Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1683475

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1683475

United States Same Day Delivery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 251 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

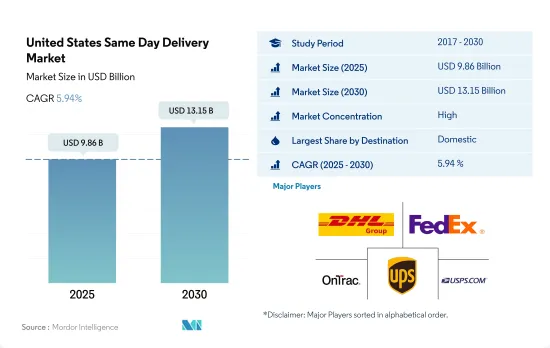

The United States Same Day Delivery Market size is estimated at 9.86 billion USD in 2025, and is expected to reach 13.15 billion USD by 2030, growing at a CAGR of 5.94% during the forecast period (2025-2030).

Delivery of essential goods and groceries majorly driving same day delivery demand in the country

- In April 2024, GLS US merged with its parent company's European network, enabling direct parcel deliveries between the U.S. and Europe. GLS US now ships about 5,000 parcels daily to Europe, with faster transit times-parcels picked up in California on Monday can reach the U.K., Germany, or the Netherlands by Thursday, thanks to GLS Group's strong ground network.

- Retailers using road and air as means to facilitate same day deliveries also face pressure to cater to consumers' preferences for environmentally sustainable deliveries. About 45% of consumers are willing to pay an extra charge, provided the retailers have carbon footprint reduction initiatives in place. To help companies potentially achieve this and reduce emissions, the Biden-Harris Administration set a target of 50% of vehicles (including both light and heavy duty vehicles) sold in the United States by 2030 to be zero-emissions vehicles. Also, the Sustainable Aviation Fuel (SAF) Grand Challenge, which sets targets to produce 3 billion gallons of SAF by 2030, aims to reduce air cargo emissions. Such initiatives are expected to drive the market.

United States Same Day Delivery Market Trends

United States leads regional GDP with 86% contribution, driven by infrastructure and supply chain investments

- In September 2024, the FAA, under the US Department of Transportation, allocated USD 1.9 billion in grants for 519 projects. These projects span 48 states, Guam, Puerto Rico, and other territories, all part of the Airport Improvement Program (AIP). Additionally, USD 269 million in Supplemental Discretionary Grants for 2023 will back 62 projects at 56 U.S. airports. This competitive initiative aids airport owners and operators in enhancing the U.S. airport system. Marking its largest round yet, this fifth AIP grant cycle funds diverse projects, from airport safety and sustainability upgrades to noise reduction. The grants cater to airports nationwide, regardless of size.

- With infrastructure development and the e-commerce boom, the transportation and storage sector is set for a job surge. The Bureau of Labor Statistics (BLS) projects a 0.8% annual growth rate from 2022 to 2032, translating to nearly 570,000 new jobs. Notably, the couriers and messengers industry, alongside warehousing and storage, is expected to drive about 80% of this job growth.

The United States remained a net crude oil importer in 2022, importing about 6.28 million bpd of crude oil from 80 countries

- Gasoline prices in the US are expected to drop below USD 3 a gallon for the first time in over three years by October 2024, just before the presidential election. Lower fuel prices are mainly due to weaker demand and falling oil prices, providing relief to consumers who have faced high costs that fueled inflation. This could also help Vice President Kamala Harris and other Democrats counter Republican criticism over high gas prices. In September 2024, the average price for regular gas was USD 3.25 a gallon, down 19 cents from last month and 58 cents from last year.

- According to US Energy Information Administration (EIA), crude oil prices will stay steady in 2024 compared to 2023, then decrease in 2025. The US' introduction of new refining capacities in 2023 will boost its operable capacity, alleviating price strain on oil products in 2024 and 2025. Furthermore, the Middle East, particularly Kuwait, will add new international refining capacities, which will help ease global price pressure on gasoline and diesel. Also, it is expected, narrowing crack spreads in 2024 are likely to lead to lower average US retail fuel prices in both 2024 and 2025. Gasoline prices are projected to USD 3.36/gal in 2024 and USD 3.24/gal in 2025.

United States Same Day Delivery Industry Overview

The United States Same Day Delivery Market is fairly consolidated, with the major five players in this market being DHL Group, FedEx, OnTrac, United Parcel Service of America, Inc. (UPS) and USPS (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 72046

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Demographics

- 4.2 GDP Distribution By Economic Activity

- 4.3 GDP Growth By Economic Activity

- 4.4 Inflation

- 4.5 Economic Performance And Profile

- 4.5.1 Trends in E-Commerce Industry

- 4.5.2 Trends in Manufacturing Industry

- 4.6 Transport And Storage Sector GDP

- 4.7 Export Trends

- 4.8 Import Trends

- 4.9 Fuel Price

- 4.10 Logistics Performance

- 4.11 Infrastructure

- 4.12 Regulatory Framework

- 4.12.1 United States

- 4.13 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes Market Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Mode Of Transport

- 5.1.1 Air

- 5.1.2 Road

- 5.1.3 Others

- 5.2 Shipment Weight

- 5.2.1 Heavy Weight Shipments

- 5.2.2 Light Weight Shipments

- 5.2.3 Medium Weight Shipments

- 5.3 Destination

- 5.3.1 Domestic

- 5.3.2 International

- 5.4 End User Industry

- 5.4.1 E-Commerce

- 5.4.2 Financial Services (BFSI)

- 5.4.3 Healthcare

- 5.4.4 Manufacturing

- 5.4.5 Primary Industry

- 5.4.6 Wholesale and Retail Trade (Offline)

- 5.4.7 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Aramex

- 6.4.2 DHL Group

- 6.4.3 Dropoff Inc.

- 6.4.4 FedEx

- 6.4.5 International Distributions Services (including GLS)

- 6.4.6 OnTrac

- 6.4.7 Spee-Dee Delivery Service, Inc.

- 6.4.8 United Parcel Service of America, Inc. (UPS)

- 6.4.9 USA Couriers

- 6.4.10 USPS

7 KEY STRATEGIC QUESTIONS FOR CEP CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.1.5 Technological Advancements

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.