Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1683921

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1683921

Asia Pacific Same Day Delivery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 314 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

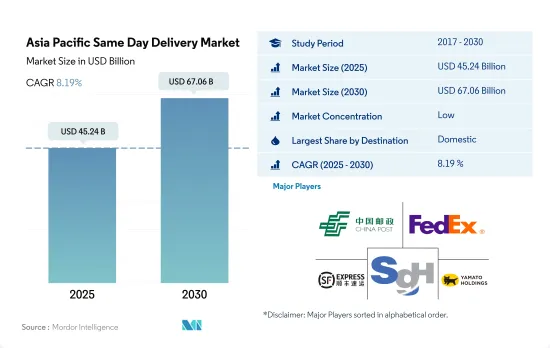

The Asia Pacific Same Day Delivery Market size is estimated at 45.24 billion USD in 2025, and is expected to reach 67.06 billion USD by 2030, growing at a CAGR of 8.19% during the forecast period (2025-2030).

The same day delivery market is growing due to increasing demand for the delivery of goods like medicines and groceries, coupled with technological advancements

- In 2022, the total volume of express deliveries accounted for about 80% of China's postal industry's delivery business total volume, the majority being same day deliveries. Same day deliveries have moved from being a valuable differentiator to a prerequisite for most platforms in Japan. Amazon and Rakuten offer this service to most of Japan's population through their extensive logistics networks. For instance, Rakuten, Japan's domestic e-commerce giant, has a network of 49,000 shops that help fulfill same day deliveries. Amazon provides same day delivery to 80% of Japanese customers as of 2023.

- Same day delivery in Australia is expected to grow largely due to required technological advancements for the service, starting in the eastern seaboard where 80% of the nation's population resides. Capitalizing on these opportunities and taking first mover advantages, Sherpa, the country's largest same day delivery provider by volume completed more than 7 million same day deliveries via a national fleet of more than 11,000 drivers and a network across 21 Australian cities within a decade as of 2022. Other players in the market are also venturing into providing same day delivery service due to increasing demand.

Autonomous warehouse robots, drone deliveries, and express air cargo services facilitating same day deliveries

- The growing trend toward same day deliveries in the region has been driven by growth in e-commerce, which registered a CAGR of 24.47% during 2017-2022, as well as rise in online shoppers who prefer faster deliveries. Several countries in the region are consistently working toward facilitating same day deliveries to consumers. For instance, in China, in 2018, Cainiao, the logistics arm of Alibaba, launched an automated warehouse in the country with over 700 robots to facilitate same day deliveries in the country.

- In 2018, DHL announced the launch of DHL Parcel Metro Same Day in Ho Chi Minh City and Hanoi to offer same day delivery to consumers in both cities, with real-time tracking and rescheduling of deliveries through DHL's digital platform. Also, in 2021, SignPost partnered with Airbus Helicopters for pilot trials of drone parcel delivery, facilitating same day deliveries nationwide. Further, in 2023, DHL Express expanded its fleet of electric vehicles (EV's) to 18 EVs in the Philippines.

Asia Pacific Same Day Delivery Market Trends

Asia Pacific freight demands driven by global seaborne trade, which is triggering transport sector investments

- On May 17, 2024, a fair at Tokyo Station in Japan highlighted the growing use of high-speed passenger trains for light freight. This shift, driven by a shortage of commercial drivers and new overtime laws, has increased road delivery costs by up to 20%. Since August 2023, JR East has been running a same-day delivery service from Niigata to Tokyo using a dedicated 12-car Series E trainset. Items transported include fresh food, confectionery, drinks, flowers, precision components, and medical supplies. In September 2023, JR East launched a freight-only service on the Tohoku Shinkansen and now offers Hakobyun-branded freight services across its high-speed and Limited Express networks.

- In the 14th Five-Year Plan (2021-2025), China revealed goals for expanding its transportation network. By 2025, high-speed railways will extend to 50,000 kms, up from 38,000 kms in 2020, with 95% of cities with populations above 500,000 covered by 250-km lines. The country aims to increase its railway length to 165,000 kms, civil airports to over 270, subway lines in cities to 10,000 kms, expressways to 190,000 kms, and high-level inland waterways to 18,500 kms by 2025. The primary objective is to achieve integrated development by 2025, emphasizing advancements in the transformation of the transportation system and its contribution to GDP.

