PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836687

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836687

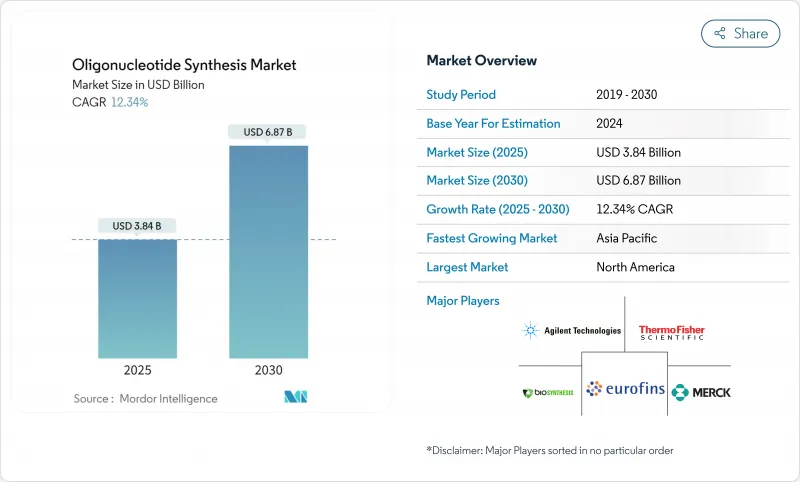

Oligonucleotide Synthesis - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The oligonucleotide synthesis market reached USD 3.84 billion in 2025 and is forecast to climb to USD 6.87 billion by 2030, advancing at a 12.34% CAGR as therapeutic breakthroughs accelerate demand.

Enzymatic platforms that create longer, cleaner strands without hazardous reagents are reshaping the oligonucleotide synthesis market by challenging four decades of phosphoramidite dominance. Government grants, notably the NIH's RNA-focused USD 15.4 million program, catalyze new production methods while contract manufacturers scale capacity to meet rising pharmaceutical outsourcing needs. Clinical approvals underscore momentum: 22 nucleic-acid drugs cleared regulators by late 2023, and four more won clearance in 2024, pulling the oligonucleotide synthesis market beyond its research-reagent roots into industrial-scale biologics. Environmental scrutiny of PFAS-linked reagents pressures legacy processes, amplifying interest in enzymatic alternatives that reduce waste while complying with evolving regulations.

Global Oligonucleotide Synthesis Market Trends and Insights

Government Funding Surge Post-Pandemic

Federal investment elevated oligonucleotides to critical-infrastructure status for pandemic preparedness and precision medicine. The NIH earmarked USD 15.4 million for RNA research that improves microfluidic long-strand synthesis and nanopore sequencing, while its Technology Development Coordinating Center secures USD 1.5 million annually through 2029 to refine nucleic-acid production systems . Parallel European grants create a trans-Atlantic push to localize supply chains, reinforce biosecurity, and accelerate oligonucleotide standards that underpin therapeutic approvals.

Clinical Adoption of Synthesized Oligos in Advanced Diagnostics

Fresh FDA guidance issued in 2024 clarifies quality requirements, accelerating diagnostic assay rollouts and boosting the oligonucleotide synthesis market . GalNAc-conjugated antisense oligos received their first approval, confirming precise delivery chemistries that rely on high-fidelity synthesis. Personalized "N-of-1" treatments now demand rapid micro-batch production, prompting service providers to integrate design-to-clinic workflows that transform how rare-disease patients are treated.

Persistent High Purification & QC Costs

Therapeutic-grade purification can consume 60-70% of manufacturing budgets as high-performance liquid chromatography remains the standard for removing truncated strands and reactive impurities. Yield erosion, demonstrated by 30-mer sequences falling to 55% at 98% coupling efficiency, forces over-production that inflates reagent use and waste disposal, stressing smaller players that lack economies of scale.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Contract Development & Manufacturing (CDMO) Capacity

- Patent Cliffs Driving Next-Gen Antisense/RNA Therapies

- Enzymatic, Benchtop "DNA Printer" Launch Pipelines

- IP Disputes Around CRISPR / Gene-Editing Sequences

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Services generated 41.25% of overall 2024 revenue as pharmaceutical sponsors prioritized turnkey solutions that compress development timelines. This dominance confirms the oligonucleotide synthesis market preference for external capacity that bundles synthesis, purification, and regulatory support into single-vendor contracts. The model suits high-value clinical batches where each lot must pass stringent GMP audits. Reagent consumption scales in parallel, offering steady annuity streams for consumables providers even as benchtop enzymatic platforms appear.

Looking ahead, service revenue is expected to outpace product sales because compliance complexity continues to rise. CDMOs spread analytical costs across dozens of clients, whereas individual biotechs seldom justify multi-million-dollar cleanroom investments. Equipment suppliers respond with higher-throughput instruments such as 384-well synthesizers that cut per-oligo costs, yet most machines will still land inside service facilities rather than drug-maker labs. The oligonucleotide synthesis market size expansion therefore tracks CDMO build-outs, while specialized benchtop systems address niche rapid-turnaround needs within research cores.

DNA retained 43.45% command of the oligonucleotide synthesis market in 2024 thanks to mature phosphoramidite protocols that deliver >99% coupling efficiency for strands up to 120 bases. RNA's 13.78% share is set to climb as mRNA vaccines, CRISPR guides, and siRNA drugs gain clinical traction. Enzymatic synthesis favors RNA because aqueous enzymology avoids the acidic deprotection steps that degrade 2'-hydroxyl groups, extending feasible lengths beyond 200 bases without capping agents.

Modified backbones such as phosphorothioates and 2'-O-methyl riboses already dominate antisense and RNAi therapeutics, commanding multiples of DNA's price per base. Niche chemistries (LNA, PNA, Morpholino) occupy small slices yet supply indispensable tools for stability-critical indications. As therapeutic demand intensifies, production shifts toward GMP-compliant enzymes and greener solvents, lifting the oligonucleotide synthesis market share of RNA while DNA remains foundational for gene-assembly and PCR primer volumes.

The Oligonucleotide Synthesis Market Report Segments the Industry Into by Product Type (Synthesized Oligonucleotide Products, and More), by Chemistry (DNA, RNA, and More), by Application (Research, Diagnostics, Therapeutics), by End-User (Academic Research Institutes, Pharmaceutical and Biotechnology Companies, and More), and by Geography. The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America captured 42.81% share in 2024, propelled by FDA guidance that de-risks development and by NIH funding that subsidizes platform innovation. United States-based firms leverage integrated ecosystems spanning venture capital, academic excellence, and manufacturing know-how. Canada benefits from proximity, with emerging GMP suites attracting cross-border projects. Mexico's low-cost sites are beginning to draw reagent packaging and QC functions, though synthesis remains concentrated further north.

Asia-Pacific held 14.71% yet registers the highest growth trajectory. Chinese sponsors poured more than USD 4 billion into small-nucleic-acid ventures during 2024, while provincial governments fast-tracked plant permits to localize supply. South Korea secured EUR 300 million from MilliporeSigma for a duplex biologics campus, and Singapore's regulatory certainty lured multi-line expansions from WuXi STA and GenScript. India's "Make in India" drive birthed CoDx-CoSara's new Gujarat facility, signaling regional intent to rise up the value chain.

Europe remains an innovation powerhouse but encounters PFAS-related chemical restrictions that complicate legacy phosphoramidite workstreams. Germany's BioSpring tripled capacity and added 1,500 jobs, offsetting supply headaches by pioneering fluorine-free reagents. The United Kingdom's Catapult centers pair public grants with biotech spin-outs, while France cultivates enzymatic start-ups. Elsewhere, Brazil and Argentina lead Latin American uptake of genetic therapies, and Gulf states build precision-medicine hubs anchored by imported oligonucleotides, foreshadowing localized production over the next decade.

- Agilent Technologies

- Thermo Fisher Scientific

- Merck

- Danaher (IDT)

- Eurofins

- Kaneka (Eurogentec)

- Genscript

- LGC Biosearch Technologies

- Maravai Life Sciences (TriLink)

- Biogen

- Sarepta Therapeutics

- Twist Bioscience

- Integrated DNA Technologies

- Bioneer

- Bio-Synthesis

- Biolegio

- GE Healthcare (Cytiva)

- Synbio Technologies

- Creative Biogene

- Vivantis Technologies

- Macrogen

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government funding surge post-pandemic

- 4.2.2 Clinical adoption of synthesized oligos in advanced diagnostics

- 4.2.3 Expansion of contract development & manufacturing (CDMO) capacity

- 4.2.4 Patent cliffs driving next-gen antisense/RNA therapies

- 4.2.5 Micro-array based ultrahigh-throughput synthesis platforms

- 4.2.6 Enzymatic, benchtop "DNA printer" launch pipelines

- 4.3 Market Restraints

- 4.3.1 Persistent high purification & QC costs

- 4.3.2 IP disputes around CRISPR / gene-editing sequences

- 4.3.3 Supply bottlenecks for specialty phosphoramidites

- 4.3.4 PFAS-linked environmental regulations on fluorinated nucleic acids

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product Type

- 5.1.1 Synthesized Oligonucleotide Products

- 5.1.2 Reagents

- 5.1.3 Equipment

- 5.1.4 Services

- 5.2 By Chemistry

- 5.2.1 DNA (Phosphoramidite)

- 5.2.2 RNA

- 5.2.3 LNA / PNA / Morpholino

- 5.3 By Application

- 5.3.1 Research

- 5.3.2 Diagnostics

- 5.3.3 Therapeutics

- 5.4 By End-user

- 5.4.1 Academic Research Institutes

- 5.4.2 Pharmaceutical & Biotechnology Companies

- 5.4.3 Hospital & Diagnostic Laboratories

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of APAC

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of MEA

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Agilent Technologies

- 6.3.2 Thermo Fisher Scientific

- 6.3.3 Merck KGaA (Sigma-Aldrich)

- 6.3.4 Danaher (IDT)

- 6.3.5 Eurofins Scientific

- 6.3.6 Kaneka (Eurogentec)

- 6.3.7 GenScript

- 6.3.8 LGC Biosearch Technologies

- 6.3.9 Maravai Life Sciences (TriLink)

- 6.3.10 Biogen

- 6.3.11 Sarepta Therapeutics

- 6.3.12 Twist Bioscience

- 6.3.13 Integrated DNA Technologies

- 6.3.14 Bioneer

- 6.3.15 Bio-Synthesis Inc.

- 6.3.16 Biolegio

- 6.3.17 GE Healthcare (Cytiva)

- 6.3.18 Synbio Technologies

- 6.3.19 Creative Biogene

- 6.3.20 Vivantis Technologies

- 6.3.21 Macrogen

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment