Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1683927

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1683927

North America Same Day Delivery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 275 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

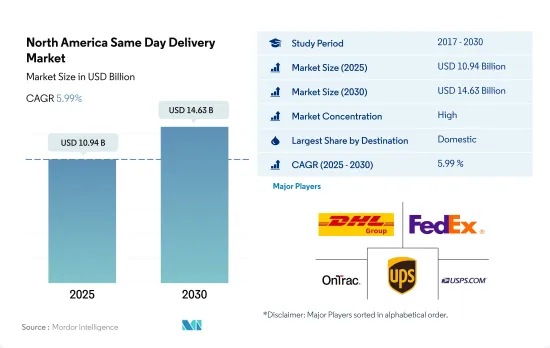

The North America Same Day Delivery Market size is estimated at 10.94 billion USD in 2025, and is expected to reach 14.63 billion USD by 2030, growing at a CAGR of 5.99% during the forecast period (2025-2030).

Environment and infrastructure playing a major role in same day delivery services

- Major same day delivery providers in the United States have taken initiatives to curb pollution by facilitating domestic and international same day deliveries, specifically by road and air. Thus, companies are moving toward net-zero emissions and reducing carbon emissions by 2050. For instance, Amazon's Sacramento same day delivery facility opened in 2022, the first logistics facility in the world to get the International Living Future Institute's Zero Carbon certification. DHL has bought 33 million L of sustainable aviation fuel (SAF) and plans to update aviation solutions to reach net zero by 2050.

- In 2020, the Mexican last mile delivery market for retail e-commerce was worth USD 400 million. It is projected to reach USD 1.1 billion by 2025, mainly due to the increasing e-commerce usage. The same day delivery of small and medium-sized goods within Mexico's major cities by niche players greatly contributes to this prediction. Puerto Rico's same day delivery demand is driven by e-commerce, wherein the user penetration rate is expected to reach 46% by 2027.

Robotic delivery vehicles, machine learning algorithms, and warehouse automations facilitating same day deliveries

- The United States along with Canada, Mexico and other countries comprise the regional market. Same day delivery is currently the fastest-growing service type for e-commerce deliveries in the United States, specifically emerging from the B2C e-commerce segment. For instance, approximately 67% of the customers in the United States expect same day delivery for online purchases. E-commerce users accounted for over 75% of the Canadian population in 2022 and are expected to grow to 77.6% in 2025. With the growth in online users, the demand for same day delivery is rising in Canada.

- With last mile delivery of parcels making up 53% of total supply chain costs, technological innovations have paced up to facilitate same day delivery in the region, such as robotic delivery cars, machine learning algorithms enabling customer experience, warehouse automation and shipments, and several other innovations. With the adoption of autonomous and zero-emission delivery modes, the last mile delivery landscape in transportation is evolving in the region.

North America Same Day Delivery Market Trends

The US dominates with maximum regional GDP contribution, fueled by an infrastructure program that boosts ports and supply chains

- An efficient and reliable transportation system is crucial for the economy. Through the National Trade Corridors Fund, the Government of Canada invests in improving supply chains, reducing trade barriers, and fostering business growth for future economic opportunities. In May 2024, the Minister of Transport announced up to USD 51.2 million for 19 digital infrastructure projects under this fund. The Canadian government aims to enhance supply chains with innovative technologies to expedite and reduce costs for Canadians. This initiative will drive collaboration with stakeholders nationwide on digital projects to address transportation bottlenecks, vulnerabilities, and port congestion effectively.

- In United States, infrastructure development and the rise of e-commerce are anticipated to boost employment in the transportation and storage sector. According to the Bureau of Labor Statistics (BLS), this sector is projected to grow at a rate of 0.8% annually from 2022 to 2032, resulting in the addition of nearly 570,000 jobs during that timeframe. The couriers and messengers industry, along with warehousing and storage, are expected to contribute significantly to about 80% of the sector's projected job growth.

Rising tensions in the Middle East are expected to affect crude oil supplies and lead to sudden price hikes in the region

- By October 2024, just ahead of the presidential election, gasoline prices in the US were projected to dip below USD 3 a gallon for the first time in over 3 years. This decline in fuel prices, primarily driven by waning demand and decreasing oil prices, offered a reprieve to consumers who had been grappling with elevated costs contributing to inflation. Such a development could have bolstered Vice President Kamala Harris and other Democrats in addressing Republican critiques regarding soaring gas prices. As of September 2024, regular gas averaged USD 3.25 a gallon, marking a 19-cent drop from the previous month and a 58-cent YoY decrease.

- Annual maintenance on Canada's oil sands plants in 2024 is expected to proceed normally. However, trade union officials warn of a labor shortage in Alberta's 2025 turnaround season due to two new industrial projects. Alberta producers annually hire thousands of skilled workers for essential maintenance on oil sands upgraders, thermal projects, and refineries. As the world's fourth-largest oil producer, Canada gets about two-thirds of its 4.9 million barrels per day of crude from the northern Alberta oil sands. This shortage might raise fuel prices in 2025.

North America Same Day Delivery Industry Overview

The North America Same Day Delivery Market is fairly consolidated, with the major five players in this market being DHL Group, FedEx, OnTrac, United Parcel Service of America, Inc. (UPS) and USPS (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50001617

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Demographics

- 4.2 GDP Distribution By Economic Activity

- 4.3 GDP Growth By Economic Activity

- 4.4 Inflation

- 4.5 Economic Performance And Profile

- 4.5.1 Trends in E-Commerce Industry

- 4.5.2 Trends in Manufacturing Industry

- 4.6 Transport And Storage Sector GDP

- 4.7 Export Trends

- 4.8 Import Trends

- 4.9 Fuel Price

- 4.10 Logistics Performance

- 4.11 Infrastructure

- 4.12 Regulatory Framework

- 4.12.1 Canada

- 4.12.2 Mexico

- 4.12.3 United States

- 4.13 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes Market Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Mode Of Transport

- 5.1.1 Air

- 5.1.2 Road

- 5.1.3 Others

- 5.2 Shipment Weight

- 5.2.1 Heavy Weight Shipments

- 5.2.2 Light Weight Shipments

- 5.2.3 Medium Weight Shipments

- 5.3 Destination

- 5.3.1 Domestic

- 5.3.2 International

- 5.4 End User Industry

- 5.4.1 E-Commerce

- 5.4.2 Financial Services (BFSI)

- 5.4.3 Healthcare

- 5.4.4 Manufacturing

- 5.4.5 Primary Industry

- 5.4.6 Wholesale and Retail Trade (Offline)

- 5.4.7 Others

- 5.5 Country

- 5.5.1 Canada

- 5.5.2 Mexico

- 5.5.3 United States

- 5.5.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Amazon

- 6.4.2 Aramex

- 6.4.3 DHL Group

- 6.4.4 DTDC Express Limited

- 6.4.5 Fastfrate Inc.

- 6.4.6 FedEx

- 6.4.7 International Distributions Services (including GLS)

- 6.4.8 Jet Delivery Inc.

- 6.4.9 OnTrac

- 6.4.10 Spee-Dee Delivery Service, Inc.

- 6.4.11 United Parcel Service of America, Inc. (UPS)

- 6.4.12 USPS

7 KEY STRATEGIC QUESTIONS FOR CEP CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.1.5 Technological Advancements

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.