PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836656

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836656

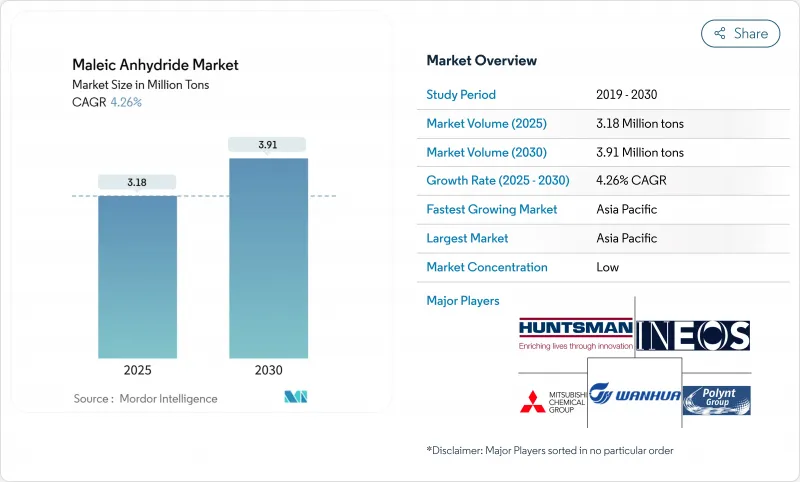

Maleic Anhydride - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The maleic anhydride market size reached 3.18 million tons in 2025 and is forecast to climb to 3.91 million tons by 2030, translating to a 4.26% CAGR.

Expanding infrastructure programs, sustained demand for unsaturated polyester resins, and the rapid substitution of benzene with n-butane feedstock are the principal growth vectors behind the maleic anhydride market. Construction accounts for the bulk of consumption, reinforced by recycled-PET UPR adoption and stringent green-building rules in Europe. North American automakers are broadening the application scope of lightweight SMC panels, adding momentum to resin demand. On the supply side, Asia Pacific's capacity leadership remains decisive, yet Chinese oversupply is compressing global margins and pushing producers elsewhere toward high-value niches.

Global Maleic Anhydride Market Trends and Insights

Surging Adoption of Recycled-PET UPR in Europe Construction

Mandatory recycled-content thresholds under the 2024 EU Packaging and Packaging Waste Regulation are steering builders toward recycled-PET unsaturated polyester resins. These formulations deliver tensile strength of 65-72 MPa, on par with virgin UPR, and trim embedded carbon by up to 25%. Maleic anhydride enhances interfacial adhesion in the polymer matrix, reinforcing composite durability and supporting the maleic anhydride market's push into low-carbon building materials.

Capacity Additions of N-Butane Plants Lowering Feedstock Cost

Recent n-butane swing-capacity projects are widening the feedstock cost gap versus benzene. BASF's trilobe-shaped catalyst lifts maleic anhydride yield by up to 2% and curbs hot-spot temperatures, translating into lower energy intensity. The resulting cost advantage is reinforcing the n-butane route's 70% share of the maleic anhydride market.

Stricter Benzene Emission Caps in OECD Raising Compliance Cost

Revisions to the U.S. Toxic Substances Control Act and EU chemical-management rules compel retrofits or closures of benzene-based units, inflating operating costs and incentivizing the migration to n-butane oxidation. The shift increases capital-spending needs and tempers growth in regions where older assets dominate.

Other drivers and restraints analyzed in the detailed report include:

- Lightweight SMC Panels for EVs Accelerating UPR Consumption in North America

- Bio-based Succinic Acid Routes Creating High-Margin Copolymers

- N-Butane Price Volatility Linked to Crude

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Unsaturated polyester resin held 50% of the maleic anhydride market share in 2024, and the segment is set to rise at a 4.9% CAGR through 2030. Recycled-PET UPR grades, offering identical mechanical performance and up to 25% lower carbon footprints, are catalyzing adoption in energy-efficient buildings. Concurrently, growth in lightweight marine structures and electric-vehicle components sustains demand. The maleic anhydride market size for UPR applications is therefore tracking above the overall industry average.

Diversification into 1,4-butanediol, copolymers, and specialty surfactants is widening the product mix. Continuous hydrogenation of maleic anhydride to BDO, achieving 85% yield over Cu-ZnO catalysts at 190 °C, illustrates process efficiency gains. Specialty copolymers derived from bio-based succinic acid are capturing premium pricing in biodegradable plastics, supporting margin expansion within the maleic anhydride industry.

N-butane oxidation processes contributed 70% to the maleic anhydride market in 2024, driven by lower unit costs and fewer hazardous by-products compared with benzene. Huntsman's fixed-bed technology, coupled with BASF's trilobe catalyst, lifts yield while lowering pressure drop, reinforcing cost leadership.

Benzene-based units operate mainly in regions where legacy infrastructure exists. Although smaller in scale, their 4.69% CAGR to 2030 reflects selective upgrades and competitive feedstock pricing in certain markets. This dual-track raw-material scenario shapes capital-allocation decisions and underpins supply flexibility in the maleic anhydride market.

The Maleic Anhydride Market Report Segments the Industry by Product Type (Unsaturated Polyester Resin, 1, 4-Butanediol, Lubricant Additives, and More), Raw Material (N-Butane and Benzene), Physical Form (Solid (Flake/Prill) and Molten), End-User Industry (Construction, Automobile, Food and Beverage, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa).

Geography Analysis

Asia Pacific held 69% of the maleic anhydride market in 2024, and the region is poised for a 4.61% CAGR through 2030. China's capacity exceeds two-thirds of the global total, underpinning supply. India and Southeast Asia sustain demand through infrastructure spending and rising automotive output, while Japan and South Korea contribute process innovations via firms such as Nippon Shokubai.

North America presents a technologically advanced yet cost-competitive production base. Huntsman operates large-scale units in Florida and Louisiana, integrating feedstock streams and downstream applications. Lightweight EV panels and forthcoming n-butane expansions reinforce regional growth, reinforcing the maleic anhydride market's revenue resilience. Europe faces higher energy costs and strict emission curbs, yet leads sustainability adoption, especially recycled-PET UPR.

South America's share is modest but rising in specialty fertilizer chelates. YPF Quimica is developing bio-based pathways to align with regional precision-agriculture priorities. The Middle East and Africa are investing in petrochemical diversification, leveraging feedstock abundance for future n-butane projects that could broaden the maleic anhydride market's global footprint.

- AOC

- Arkema

- Ashland

- Bartek Ingredients Inc.

- BASF

- Borealis AG

- Clariant

- Evonik Industries AG

- Huntsman International LLC

- I G Petrochemicals Ltd. (IGPL)

- INEOS AG

- LANXESS

- Mitsubishi Chemical Group Corporation

- NAN YA PLASTICS CORPORATION

- NIPPON SHOKUBAI CO., LTD.

- PETRONAS Chemicals Group Berhad

- Polynt S.p.A.

- Sinopec Qilu Petrochemical

- SK Functional Polymer

- Thirumalai Chemicals

- Wanhua

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging Adoption of Recycled-PET-Based UPR in Europe Construction

- 4.2.2 Capacity Additions of N-Butane Plants Lowering Feedstock Cost

- 4.2.3 Lightweight SMC Panels for EVs Accelerating UPR Consumption in North America

- 4.2.4 Bio-based Succinic Acid Routes Creating High-Margin Copolymers

- 4.2.5 Water-Soluble Fertilizer Chelates Growth in South America

- 4.3 Market Restraints

- 4.3.1 Stricter Benzene Emission Caps in OECD Raising Compliance Cost

- 4.3.2 Global Oversupply from New Chinese Capacity

- 4.3.3 N-Butane Price Volatility Linked to Crude

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Price Trend

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Product Type

- 5.1.1 Unsaturated Polyester Resin

- 5.1.2 1,4-Butanediol

- 5.1.3 Lubricant Additives

- 5.1.4 Maleic Anhydride Copolymers

- 5.1.5 Malic Acid

- 5.1.6 Fumaric Acid

- 5.1.7 Alkyl Succinic Anhydrides

- 5.1.8 Surfactants and Plasticizers

- 5.1.9 Other Product Types

- 5.2 By Raw Material

- 5.2.1 N-Butane

- 5.2.2 Benzene

- 5.3 By Physical Form

- 5.3.1 Solid (Flake/Prill)

- 5.3.2 Molten

- 5.4 By End-user Industry

- 5.4.1 Construction

- 5.4.2 Automobile

- 5.4.3 Electronics

- 5.4.4 Food and Beverage

- 5.4.5 Oil Products

- 5.4.6 Personal Care

- 5.4.7 Pharmaceuticals

- 5.4.8 Agriculture

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 AOC

- 6.4.2 Arkema

- 6.4.3 Ashland

- 6.4.4 Bartek Ingredients Inc.

- 6.4.5 BASF

- 6.4.6 Borealis AG

- 6.4.7 Clariant

- 6.4.8 Evonik Industries AG

- 6.4.9 Huntsman International LLC

- 6.4.10 I G Petrochemicals Ltd. (IGPL)

- 6.4.11 INEOS AG

- 6.4.12 LANXESS

- 6.4.13 Mitsubishi Chemical Group Corporation

- 6.4.14 NAN YA PLASTICS CORPORATION

- 6.4.15 NIPPON SHOKUBAI CO., LTD.

- 6.4.16 PETRONAS Chemicals Group Berhad

- 6.4.17 Polynt S.p.A.

- 6.4.18 Sinopec Qilu Petrochemical

- 6.4.19 SK Functional Polymer

- 6.4.20 Thirumalai Chemicals

- 6.4.21 Wanhua

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Commercialization of Bio-based Maleic Anhydride