Owing to global uncertainties, crude oil prices are soaring in the Asian economies as most of them are net oil importers

- In 2023, China's crude oil imports rose by 11% to 563.99 MMT, driven by higher global oil prices due to the Russia-Ukraine War. In early 2024, imports increased by 5.1% YoY, reaching 88.31 MMT, as China capitalized on lower prices earlier. Brent futures peaked at USD 97.69 in September 2023, dropped to USD 72.29 in December, and rose to USD 84.05 by March 2024. OPEC+'s decision in March 2024 to extend output cuts has further boosted prices, raising concerns about global demand and potentially slowing China's imports in H2 2024.

- Australia's federal government will introduce a new fuel efficiency standard for passenger and light commercial vehicles starting January 1, 2025. This follows a one-month consultation period before drafting the new laws. Announced as part of the 2023 budget and linked to the EV strategy released in April 2023, the standard sets average CO2 targets for vehicle manufacturers. These targets will gradually decrease, requiring the production of more fuel-efficient and low or zero-emissions vehicles.

Asia Pacific Same Day Delivery Industry Overview

The Asia Pacific Same Day Delivery Market is fragmented, with the major five players in this market being China Post, FedEx, SF Express (KEX-SF), SG Holdings Co., Ltd. and Yamato Holdings Co., Ltd. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50001611

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Demographics

- 4.2 GDP Distribution By Economic Activity

- 4.3 GDP Growth By Economic Activity

- 4.4 Inflation

- 4.5 Economic Performance And Profile

- 4.5.1 Trends in E-Commerce Industry

- 4.5.2 Trends in Manufacturing Industry

- 4.6 Transport And Storage Sector GDP

- 4.7 Export Trends

- 4.8 Import Trends

- 4.9 Fuel Price

- 4.10 Logistics Performance

- 4.11 Infrastructure

- 4.12 Regulatory Framework

- 4.12.1 Australia

- 4.12.2 China

- 4.12.3 India

- 4.12.4 Indonesia

- 4.12.5 Japan

- 4.12.6 Malaysia

- 4.12.7 Pakistan

- 4.12.8 Philippines

- 4.12.9 Thailand

- 4.12.10 Vietnam

- 4.13 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes Market Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Mode Of Transport

- 5.1.1 Air

- 5.1.2 Road

- 5.1.3 Others

- 5.2 Shipment Weight

- 5.2.1 Heavy Weight Shipments

- 5.2.2 Light Weight Shipments

- 5.2.3 Medium Weight Shipments

- 5.3 Destination

- 5.3.1 Domestic

- 5.3.2 International

- 5.4 End User Industry

- 5.4.1 E-Commerce

- 5.4.2 Financial Services (BFSI)

- 5.4.3 Healthcare

- 5.4.4 Manufacturing

- 5.4.5 Primary Industry

- 5.4.6 Wholesale and Retail Trade (Offline)

- 5.4.7 Others

- 5.5 Country

- 5.5.1 Australia

- 5.5.2 China

- 5.5.3 India

- 5.5.4 Indonesia

- 5.5.5 Japan

- 5.5.6 Malaysia

- 5.5.7 Pakistan

- 5.5.8 Philippines

- 5.5.9 Thailand

- 5.5.10 Vietnam

- 5.5.11 Rest of Asia Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Blue Dart Express Limited

- 6.4.2 China Post

- 6.4.3 CJ Logistics Corporation

- 6.4.4 DHL Group

- 6.4.5 DTDC Express Limited

- 6.4.6 FedEx

- 6.4.7 Japan Post Holdings Co., Ltd. (including Toll Group)

- 6.4.8 JWD Group

- 6.4.9 SF Express (KEX-SF)

- 6.4.10 SG Holdings Co., Ltd.

- 6.4.11 Shanghai YTO Express (Logistics) Co., Ltd.

- 6.4.12 United Parcel Service of America, Inc. (UPS)

- 6.4.13 Yamato Holdings Co., Ltd.

- 6.4.14 ZTO Express

7 KEY STRATEGIC QUESTIONS FOR CEP CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.1.5 Technological Advancements

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.