PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836582

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836582

Spain Wound Care Management Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

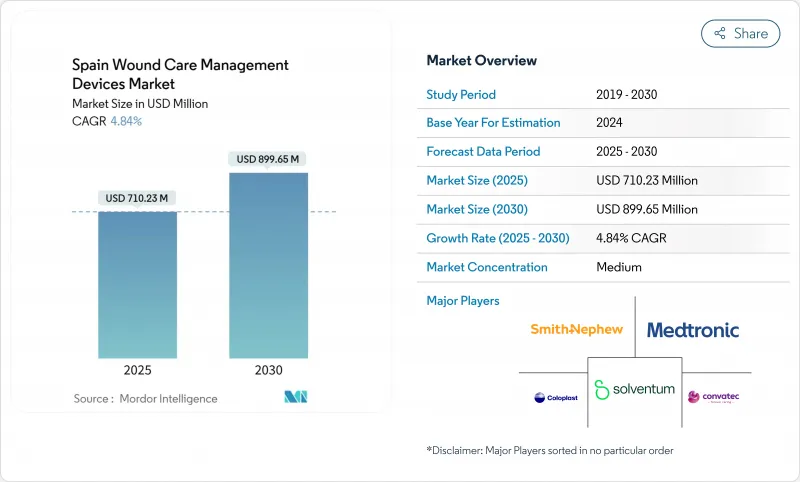

The Spain wound care management devices market size stands at USD 710.23 million in 2025 and is forecast to reach USD 899.65 million by 2030, advancing at a 4.84% CAGR during the period.

Rising life expectancy, with 37.2% of residents expected to be over 65 by 2052, intensifies demand for chronic-wound therapies. A national type 2 diabetes prevalence of 14.7%, and 30.3% among people older than 70, further fuels the Spain wound care management devices market as diabetic foot ulcers require specialized care. Decentralized procurement across 17 Autonomous Communities drives cost variation yet stimulates adoption of advanced dressings and negative pressure wound therapy (NPWT) to lower per-patient costs. Chronic wounds account for 60.34% of revenue, while acute wounds are growing faster in tandem with recovering surgical procedures . Technology-enabled home care, including tele-monitoring and portable NPWT, underpins a rapid shift from hospital to community settings.

Spain Wound Care Management Devices Market Trends and Insights

Growing Prevalence of Diabetic Foot & Pressure Ulcers

Diabetic foot ulcers are now the primary diagnosis in 90.5% of Spain's specialized wound units, generating EUR 2.063 million per infected case when hospitalization is required . Hospital stays account for 88% of that expense and lengthen healing to 194 days versus 136 days for outpatient care. Advanced thermographic AI yields 95% diagnostic accuracy for peripheral neuropathy, prompting earlier interventions that lower ulcer incidence . Health authorities view investment in advanced dressings and NPWT as a cost-saving strategy that curbs amputations and readmissions.

Rising Volume of Elective & Trauma Surgeries

Elective procedures rebounded in 2024-2025, sustaining demand for post-operative closure and infection-prevention devices. Vacuum-assisted closure therapy reduced healing time and length of stay in 41 complex cases at the University Clinic of Navarra. Polyurethane foam multilayer dressings cut dressing changes by 47.1% and weekly costs by 58.7%. Surgeons increasingly prescribe single-use NPWT systems that enable earlier discharge and support community-based follow-ups.

Limited National Reimbursement for Advanced Dressings

Advanced devices need CE marking through the Spanish Agency of Medicines and Medical Devices (AEMPS), yet decisions on funding rest with each region, creating a patchwork of coverage. Manufacturers negotiate multiple formularies, slowing time-to-market even when cost-effectiveness is proven via health technology assessments.

Other drivers and restraints analyzed in the detailed report include:

- Ageing Population Boosting Chronic-Wound Incidence

- Hospital-to-Home Shift & Home-Based NPWT Adoption

- High Per-Patient Cost of NPWT & Bio-Engineered Grafts

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Advanced wound care solutions held 65.41% of the Spain wound care management devices market in 2024, led by antimicrobial foam dressings that trimmed weekly treatment expenses by 58.6%. The Spain wound care management devices market size for wound closure products is growing at a 5.23% CAGR, driven by demand for tissue adhesives that lower infection risk and enable faster outpatient turnover. Smith+Nephew marked 12.2% sales growth within its local advanced wound unit following the release of the Red Dot-winning RENASYS EDGE NPWT platform, reinforcing brand momentum.

Sutures remain dominant in closure devices, yet smart sealants containing growth factors are entering operating rooms. Bio-engineered topical agents continue to capture niche demand for antimicrobial control, while enzymatic debridement gels receive attention in diabetic care pathways. Emerging Internet-of-Things-enabled dressings transmit temperature and exudate data, allowing clinicians to predict infection onset and adjust therapy without unnecessary dressing removal.

Chronic wounds accounted for 60.34% of the Spain wound care management devices market share in 2024 as diabetic foot, venous leg, and pressure ulcers prevail in an aging society. The Spain wound care management devices market size for acute wounds is projected to grow at 5.34% CAGR to 2030, reflecting surgical rebounds and trauma incidence.

Diabetic foot ulcers represent the largest chronic segment, correlating with 14.7% diabetes prevalence. Pressure ulcers pose significant resource burdens, yet structured prevention programs demonstrate a 50% reduction in prevalence when spearheaded by advanced practice nurses. Acute surgical wounds benefit from prophylactic NPWT and antimicrobial hydrofiber dressings that shorten closure times.

The Spain Wound Care Management Devices Market is Segmented by Product (Wound Care [Dressings, Wound-Care Devices, and More] and Wound Closure [Sutures, Surgical Staplers, and More]), Wound Type (Chronic Wounds and Acute Wounds), End User (Hospitals & Specialty Wound Clinics and More), and Mode of Purchase (Institutional Procurement and Retail / OTC Channel). The Market and Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Solventum

- Smiths Group

- Molnlycke Health Care

- Coloplast

- ConvaTec Group plc

- Medtronic

- Cardinal Health

- B. Braun

- Laboratories Hartmann SA

- Integra LifeSciences

- Urgo Medical

- Baxter

- Johnson & Johnson

- Lohmann & Rauscher GmbH

- Advanced Medical Solutions Group

- Medela

- Kerecis ehf (Coloplast)

- Histocell S.L.

- Genia BioPharma S.L.

- Grena

- MiMedx Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing prevalence of diabetic foot & pressure ulcers

- 4.2.2 Rising volume of elective & trauma surgeries

- 4.2.3 Ageing population boosting chronic-wound incidence

- 4.2.4 Hospital-to-home shift & home-based NPWT adoption

- 4.2.5 Regional clinical-nurse-led wound units cutting recurrence

- 4.2.6 E-health tele-monitoring platforms reducing follow-up visits

- 4.3 Market Restraints

- 4.3.1 Limited national reimbursement for advanced dressings

- 4.3.2 High per-patient cost of NPWT & bio-engineered grafts

- 4.3.3 Fragmented procurement across 17 Autonomous Communities

- 4.3.4 Shortage of certified wound-care specialists in primary care

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porters Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 Wound Care

- 5.1.1.1 Dressings

- 5.1.1.1.1 Traditional Gauze & Tape Dressings

- 5.1.1.1.2 Advanced Dressings

- 5.1.1.2 Wound-Care Devices

- 5.1.1.2.1 Negative Pressure Wound Therapy (NPWT)

- 5.1.1.2.2 Oxygen & Hyperbaric Systems

- 5.1.1.2.3 Electrical Stimulation Devices

- 5.1.1.2.4 Other Wound Care Devices

- 5.1.1.3 Topical Agents

- 5.1.1.4 Other Wound Care Products

- 5.1.2 Wound Closure

- 5.1.2.1 Sutures

- 5.1.2.2 Surgical Staplers

- 5.1.2.3 Tissue Adhesives, Strips, Sealants & Glues

- 5.1.1 Wound Care

- 5.2 By Wound Type

- 5.2.1 Chronic Wounds

- 5.2.1.1 Diabetic Foot Ulcer

- 5.2.1.2 Pressure Ulcer

- 5.2.1.3 Venous Leg Ulcer

- 5.2.1.4 Other Chronic Wounds

- 5.2.2 Acute Wounds

- 5.2.2.1 Surgical/Traumatic Wounds

- 5.2.2.2 Burns

- 5.2.2.3 Other Acute Wounds

- 5.2.1 Chronic Wounds

- 5.3 By End User

- 5.3.1 Hospitals & Specialty Wound Clinics

- 5.3.2 Long-term Care Facilities

- 5.3.3 Home-Healthcare Settings

- 5.4 By Mode of Purchase

- 5.4.1 Institutional Procurement

- 5.4.2 Retail / OTC Channel

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Solventum

- 6.3.2 Smith & Nephew plc

- 6.3.3 Molnlycke Health Care AB

- 6.3.4 Coloplast A/S

- 6.3.5 ConvaTec Group plc

- 6.3.6 Medtronic plc

- 6.3.7 Cardinal Health Inc.

- 6.3.8 B. Braun SE

- 6.3.9 Laboratories Hartmann SA

- 6.3.10 Integra LifeSciences

- 6.3.11 Urgo Medical

- 6.3.12 Baxter International Inc.

- 6.3.13 Johnson & Johnson (Ethicon)

- 6.3.14 Lohmann & Rauscher GmbH

- 6.3.15 Advanced Medical Solutions Group plc

- 6.3.16 Medela AG

- 6.3.17 Kerecis ehf (Coloplast)

- 6.3.18 Histocell S.L.

- 6.3.19 Genia BioPharma S.L.

- 6.3.20 Grena Ltd

- 6.3.21 MiMedx Group

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment