PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836455

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836455

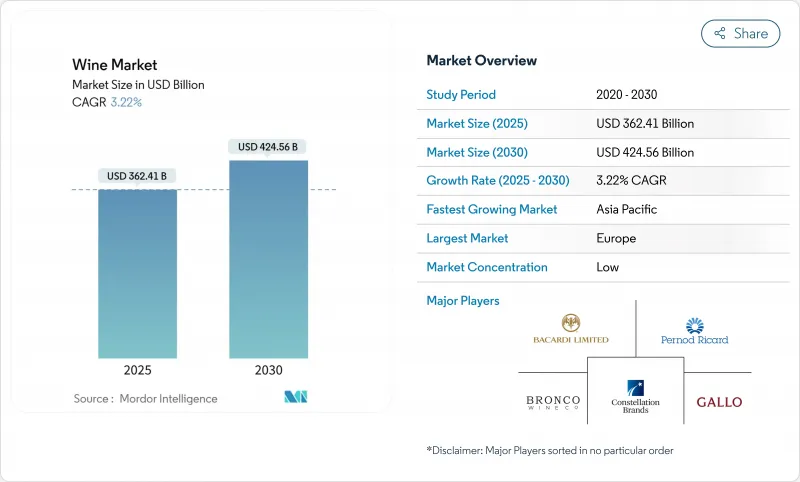

Wine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The global wine market is valued at USD 362.41 billion in 2025 and is projected to reach USD 424.56 billion by 2030, growing at a CAGR of 3.22%.

While overall volumes are declining, premium wine segments continue to show strong demand, reflecting consumer preferences for quality products. According to the International Organisation of Vine and Wine (OIV), global wine production decreased by 5% in 2024 compared to 2023, reaching its lowest level due to extreme weather conditions, including droughts, frosts, and irregular rainfall patterns. The market growth is driven by increasing awareness of wine's health benefits, such as antioxidant properties and potential cardiovascular benefits, premiumization trends, flavor innovations, and expanding distribution networks worldwide. Off-trade sales dominate the market through retail channels and e-commerce platforms, while on-trade consumption is recovering alongside the tourism and hospitality sectors, particularly in restaurants, bars, and hotels. Consumer preferences are shifting toward organic, low-alcohol, and sustainably packaged wines, driven by younger, multicultural consumers who prioritize environmental and health considerations. Market growth is supported by celebration-based consumption and rising disposable income in emerging economies. Companies gain competitive advantages through digital vineyard management systems, technology-enabled supply chain operations, and sustainable practices, including transparent sourcing and eco-friendly packaging.

Global Wine Market Trends and Insights

Growing tourism and hospitality impact positive growth

Rise in tourism is transforming wine consumption patterns, with wine tourism growing significantly among younger travelers seeking experience-based purchases. The United Nations World Tourism Organization (UNWTO) Global Conference highlighted wine tourism's importance in regional development, as destinations use wine experiences to attract millennials and Gen Z consumers interested in authentic cultural experiences. These younger consumers are increasingly participating in wine tastings, vineyard tours, and harvest events, demonstrating a shift from traditional consumption to immersive experiences. This trend is notable in emerging wine regions, where new tourism infrastructure creates market opportunities for premium producers. Many wineries are developing visitor centers, tasting rooms, and accommodation facilities to meet this growing demand. The Spanish Association of Wine Cities (Wine Routes of Spain) reported that wine tourists in Spain reached nearly three million in 2023, an 18.2% increase from the previous year. This growth reflects the broader trend of experiential tourism in the wine industry. Wine tourism's economic impact extends beyond direct sales, as visitors purchase more wine per capita than non-visitors, generating sustained revenue for producers who invest in experiential facilities. Additionally, wine tourism contributes to regional employment, hospitality sector growth, and the development of complementary tourism services in wine-producing regions.

Surge in demand for premium wine

The wine market is shifting toward premium products, with consumers selecting higher-priced wines despite inflationary pressures on discretionary spending. Silicon Valley Bank reports that while overall wine volumes are declining, wines priced between USD 30-80 are showing growth in 2024, reflecting consumers' emphasis on quality over quantity in the fine wine segment. Premium wine consumption continues to rise in established markets, driven by consumers with sophisticated preferences and extensive wine knowledge. This growth reflects a shift toward quality-focused consumption and greater appreciation for wine craftsmanship. Producers highlighting their terroir, sustainability practices, and traditional winemaking methods gain market advantage as consumers seek authentic wine experiences. Moreover, digital platforms have transformed wine purchasing and education, with younger consumers using them to research wine origins, production methods, and sustainability certifications. These platforms enable wine discovery by providing detailed information about vineyards, winemaking processes, and expert reviews. Consumer purchasing decisions are influenced by both product information and peer recommendations available on these platforms.

Stringent government regulations

The European Union has implemented new regulations requiring ingredient and nutrition disclosures on wine bottles from the 2024 harvest, necessitating changes to labels and digital traceability systems. Starting December 2023, these regulations on labelling ingredients and nutritional values apply to wine and aromatised wine products in the EU. The regulations aim to provide consumers with more detailed product information for informed decision-making. While these rules affect all wines from the 2024 harvest, products manufactured before December 8, 2023, remain exempt until existing stocks are depleted. In the United States, the Alcohol and Tobacco Tax and Trade Bureau (TTB) introduced a proposed rule in January 2025 requiring disclosure of major food allergens in alcoholic beverages under their regulatory authority. The rule mandates labels to declare the presence of milk, eggs, fish, crustacean shellfish, tree nuts, wheat, peanuts, soybeans, and sesame. Additionally, labels must indicate ingredients containing proteins derived from these allergens. The TTB proposes a five-year compliance period from the final rule's publication date. These regulatory changes present significant challenges for the industry. These increased compliance costs reduce profit margins and may restrict funds available for innovation.

Other drivers and restraints analyzed in the detailed report include:

- Rise in the demand for sustainable and organic wines

- Innovative formats and varieties

- Rising consumer inclination towards other alcoholic beverages

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Still wine holds a 71.01% market share in 2024, reflecting established consumption patterns. Meanwhile, sparkling wine demonstrates robust growth with a 3.82% CAGR, driven by increasing demand for premium and celebration-oriented consumption. The sparkling wine segment's growth is supported by broad demographic appeal, with younger consumers favoring Prosecco and Moscato, while older consumers prefer Champagne. Fortified wines maintain a specialized market position, and the other wine types category includes emerging products like low-alcohol and flavored variants that meet health-conscious consumer preferences. Each category shows potential for premiumization as consumers increasingly value quality and authenticity.

Sparkling wine's growth is enhanced by its social media presence and popularity as a gifting option. The category has expanded beyond traditional celebrations to year-round consumption, with increased sales in casual dining establishments. The segment's appeal is further strengthened by innovations in sustainable packaging and organic certification, attracting environmentally conscious consumers. Market success increasingly favors producers who emphasize experiential marketing and sustainability in their product development and communication strategies.

Red wines accounted for 47.88% of 2024 revenue, maintaining their position as the wine market's foundation. Cabernet Sauvignon, Merlot, and Malbec remain prominent in retail channels, while Pinot Noir and Nebbiolo serve the premium segment. Rose wines demonstrate strong growth with a 4.02% CAGR, driven by attractive packaging, approachable taste profiles, and broad consumer appeal. White wines maintain a stable market position, supported by seasonal consumption patterns and health-conscious consumers. Climate change impacts traditional red wine production in Mediterranean regions, encouraging vineyards to adopt heat-tolerant varieties such as Grenache and Touriga Nacional.

Wine producers expand their rose offerings through seasonal releases, alternative packaging formats, and Provence-inspired blends that appeal to modern consumers. Premium rose products include oak-aged varieties for wine enthusiasts seeking nuanced flavors. Red wine producers introduce chilled varieties for warm-weather consumption. White wine production focuses on aromatic varieties like Riesling and Albarino, emphasizing their compatibility with seafood dishes. Consumer purchasing patterns now reflect specific occasions rather than traditional preferences, requiring wine producers to develop diverse portfolios while maintaining distinct market segments.

The Wine Market Report is Segmented by Product Type (Still Wine, Sparkling Wine, and More), Color (Red Wine, Rose Wine, and White Wine), End User (Men and Women), Distribution Channel (On Trade and Off Trade), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe generated 44.45% of global wine revenues in 2024, supported by established cultural traditions and concentrated wine-producing regions. Consumer behavior shows a shift from daily consumption to weekend and special occasion drinking, resulting in decreased low-price volume but increased premium segment share. In France, wine remains the primary alcoholic beverage, with strong adoption among 18-25-year-olds. Italy's market growth is driven by DOCG promotional activities and increased exports to the United States. European producers face strict environmental regulations, leading to increased adoption of organic certifications and biodynamic practices, which increase production costs while providing marketing benefits.

The Asia-Pacific region shows a 5.36% CAGR through 2030. China's market expands through domestic premium wine production and duty-free retail development. India's growth stems from wine tourism initiatives in Maharashtra, combining agricultural experiences with high-end accommodations. South Korea, Thailand, and Japan demonstrate double-digit import growth, with distinct preferences-South Korean consumers favor sweeter wines, while Japanese buyers prefer sparkling Moscato. Digital platforms like Alibaba's Tmall enable direct shipments from small European producers to Asian consumers, reducing traditional import barriers.

South American exporters, particularly Chile and Argentina, use free-trade agreements to maintain market presence against increasing competition from Spain and Portugal. The Middle East and Africa regions show long-term growth potential, despite regulatory restrictions, with wealthy urban areas importing premium wines for upscale restaurants. Success in these diverse markets requires effective regulatory compliance and market-specific communication strategies.

- E. and J. Gallo Winery

- Constellation Brands Inc.

- The Wine Group LLC

- Pernod Ricard

- Treasury Wine Estates

- Sula Vineyards Limited

- Bronco Wine Company

- Foley Family Wines

- Bacardi Limited

- Symington Family Estates

- Madeira Wine Company SA

- Accolade Wines

- Moet Hennessy (LVMH)

- Jackson Family Wines

- Caviro Group

- Grupo Penaflor

- Vina Concha y Toro SA

- Familia Torres

- Changyu Pioneer Wine

- Domaines Barons de Rothschild (Lafite)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing tourism and hospitality impact positive growth

- 4.2.2 Rising consumer preference for low alcohol products

- 4.2.3 Surge in demand for premium wine

- 4.2.4 Product diffrentiation in terms of alcohol content

- 4.2.5 Innovative formats and varieties

- 4.2.6 Rise in the demand for sustanable and organic wines

- 4.3 Market Restraints

- 4.3.1 Stringent government regulations

- 4.3.2 Rising consumer inclination towards other alcoholic beverages

- 4.3.3 High production costs and climate change

- 4.3.4 Counterfeit products

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Fortified Wine

- 5.1.2 Still Wine

- 5.1.3 Sparkling Wine

- 5.1.4 Others Wine Types

- 5.2 By Color

- 5.2.1 Red Wine

- 5.2.2 White Wine

- 5.2.3 Rose Wine

- 5.3 By End User

- 5.3.1 Men

- 5.3.2 Women

- 5.4 By Distribution Channel

- 5.4.1 On-Trade

- 5.4.2 Off-Trade

- 5.4.2.1 Specialty/Liquor Stores

- 5.4.2.2 Others Off Trade Channels

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 Italy

- 5.5.2.4 France

- 5.5.2.5 Spain

- 5.5.2.6 Netherlands

- 5.5.2.7 Poland

- 5.5.2.8 Belgium

- 5.5.2.9 Sweden

- 5.5.2.10 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 Indonesia

- 5.5.3.6 South Korea

- 5.5.3.7 Thailand

- 5.5.3.8 Singapore

- 5.5.3.9 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Chile

- 5.5.4.5 Peru

- 5.5.4.6 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Nigeria

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 E. and J. Gallo Winery

- 6.4.2 Constellation Brands Inc.

- 6.4.3 The Wine Group LLC

- 6.4.4 Pernod Ricard

- 6.4.5 Treasury Wine Estates

- 6.4.6 Sula Vineyards Limited

- 6.4.7 Bronco Wine Company

- 6.4.8 Foley Family Wines

- 6.4.9 Bacardi Limited

- 6.4.10 Symington Family Estates

- 6.4.11 Madeira Wine Company SA

- 6.4.12 Accolade Wines

- 6.4.13 Moet Hennessy (LVMH)

- 6.4.14 Jackson Family Wines

- 6.4.15 Caviro Group

- 6.4.16 Grupo Penaflor

- 6.4.17 Vina Concha y Toro SA

- 6.4.18 Familia Torres

- 6.4.19 Changyu Pioneer Wine

- 6.4.20 Domaines Barons de Rothschild (Lafite)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK