PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842466

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842466

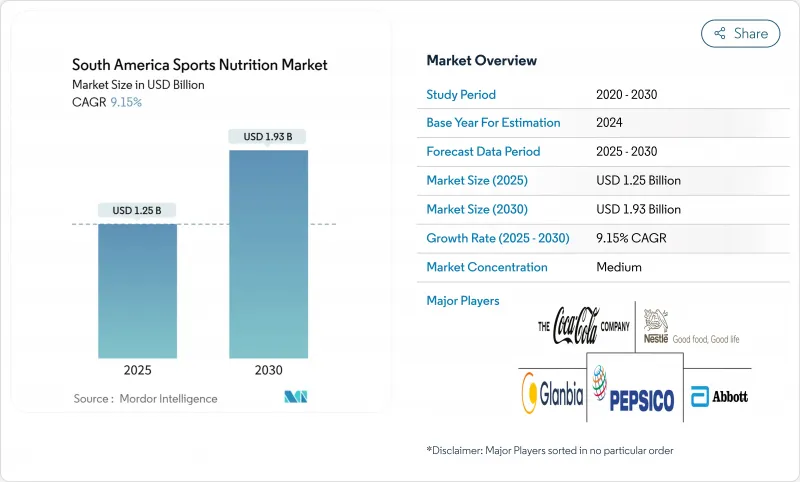

South America Sports Nutrition - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The South American sports nutrition market demonstrates significant growth potential, with the market value estimated to be USD 1.25 billion in 2025 and expected to expand to USD 1.93 billion by 2030 with a CAGR of 9.15% during the forecast period.

Brazil emerges as the dominant force in the regional market, commanding the leading market share in 2024 and exhibiting the highest growth rate over the forecast period. The market's expansion is primarily driven by traditional consumers such as athletes and bodybuilders, while witnessing increased adoption among recreational and lifestyle users. Several factors contribute to this growth, including rising disposable income levels across the region, evolving lifestyle patterns, and heightened awareness regarding the benefits of protein-based sports nutrition products. This combination of factors positions the South American sports nutrition market for sustained growth in the coming years.

South America Sports Nutrition Market Trends and Insights

Growth of Urban Fitness Culture

The growth of urban fitness culture is changing consumption patterns in South America's sports nutrition market. Gym membership growth in metropolitan areas is three times higher than population growth. This shift has created a consumer base that prioritizes performance enhancement over basic nutrition needs, driving increased product demand across segments. According to the Ministry of Tourism and Sports of Argentina in 2023, 50.1% of surveyed individuals were physically active, showing the relationship between professional fitness practices and supplement use . This trend is most evident in Brazil's southeast region, where the high concentration of fitness facilities and manufacturing infrastructure supports both product development and consumer education.

Rising Awareness of Sports Nutrition Benefits among Athletes

The growing awareness of sports nutrition benefits among athletes is driving the South American sports nutrition market growth. Both professional and amateur athletes increasingly understand the importance of specialized nutrition for performance enhancement, recovery, and overall health. The expansion of fitness centers, gyms, and health clubs across the region supports this trend, as these facilities actively promote products such as protein supplements, energy drinks, and nutrition bars, often with guidance from in-house dieticians. The fitness industry continues to expand in response to consumer demand. For example, Brazilian franchise Smart Fit operated 706 fitness clubs in Brazil by the end of 2023, showing an 11% increase from 2022. Additionally, social media fitness influencers and content creators have contributed to consumer education and market expansion, particularly in emerging urban and semi-urban markets.

High Cost Associated with Sports Nutrition

The elevated pricing structure of sports nutrition products restricts market penetration beyond affluent consumer segments, particularly in Argentina and Chile where economic conditions have diminished consumer purchasing capacity. Imported products encounter additional financial barriers through tariffs and multilayered distribution networks, resulting in higher retail prices compared to domestic alternatives. This market segmentation has resulted in international premium brands concentrating on high-income demographics, while domestic manufacturers utilize competitive pricing strategies to capture the expanding middle-class consumer base. Consequently, manufacturers have implemented strategic packaging innovations, incorporating single-serve sachets and reduced unit volumes, to enhance product accessibility for price-sensitive consumers while maintaining profit margins.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Sports Events and Endurance Races

- Personalized Sports Nutrition Products

- Stringent Regulatory Framework

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The sports nutrition market shows a significant shift in product dynamics, with non-protein products projected to grow at 9.93% CAGR (2025-2030). While sports protein products maintain market dominance with an 80.78% share in 2024, consumers are expanding their nutritional choices beyond protein supplementation. Plant-based proteins are gaining market share in the traditionally whey-dominated segment, with 92% of South American performance nutrition consumers reporting use of plant protein products according to Glanbia Nutritionals.

The market shows increased demand for energy gels and creatine powder, driven by the rising popularity of endurance sports in the region. Consumers prefer powder formats due to their cost-effectiveness and flexible dosing options. The ready-to-drink protein segment benefits from established beverage distribution networks, particularly through PepsiCo and Coca-Cola's extensive regional infrastructure in refrigerated product distribution.

The South America Sports Nutrition Market is Segmented by Product Type (Sports Protein Products and Sports Non-Protein Products), by Source (Animal-Based and Plant-Based), Distribution Channel (Supermarkets/Hypermarkets, Pharmacy/Health Stores, Online Retail Stores, and Others), and Geography (Brazil, Chile, Argentina, and Rest of South America). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- PepsiCo, Inc.

- The Coca-Cola Company

- Nestle S.A.

- Glanbia, Plc

- Abbott Laboratories

- The Simply Good Foods Company

- Herbalife Nutrition Ltd.

- Otsuka Pharmaceutical Co., Ltd.

- Probiotic Laboratories Ltd.

- MusclePharm Corporation

- Mondelez International, Inc.

- Atlhetica Nutrition

- Nutrabolt

- GNC Holdings, LLC

- Now Foods

- BPI Sports LLC

- Post Holdings, Inc.

- Max Titanium Suplementos

- Bright LifeCare Pvt. Ltd

- THG plc

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growth of Urban Finteness Culture

- 4.2.2 Rising Awarness of Sports Nutrition Benefits among Athletes

- 4.2.3 Expansion of Sports Events and Endurance Races

- 4.2.4 Personalized Sports Nutrition Products

- 4.2.5 Social media influence promoting sports nutrition products

- 4.2.6 Expansion of e-commerce and specialty nutrition stores

- 4.3 Market Restraints

- 4.3.1 High Cost Associated with Sports Nutrition

- 4.3.2 Stringent Regulatory Framework

- 4.3.3 Economic instability impacts purchasing power

- 4.3.4 Limited consumer awareness in rural and semi-urban areas

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Sports Protein Products

- 5.1.1.1 Powder

- 5.1.1.1.1 Whey And Casein Powder

- 5.1.1.1.2 Plant based Protein Powder

- 5.1.1.1.3 Other Sports Protein Powder

- 5.1.1.2 Protein Ready to Drink

- 5.1.1.3 Protein/Energy Bars

- 5.1.2 Sports Non Protein Products

- 5.1.2.1 Energy Gels

- 5.1.2.2 BCAA Powder

- 5.1.2.3 Creatine Powder

- 5.1.2.4 Other Sports Non Protein Products

- 5.1.1 Sports Protein Products

- 5.2 By Source

- 5.2.1 Animal-based

- 5.2.2 Plant-based

- 5.3 By Distribution Channel

- 5.3.1 Supermarkets/Hypermarkets

- 5.3.2 Pharmacy/Health Stores

- 5.3.3 Online Retail Stores

- 5.3.4 Other Distribution Channels

- 5.4 By Geography

- 5.4.1 Brazil

- 5.4.2 Chile

- 5.4.3 Argentina

- 5.4.4 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 PepsiCo, Inc.

- 6.4.2 The Coca-Cola Company

- 6.4.3 Nestle S.A.

- 6.4.4 Glanbia, Plc

- 6.4.5 Abbott Laboratories

- 6.4.6 The Simply Good Foods Company

- 6.4.7 Herbalife Nutrition Ltd.

- 6.4.8 Otsuka Pharmaceutical Co., Ltd.

- 6.4.9 Probiotic Laboratories Ltd.

- 6.4.10 MusclePharm Corporation

- 6.4.11 Mondelez International, Inc.

- 6.4.12 Atlhetica Nutrition

- 6.4.13 Nutrabolt

- 6.4.14 GNC Holdings, LLC

- 6.4.15 Now Foods

- 6.4.16 BPI Sports LLC

- 6.4.17 Post Holdings, Inc.

- 6.4.18 Max Titanium Suplementos

- 6.4.19 Bright LifeCare Pvt. Ltd

- 6.4.20 THG plc

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK