PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1835654

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1835654

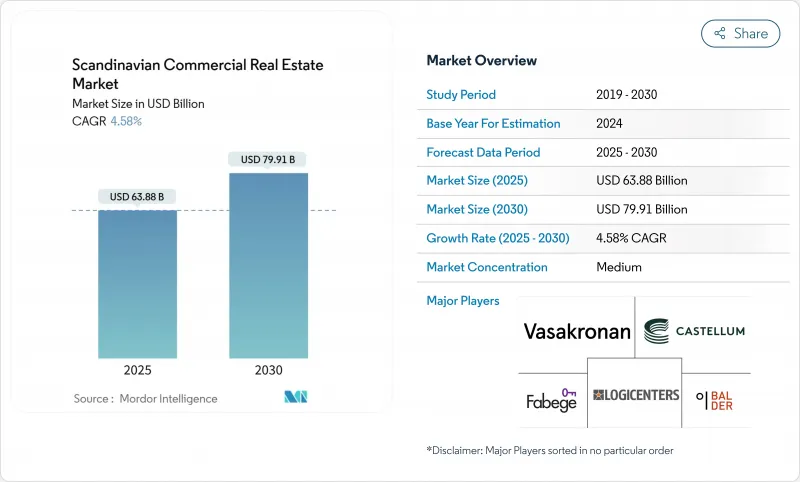

Scandinavian Commercial Real Estate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Scandinavian commercial real estate market size is valued at USD 63.88 billion in 2025 and is expected to reach USD 79.91 billion by 2030, expanding at a 4.58% CAGR.

Steady growth reflects a mature environment where institutional investors tilt portfolios toward energy-efficient buildings rather than purely yield-driven assets. Sovereign wealth funds accelerate this tilt, especially after Norway's Government Pension Fund Global (GPFG) pledged net-zero emissions for its unlisted holdings by 2050. Stable borrowing costs follow the European Central Bank's 25-basis-point rate cut in 2024, while cross-border capital still grapples with Swedish krona volatility. Country demand remains anchored in Sweden's technology-focused economy, yet Denmark now captures logistics attention as the Fehmarnbelt link nears completion. Office buildings still dominate volume, but logistics warehouses post the fastest absorption on record, vacancy lows around the Oresund corridor..

Scandinavian Commercial Real Estate Market Trends and Insights

Ageing Prime-Office Stock Triggering Refurbish-First Investment Wave

Large office blocks built in the late 1980s are due for energy retrofits to satisfy tight ESG standards. Sweden's proposal to raise the safe-harbor limit on interest deductions to USD 2.4 million encourages investors to finance deep renovations beyond routine upkeep. Skanska's USD 55.1 million Regndroppen project in Malmo illustrates capital flowing to certified, low-carbon refurbishments. Higher-spec space now secures premium rents and longer leases as tenants downsize but upgrade. Non-certified stock risks valuation discounts, reinforcing a two-tier office market.

Sovereign-Wealth-Backed Green-Building Mandates

GPFG targets a 40% carbon-intensity cut by 2030, already aligning 43% of its portfolio with a 1.5 °C pathway. Denmark raises the bar too, capping new-build emissions at 7.1 kg CO2e/m2/year from mid-2025, roughly 15% tighter than prior rules. Developers who integrate on-site renewables and circular materials unlock a cost-of-capital advantage as lenders price green premiums. Retrofits will still play a role, but new builds designed for Swan Ecolabel thresholds win the clearest investor backing.

Denmark's 2025 Energy-Performance Regulation Cost Inflation

Stricter BR18 rules demand lower carbon footprints and new fire-safety upgrades, stretching retrofit budgets on legacy stock. Certificates last 10 years, but owners of older assets must retrofit sooner to avoid rental downgrades. International investors must also navigate longer permitting cycles, extending holding periods before cash flow stabilises.

Other drivers and restraints analyzed in the detailed report include:

- Retail-to-Last-Mile Conversion Subsidies in Sweden

- Data-Centre Corridor Incentives in Norway

- Swedish Krona Volatility Dampening Cross-Border Capital

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Offices accounted for 38% of the Nordic commercial real estate market in 2024, underlining deep headquarters demand across Stockholm, Copenhagen, and Oslo. Prime CBD towers capture occupancy from technology and finance tenants that insist on wellness certifications and renewable energy-sourced power. Occupiers pay premiums for proximity to mass transit and onsite amenities, keeping rental uplifts intact even as hybrid working trims space footprints. High-spec buildings command superior valuations, whereas class-B stock suffers from rising vacancy and retrofit expenses.

Logistics assets expand at a 4.90% CAGR, the fastest among all property types through 2030, as cross-border e-commerce and pharma cold-chain requirements escalate. Record-low vacancy around the Oresund feeds rent inflation and development pre-lets. Nomeco's USD 75 million pharmaceutical hub in Koge highlights how specialist storage creates defensive income streams. Government backing for rail and ferry upgrades shortens delivery lead times, further lifting take-up. In contrast, retail continues to recalibrate; grocery-anchored centres remain defensive, but discretionary malls repurpose excess space into logistics or healthcare units, supporting a gradual supply-demand re-balance.

The Scandinavian Commercial Real Estate Market Report is Segmented by Property Type (Offices, Retail and More), by Business Model (Rental and Sales), by End User (Individuals / Households and More) and by Country (Denmark, Norway and More). The Report Offers Market Size and Forecasts in Value (USD) for all the Above Segments.

List of Companies Covered in this Report:

- Vasakronan AB

- Castellum AB

- Fabege AB

- Balder Fastigheter

- NREP (Logicenters)

- Jeudan A/S

- Citycon Oyj

- BPT Group

- Heimstaden Bostad

- Newsec AB

- DSV Logistics Real Estate

- CBRE Group Inc.

- Jones Lang LaSalle

- Cushman & Wakefield

- Colliers International

- Savills plc

- Stronghold Invest

- Nordkap AB

- Spotscale AB

- WEC360 AB

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Commercial Real-Estate Buying Trends - Socio-economic & Demographic Insights

- 4.3 Rental Yield Analysis

- 4.4 Capital-Market Penetration & REIT Presence

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Insights into Real-Estate Tech and Start-ups Active in the Segment

- 4.8 Insights into Existing and Upcoming Projects

- 4.9 Market Drivers

- 4.9.1 Ageing prime-office stock triggering refurbish-first investment wave

- 4.9.2 Sovereign-wealth-backed green-building mandates

- 4.9.3 Retail-to-last-mile conversion subsidies in Sweden

- 4.9.4 Data-centre corridor incentives in Norway

- 4.9.5 Record-low logistics vacancy around the Oresund

- 4.9.6 Pension-fund reallocations from bonds to Nordic multifamily

- 4.10 Market Restraints

- 4.10.1 Denmark's 2025 energy-performance regulation cost inflation

- 4.10.2 Sovereign-wealth fund tightening ESG divestment criteria

- 4.10.3 Swedish krona volatility dampening cross-border capital

- 4.10.4 Limited REIT-law harmonisation across the region

- 4.11 Value / Supply-Chain Analysis

- 4.11.1 Overview

- 4.11.2 Real-Estate Developers & Contractors - Quantitative & Qualitative Insights

- 4.11.3 Real-Estate Brokers & Agents - Quantitative & Qualitative Insights

- 4.11.4 Property-Management Companies - Quantitative & Qualitative Insights

- 4.11.5 Valuation Advisory & Other Real-Estate Services Insights

- 4.11.6 Building-Materials Industry & Partnerships with Developers

- 4.11.7 Strategic Real-Estate Investors / Buyers Insights

- 4.12 Porter's Five Forces

- 4.12.1 Threat of New Entrants

- 4.12.2 Bargaining Power of Suppliers

- 4.12.3 Bargaining Power of Buyers

- 4.12.4 Threat of Substitutes

- 4.12.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Property Type

- 5.1.1 Offices

- 5.1.2 Retail

- 5.1.3 Logistics

- 5.1.4 Others (Industrial, Hospitality, etc.)

- 5.2 By Business Model

- 5.2.1 Sales

- 5.2.2 Rental

- 5.3 By End-user

- 5.3.1 Individuals / Households

- 5.3.2 Corporates & SMEs

- 5.3.3 Others

- 5.4 By Country

- 5.4.1 Denmark

- 5.4.2 Norway

- 5.4.3 Sweden

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Vasakronan AB

- 6.4.2 Castellum AB

- 6.4.3 Fabege AB

- 6.4.4 Balder Fastigheter

- 6.4.5 NREP (Logicenters)

- 6.4.6 Jeudan A/S

- 6.4.7 Citycon Oyj

- 6.4.8 BPT Group

- 6.4.9 Heimstaden Bostad

- 6.4.10 Newsec AB

- 6.4.11 DSV Logistics Real Estate

- 6.4.12 CBRE Group Inc.

- 6.4.13 Jones Lang LaSalle

- 6.4.14 Cushman & Wakefield

- 6.4.15 Colliers International

- 6.4.16 Savills plc

- 6.4.17 Stronghold Invest

- 6.4.18 Nordkap AB

- 6.4.19 Spotscale AB

- 6.4.20 WEC360 AB

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment