PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836650

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836650

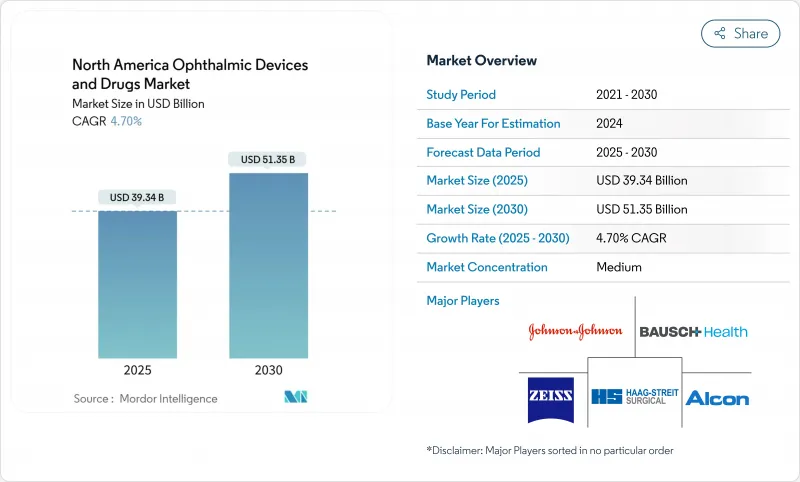

North America Ophthalmic Drugs And Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The North America ophthalmology market stands at USD 39.34 billion in 2025 and is forecast to post USD 51.35 billion by 2030, advancing at a 4.7% CAGR.

Growth has moderated from the last decade's surge, yet the sector keeps expanding because almost three-quarters of severe vision loss could still be prevented through early detection and timely care. The demographic tilt toward an older population underpins a steady flow of cataract, glaucoma, and diabetic eye-disease cases, while private-equity backed consolidation is reshaping competitive dynamics to secure scale and technology leverage. Practice profitability faces short-term pressure after Medicare trimmed physician reimbursement by 2.8% in 2025, nudging providers toward higher-margin premium intraocular lenses (IOLs), minimally invasive surgery, and continuous-delivery drug implants. Rural under-supply is projected to leave 30% of ophthalmology positions unfilled by 2035, which has accelerated optometric scope expansion and fueled the adoption of AI-powered tele-ophthalmology platforms that bring diagnostics to underserved communities. Despite these headwinds, the North American ophthalmology market retains a reputation for recession-resilient demand because most conditions impair daily living if care is delayed.

North America Ophthalmic Drugs And Devices Market Trends and Insights

Aging Population Accelerating Prevalence of Chronic Ophthalmic Conditions

People aged 65 and above are growing 3.2% per year across North America, and vision quality declines sharply once individuals cross the mid-50s threshold. Nearly 750,000 Americans already live with diabetic macular edema, reinforcing demand for long-term disease management solutions. The demographic shift keeps ophthalmology clinics busy even during economic slowdowns because untreated cataract, glaucoma, and retinal disorders quickly erode functional independence. Older adults also show a higher readiness to pay for premium IOLs that restore spectacle-free vision, supporting upsell opportunities. Workforce shortages in rural counties intensify the need for tele-screening and optometric co-management, aligning with recent scope expansions authorized in several US states.

Technological Breakthroughs in Minimally Invasive & Image-Guided Eye Surgery

Advances in femtosecond lasers, robotic guidance, and real-time optical coherence tomography are trimming surgery time and reducing operator variability. Alcon's Voyager Direct SLT device, for instance, eliminates manual aiming and the need for a gonio lens while treating nearly 5 million Americans living with glaucoma. FDA breakthrough-device approvals (e.g., FYXS Ocular Pressure Adjusting Pump) signal the regulator's commitment to the rapid diffusion of meaningful innovation. Ambulatory surgery centers, which received a 2.8% reimbursement bump for quality reporting in 2025, are quick adopters because shorter procedures boost throughput. As these platforms cost well above USD 350,000, capital expenditure favors multisite groups, deepening practice consolidation trends.

High Cost of Advanced Devices & Limited Procedure Reimbursement

Medicare's 2025 conversion-factor cut to USD 32.35 pushed cataract fees down to USD 521.75, barely covering the disposable pack cost when expensive femtosecond lasers are used. Provincial Canadian plans still reimburse only manual phacoemulsification with monofocal lenses, leaving premium IOLs entirely patient-paid. Small practices hesitate to finance USD 500,000 surgical platforms without a clear volume pipeline, so technology diffusion skews toward corporate groups and academic centers. A nascent trend toward office-based surgery could trim facility fees, yet Medicare has not differentiated payments by site of service, limiting near-term relief.

Other drivers and restraints analyzed in the detailed report include:

- Rising Adoption of Premium IOLs & Femtosecond Laser-Assisted Cataract Procedures

- AI-Powered Tele-Ophthalmology Expanding Rural Access

- Specialty Optical-Component Supply Bottlenecks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Devices accounted for 60.3% of 2024 revenue in the North America ophthalmology market, reflecting the capital nature of surgical platforms and diagnostic imaging. Drugs, however, are set to log the fastest 9.6% CAGR and are projected to lift their slice of the North America ophthalmology market size alongside launches such as Alcon's TRPM8 agonist Tryptyr for dry eye and Genentech's refillable Susvimo implant for retinal disorders. Premium cataract systems, femtosecond lasers and next-generation ultrasound phaco machines allow clinics to charge higher facility fees, keeping equipment demand healthy. Diagnostic-device makers integrate AI algorithms into optical coherence tomography to automate pathology flagging, further supporting hardware upgrades.

Pharmaceutical innovators target chronic care. Susvimo delivers ranibizumab continuously, cutting injections from 12 to two per year and boosting adherence. Generic pressure weighs on first-generation anti-VEGF agents, but biologics coupled with depot implants blur the once-clear boundary between "device" and "drug", prompting new reimbursement codes. Vision-care accessories-traditional contact lenses and consumer sunglasses-see margin dilution due to online retailers that bypass optician channels. Overall, devices will keep the larger pool, but drugs will account for most incremental growth through 2030.

The North America Ophthalmic Drugs and Devices Market Ris Segmented by Product (Devices {Surgical Devices, Diagnostic Devices, and More} and Drugs {Glaucoma Drugs, Retinal Disorder Drugs, and More), Disease (Glaucoma, Cataract, Age-Related Macular Degeneration, Inflammatory Diseases, Refractive Disorders, and More), and Geography (United States, Canada, Mexico). The Market Sizes and Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Alcon

- Bausch + Lomb

- Carl Zeiss

- EssilorLuxottica

- HAAG-Streit

- Johnson & Johnson

- Nidek

- Topcon

- Ziemer Group

- AbbVie (Allergan Eye Care)

- Novartis

- Roche (Genentech)

- Santen Pharmaceutical Co.

- The Cooper Companies

- Glaukos

- STAAR Surgical

- Lumenis

- Aerie Pharmaceutical

- Boston Scientific (ELLEX assets)

- Visioneering Technologies Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Aging Population Accelerating Prevalence of Chronic Ophthalmic Conditions

- 4.2.2 Technological Breakthroughs in Minimally Invasive & Image-Guided Eye Surgery

- 4.2.3 Rising Adoption of Premium IOLs & Femtosecond Laser-Assisted Cataract Procedures

- 4.2.4 AI-Powered Tele-Ophthalmology Expanding Rural Access

- 4.2.5 Corporate Vision-Benefit Programs Boosting Routine Eye-Care Demand

- 4.2.6 FDA Breakthrough Device Pathway Speeding Novel Ocular Technologies

- 4.3 Market Restraints

- 4.3.1 High Cost of Advanced Devices & Limited Procedure Reimbursement

- 4.3.2 Stringent Approval Pathway for Combination Drug-Device Products

- 4.3.3 Specialty Optical-Component Supply Bottlenecks

- 4.3.4 Generic Drug Competition Compressing Branded-Drug Pricing

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product

- 5.1.1 Devices

- 5.1.1.1 Surgical Devices

- 5.1.1.1.1 Intra-ocular Lenses

- 5.1.1.1.2 Ophthalmic Lasers

- 5.1.1.1.3 Phacoemulsification Systems

- 5.1.1.1.4 Other Surgical Devices

- 5.1.1.2 Diagnostic Devices

- 5.1.1.2.1 Optical Coherence Tomography Scanners

- 5.1.1.2.2 Fundus Cameras

- 5.1.1.2.3 Tonometers

- 5.1.1.2.4 Other Diagnostic Devices

- 5.1.1.3 Vision Care Devices

- 5.1.1.3.1 Contact Lenses

- 5.1.1.3.2 Spectacle Lenses

- 5.1.2 Drugs

- 5.1.2.1 Glaucoma Drugs

- 5.1.2.2 Retinal Disorder Drugs

- 5.1.2.3 Dry-Eye Therapies

- 5.1.2.4 Anti-Allergy / Anti-Inflammatory Drugs

- 5.1.2.5 Anti-Infective Drugs

- 5.1.2.6 Other Drugs

- 5.1.1 Devices

- 5.2 By Disease

- 5.2.1 Glaucoma

- 5.2.2 Cataract

- 5.2.3 Age-related Macular Degeneration

- 5.2.4 Diabetic Retinopathy

- 5.2.5 Inflammatory Diseases

- 5.2.6 Refractive Disorders

- 5.2.7 Other Diseases

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Specialty Clinics & ASCs

- 5.3.3 Retail Pharmacies & Optical Stores

- 5.3.4 Online Pharmacies

- 5.4 By Country

- 5.4.1 United States

- 5.4.2 Canada

- 5.4.3 Mexico

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, Recent Developments)

- 6.3.1 Alcon Inc.

- 6.3.2 Bausch + Lomb

- 6.3.3 Carl Zeiss Meditec AG

- 6.3.4 EssilorLuxottica SA

- 6.3.5 Haag-Streit Group

- 6.3.6 Johnson & Johnson Vision

- 6.3.7 Nidek Co., Ltd.

- 6.3.8 Topcon Corporation

- 6.3.9 Ziemer Group AG

- 6.3.10 AbbVie (Allergan Eye Care)

- 6.3.11 Novartis AG

- 6.3.12 Roche (Genentech)

- 6.3.13 Santen Pharmaceutical Co.

- 6.3.14 CooperVision

- 6.3.15 Glaukos Corporation

- 6.3.16 STAAR Surgical Company

- 6.3.17 Lumenis

- 6.3.18 Aerie Pharmaceuticals

- 6.3.19 Boston Scientific (ELLEX assets)

- 6.3.20 Visioneering Technologies Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment