochemical technology.These monitors are also used to monitor blood glucose levels in clinical settings. In general, portable glucose devices have improved in precision and accuracy with each generation.

Self-monitoring is a commitment that many diabetic patients follow to manage their condition. The blood glucose levels help the patients and doctors modify their diet, lifestyle, insulin therapy, and medications that can help their blood sugar come back to normal. With newer innovations in medical technology, glucometers these days have highly sensitive strips and sensors that can detect every component of blood accurately, close to lab results.

The National Service Framework (NSF) program is improving services by setting national standards to drive up service quality and tackle variations in care. The Association of British HealthTech Industries (ABHI) made a section for diabetes. This is the first forum of its kind that allows diabetes technology companies to work together. The ABHI group is for any health technology company with an interest in diabetes care, from CGM and insulin pumps to apps. Such advantages have helped spur the adoption of these products in the United Kingdom market.

UK Self-Monitoring Blood Glucose Industry Overview

The United Kingdom self-monitoring blood glucose market is moderately fragmented, with a few significant and other generic players. Manufacturers like Abbott, LifeScan, F. Hoffmann-La Roche AG, and Ascensia occupy a major share.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Component (Value and Volume, 2017 - 2028)

- 5.1.1 Glucometer Devices

- 5.1.2 Test Strips

- 5.1.3 Lancets

6 MARKET INDICATORS

- 6.1 Type-1 Diabetes population (2017 - 2028)

- 6.2 Type-2 Diabetes population (2017 - 2028)

7 COMPETITIVE LANDSCAPE

- 7.1 COMPANY PROFILES

- 7.1.1 Abbott Diabetes Care

- 7.1.2 Roche Holding AG

- 7.1.3 LifeScan

- 7.1.4 Trividia Health

- 7.1.5 Ascensia Diabetes Care

- 7.1.6 Acon Laboratories Inc.

- 7.1.7 Agamatrix Inc.

- 7.1.8 Bionime Corporation

- 7.1.9 Sinocare

- 7.1.10 Arkray Inc.

- 7.2 COMPANY SHARE ANALYSIS

- 7.2.1 Abbott Diabetes Care

- 7.2.2 Roche Holding AG

- 7.2.3 LifeScan

- 7.2.4 Other Company Share Analyses

8 MARKET OPPORTUNITIES AND FUTURE TRENDS