PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1835664

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1835664

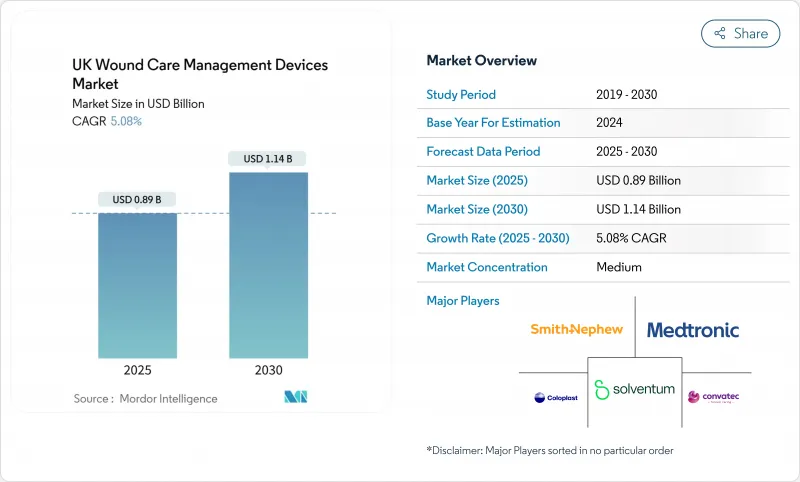

UK Wound Care Management Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The UK wound care management devices market is currently valued at USD 0.89 billion in 2025 and is projected to reach USD 1.14 billion by 2030, reflecting a steady 5.08% CAGR.

Persistent demographic pressure from an aging population, the NHS directive to shift care into community settings, and the resumption of elective surgery are combining to lift demand for both traditional dressings and technologically advanced closure systems. Post-Brexit dual-regulation costs are encouraging local innovation while deterring some EU-centric suppliers, subtly reshaping the competitive mix. Procurement teams are prioritizing devices that shorten healing times, lower readmissions, and align with Net-Zero goals, which is steering capital toward negative-pressure therapy, bio-based dressings, and AI-enabled assessment platforms. At the same time, staffing shortages inside hospital wards are tempering adoption of the most labor-intensive technologies, handing momentum to simpler, home-use solutions that can be deployed with minimal clinician oversight.

UK Wound Care Management Devices Market Trends and Insights

Increase in Geriatric Population

The proportion of UK residents aged 65 and older continues to climb and is projected to reach 26% by 2065, pushing up the incidence of venous leg ulcers, diabetic foot ulcers, and pressure injuries . Older patients often present with multiple comorbidities that slow healing, creating repeat demand for absorbent, antimicrobial, and negative-pressure dressings. Rural and coastal communities face extended travel times to acute hospitals, so tele-enabled wound assessment tools are becoming critical for home-based care. Suppliers that bundle AI triage software with easy-to-apply dressings are therefore well positioned. Over the long term, sustained geriatric growth will underpin baseline volumes in the UK wound care management devices market, encouraging manufacturers to spread fixed costs across larger unit throughput and keep prices competitive.

Growing Burden of Chronic Wounds & Related Diseases

A Health Foundation projection indicates 9.3 million UK residents will be living with major illness by 2040, with 80% of working-age increases located in the most deprived districts . Rising diabetes prevalence inflates the pool of chronic wounds, leading the NHS to allocate a reported 3% of its entire budget to wound care. Procurement teams in high-burden regions are prioritizing products proven to shorten time-to-heal, such as ConvaTec's InnovaMatrix and Aquacel Ag+ lines, which helped the company deliver 6.7% organic wound-care growth in 2024. Regional inequalities are steering additional funding to northern urban centers where chronic disease rates are highest. As these geographies widen specialist clinic capacity, the UK wound care management devices market gains incremental volume from advanced dressings, skin substitutes, and remote-monitoring hardware.

High Cost of Advanced Wound Devices

Next-generation skin substitutes can cost thousands of dollars per square inch, stretching the budgets of smaller NHS trusts that lack central purchasing leverage. Even when clinical efficacy is favorable, financial directors scrutinize net-present-value calculations to ensure benefits outweigh expense. Manufacturers are responding with value-based contracting, pay-for-performance clauses, and health-economic dossiers that quantify reductions in readmission or amputation rates. Hartmann's 4.4% organic sales rise in 2024 illustrates how competitively priced silicone-based super-absorbent dressings, supported by solid evidence, can still penetrate cost-constrained formularies. Until price points fall or reimbursement widens, uptake of premium devices will remain concentrated in teaching hospitals, tempering aggregate growth for the UK wound care management devices market.

Other drivers and restraints analyzed in the detailed report include:

- Technological Advances in Surgical Procedures & Devices

- NHS-Backed Shift Toward Community-Based Wound Clinics

- Limited Reimbursement for Home-Care Consumables

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Wound Care products represented 63.69% of UK wound care management devices market share in 2024, reflecting decades-long clinical familiarity and a broad catalog ranging from gauze to bioactive matrices. Negative-pressure wound therapy (NPWT) systems, disposable canisters, and silver-impregnated foams account for a rising slice of this pool, in part because RENASYS EDGE won a global design award that underscored its patient-mobility advantage. The smaller Wound Closure category is on a 5.75% CAGR path as robotic and laparoscopic procedures broaden indications for absorbable staplers and topical tissue adhesives. Manufacturers are embedding RFID tags and moisture sensors into dressings, converting what was once inert material into data-rich platforms that integrate with electronic health records. Traditional gauze retains a role for low-exudate wounds, yet advanced silicone-based super-absorbents from Hartmann are gaining formulary priority after proving cost-effective in multicenter audits.

Second-generation skin substitutes, recombinant growth factors, and bioresorbable meshes are poised to command premium price bands, though their diffusion will depend on cost-effectiveness dossiers. ConvaTec's InnovaMatrix, for instance, employs porcine dermis to accelerate tissue regeneration, supporting the firm's 6.7% organic revenue rise in H1 2024. As hospitals align procurement with Net-Zero, bio-based and recyclable packaging gains influence. AI algorithms that flag early infection signs from dressing photos are being bundled with starter kits, a move that elevates switching barriers and anchors account loyalty. Taken together, product differentiation, regulatory compliance, and sustainability credentials direct purchasing decisions in the UK wound care management devices market.

Chronic Wounds accounted for 59.76% of revenue in 2024, cementing their role as the largest demand driver for the UK wound care management devices market. Venous leg ulcers and pressure injuries dominate incidence tables, although diabetic foot ulcers incur the steepest per-patient cost because of high amputation risk. NICE endorsement of UrgoStart Plus opened reimbursement pathways for oxidative and protease-modulating dressings, sharpening the focus on evidence-backed therapies. AI-enabled prediction tools are reducing variability in chronic-wound assessment, steering clinicians toward early intervention protocols that rely on antimicrobial foams and skin substitutes.

Acute Wounds are set to expand at a 5.89% CAGR through 2030, driven by the rebound in trauma presentations and elective surgeries. Johnson & Johnson's antibacterial Ethicon Plus sutures report lower infection odds, which is encouraging theatre departments to standardize on coated suture packs. Burns units are trialing hydrogel membranes embedded with slow-release analgesics that cut dressing-change pain, enhancing patient compliance and outcomes. Military and emergency-response markets are demanding lightweight haemostatic patches that function under austere conditions, introducing new end-user segments. The interplay between chronic complexity and acute episode volume underpins a dynamic product-development cycle inside the UK wound care management devices market.

The UK Wound Care Management Devices Market is Segmented by Product (Wound Care [Dressings, Wound-Care Devices, and More] and Wound Closure [Sutures, Surgical Staplers, and More]), Wound Type (Chronic Wounds and Acute Wounds), End User (Hospitals & Specialty Wound Clinics and More), and Mode of Purchase (Institutional Procurement and Retail / OTC Channel). The Market and Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Solventum

- Smiths Group

- Convatec

- Johnson & Johnson

- Molnlycke Health Care

- KCI Inc. (Acelity)

- Coloplast

- Medtronic

- B. Braun

- Baxter

- Hartmann Group

- BSN Medical

- Lohmann & Rauscher

- Advanced Medical Solutions Group

- Integra LifeSciences

- Medela

- Stryker

- Derma Sciences (Integra)

- DermaRite Industries

- Mimedx Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increase in geriatric population

- 4.2.2 Growing burden of chronic wounds & related diseases

- 4.2.3 Technological advances in surgical procedures & devices

- 4.2.4 NHS-backed shift toward community-based wound clinics

- 4.2.5 AI-enabled digital wound assessment platforms

- 4.2.6 Bio-based dressings aligned with UK Net-Zero targets

- 4.3 Market Restraints

- 4.3.1 High cost of advanced wound devices

- 4.3.2 Limited reimbursement for home-care consumables

- 4.3.3 Post-Brexit UKCA regulatory delays & supply risk

- 4.3.4 Clinical staffing shortages for tech-intensive devices

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porters Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 Wound Care

- 5.1.1.1 Dressings

- 5.1.1.1.1 Traditional Gauze & Tape Dressings

- 5.1.1.1.2 Advanced Dressings

- 5.1.1.2 Wound-Care Devices

- 5.1.1.2.1 Negative Pressure Wound Therapy (NPWT)

- 5.1.1.2.2 Oxygen & Hyperbaric Systems

- 5.1.1.2.3 Electrical Stimulation Devices

- 5.1.1.2.4 Other Wound Care Devices

- 5.1.1.3 Topical Agents

- 5.1.1.4 Other Wound Care Products

- 5.1.2 Wound Closure

- 5.1.2.1 Sutures

- 5.1.2.2 Surgical Staplers

- 5.1.2.3 Tissue Adhesives, Strips, Sealants & Glues

- 5.1.1 Wound Care

- 5.2 By Wound Type

- 5.2.1 Chronic Wounds

- 5.2.1.1 Diabetic Foot Ulcer

- 5.2.1.2 Pressure Ulcer

- 5.2.1.3 Venous Leg Ulcer

- 5.2.1.4 Other Chronic Wounds

- 5.2.2 Acute Wounds

- 5.2.2.1 Surgical/Traumatic Wounds

- 5.2.2.2 Burns

- 5.2.2.3 Other Acute Wounds

- 5.2.1 Chronic Wounds

- 5.3 By End User

- 5.3.1 Hospitals & Specialty Wound Clinics

- 5.3.2 Long-term Care Facilities

- 5.3.3 Home-Healthcare Settings

- 5.4 By Mode of Purchase

- 5.4.1 Institutional Procurement

- 5.4.2 Retail / OTC Channel

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.3.1 Solventum

- 6.3.2 Smith & Nephew

- 6.3.3 Convatec Group PLC

- 6.3.4 Johnson & Johnson (Ethicon)

- 6.3.5 Molnlycke Health Care

- 6.3.6 KCI Inc. (Acelity)

- 6.3.7 Coloplast A/S

- 6.3.8 Medtronic PLC

- 6.3.9 B. Braun SE

- 6.3.10 Baxter International

- 6.3.11 Paul Hartmann AG

- 6.3.12 BSN Medical (Essity)

- 6.3.13 Lohmann & Rauscher

- 6.3.14 Advanced Medical Solutions Group

- 6.3.15 Integra LifeSciences

- 6.3.16 Medela AG

- 6.3.17 Stryker Corporation

- 6.3.18 Derma Sciences (Integra)

- 6.3.19 DermaRite Industries

- 6.3.20 Mimedx Group

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment