PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836571

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836571

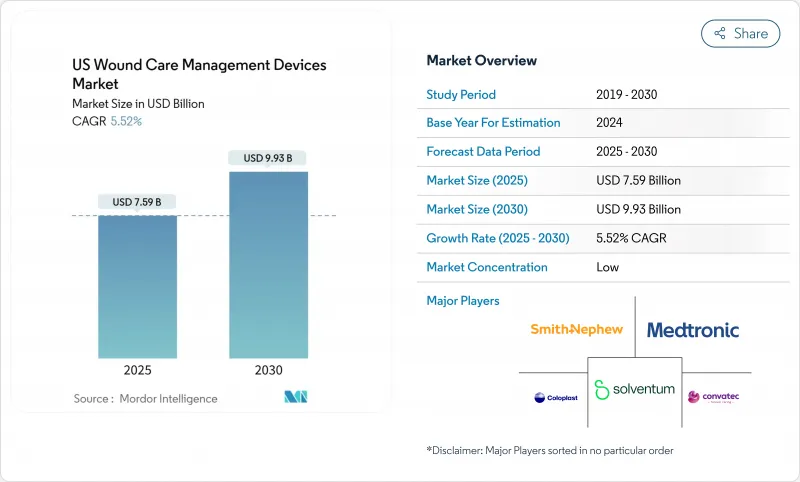

US Wound Care Management Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The United States wound care management devices market grew to USD 7.59 billion in 2025 and is forecast to reach USD 9.93 billion by 2030, registering a 5.52% CAGR.

Demand momentum reflects the convergence of an aging population, higher diabetes prevalence, and post-pandemic recovery in surgical volumes. Home-based treatment adoption, reimbursement incentives for telehealth visits, and payer scrutiny of avoidable readmissions are reshaping procurement decisions. Leading manufacturers are accelerating digital integration-remote monitoring, predictive analytics, and smart dressings-to align with value-based care targets. In parallel, consolidation among suppliers is unlocking scale advantages in sourcing, clinical education, and bundled product offerings.

US Wound Care Management Devices Market Trends and Insights

Increasing incidence of chronic and diabetic wounds

Chronic wound prevalence among Medicare beneficiaries rose, equating to roughly 8.2 million patients requiring ongoing management. Diabetic foot ulcers alone incur a large sum in annual Medicare spending and show a high recurrence rate within one year. Geographic clustering in Texas, Florida, and California stems from elevated diabetes prevalence, reinforcing regional demand for advanced dressings, NPWT systems, and adjunctive therapies.

Growing volume of surgical procedures

Annual surgical incisions have rebounded to nearly 100 million, each requiring closure devices or dressings. The outpatient migration of procedures fuels demand for portable NPWT pumps and bio-active tissue adhesives suited to home recovery. Johnson & Johnson's Ethizia wound-sealing patch exemplifies this trend, offering hemostasis plus antimicrobial protection. Hospitals emphasize technologies that lower surgical site infection costs, which can exceed USD 20,000 per readmission.

Stringent FDA regulations and CMS coding hurdles

The FDA has proposed reclassifying antimicrobial dressings, pushing many products from the 510(k) pathway to Class III PMA. Manufacturers must also comply with updated Quality System Regulation amendments aligning with ISO 13485 standards by 2026. Parallel CMS policy demands peer-reviewed evidence for skin substitutes, prompting longer and costlier clinical programs.

Other drivers and restraints analyzed in the detailed report include:

- Rising geriatric population base

- Rapid adoption of advanced therapies such as NPWT and skin substitutes

- High total cost of care and device pricing

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The United States wound care management devices market share favored wound care products at 67.23% in 2024. Foam and hydrocolloid dressings have displaced traditional gauze due to better moisture control, extended wear, and decreased nursing workload. Antimicrobial agents embedded in dressings target biofilm formation without frequent changes, while flexible printed sensors capture pH, temperature, and exudate volume for real-time feedback.

Wound closure devices, though smaller in base revenue, are advancing at 5.98% CAGR. Tissue adhesives, absorbable strips, and sprayable sealants are gaining traction among surgeons who value faster application and improved cosmesis. Smart staplers equipped with compression sensors provide intraoperative guidance that lowers leak rates. Increasing bariatric and orthopedic volumes support demand for bio-active patches that combine hemostasis with infection suppression.

Chronic wounds retained 59.33% of the United States wound care management devices market share in 2024. Diabetic foot ulcers and pressure ulcers consume the largest share of Medicare spending, driving adoption of off-loading devices, NPWT, and skin substitutes that expedite closure. AI-driven imaging tools achieve expert-level accuracy in predicting healing trajectories, enabling earlier therapy escalation .

Acute wounds are expanding at a 6.12% CAGR as elective surgeries rebound and trauma care protocols intensify infection control. The United States wound care management devices market size for acute applications is poised to benefit from bio-resorbable sealants and negative-pressure dressings that shorten hospital stays. Burns constitute a niche segment where advanced dermal matrices like AVITA's Cohealyx support scar minimization and rapid re-epithelialization.

The US Wound Care Management Devices Market is Segmented by Product (Wound Care [Dressings, Wound-Care Devices, and More] and Wound Closure [Sutures, Surgical Staplers, and More]), Wound Type (Chronic Wounds and Acute Wounds), End User (Hospitals & Specialty Wound Clinics and More), and Mode of Purchase (Institutional Procurement and Retail / OTC Channel). The Market and Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Solventum

- Smiths Group

- Johnson & Johnson

- Convatec

- Medtronic

- B. Braun

- Cardinal Health

- Coloplast

- Molnlycke Health Care

- Integra LifeSciences

- Organogenesis

- Teleflex

- Urgo Medical

- Hollister

- Medline Industries

- Zimmer Biomet

- MiMedx Group

- Essity Medical

- AVITA Medical, Inc.

- Hartmann Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing incidence of chronic & diabetic wounds

- 4.2.2 Growing volume of surgical procedures

- 4.2.3 Rising geriatric population base

- 4.2.4 Rapid adoption of advanced therapies such as NPWT and skin substitutes

- 4.2.5 Reimbursement-linked telehealth & smart dressing deployment

- 4.2.6 Rising hospital-acquired wound cases and infection control mandates

- 4.3 Market Restraints

- 4.3.1 Stringent FDA regulations & CMS coding hurdles

- 4.3.2 High total cost of care and device pricing

- 4.3.3 Heightened payer scrutiny of skin substitutes

- 4.3.4 Shortage of certified wound-care specialists

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porters Five Forces Analysis

- 4.6.1 Bargaining Power of Buyers

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 Wound Care

- 5.1.1.1 Dressings

- 5.1.1.1.1 Traditional Gauze & Tape Dressings

- 5.1.1.1.2 Advanced Dressings

- 5.1.1.2 Wound-Care Devices

- 5.1.1.2.1 Negative Pressure Wound Therapy (NPWT)

- 5.1.1.2.2 Oxygen & Hyperbaric Systems

- 5.1.1.2.3 Electrical Stimulation Devices

- 5.1.1.2.4 Other Wound Care Devices

- 5.1.1.3 Topical Agents

- 5.1.1.4 Other Wound Care Products

- 5.1.2 Wound Closure

- 5.1.2.1 Sutures

- 5.1.2.2 Surgical Staplers

- 5.1.2.3 Tissue Adhesives, Strips, Sealants & Glues

- 5.1.1 Wound Care

- 5.2 By Wound Type

- 5.2.1 Chronic Wounds

- 5.2.1.1 Diabetic Foot Ulcer

- 5.2.1.2 Pressure Ulcer

- 5.2.1.3 Venous Leg Ulcer

- 5.2.1.4 Other Chronic Wounds

- 5.2.2 Acute Wounds

- 5.2.2.1 Surgical/Traumatic Wounds

- 5.2.2.2 Burns

- 5.2.2.3 Other Acute Wounds

- 5.2.1 Chronic Wounds

- 5.3 By End User

- 5.3.1 Hospitals & Specialty Wound Clinics

- 5.3.2 Long-term Care Facilities

- 5.3.3 Home-Healthcare Settings

- 5.4 By Mode of Purchase

- 5.4.1 Institutional Procurement

- 5.4.2 Retail / OTC Channel

6 Competitive Landscape

- 6.1 Market Concentration Analysis

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Solventum

- 6.3.2 Smith & Nephew

- 6.3.3 Johnson & Johnson

- 6.3.4 ConvaTec Group

- 6.3.5 Medtronic

- 6.3.6 B. Braun SE

- 6.3.7 Cardinal Health

- 6.3.8 Coloplast

- 6.3.9 Molnlycke Health Care

- 6.3.10 Integra LifeSciences

- 6.3.11 Organogenesis

- 6.3.12 Teleflex

- 6.3.13 Urgo Medical

- 6.3.14 Hollister Incorporated

- 6.3.15 Medline Industries

- 6.3.16 Zimmer Biomet

- 6.3.17 MiMedx Group

- 6.3.18 Essity Medical

- 6.3.19 AVITA Medical, Inc.

- 6.3.20 Hartmann Group

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment