PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842686

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842686

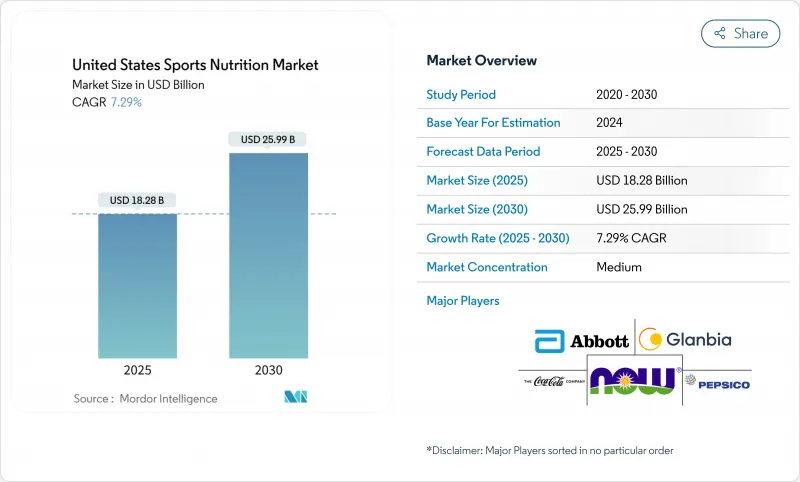

United States Sports Nutrition - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The global sports nutrition supplements market, valued at USD 18.28 billion in 2025, is expected to reach USD 25.99 billion by 2030, growing at a CAGR of 7.29%.

While athletes and bodybuilders remain core consumers, the market has expanded significantly to include recreational users, weekend warriors, and lifestyle enthusiasts, driven by increased health awareness and rising disposable income. This evolution from a niche athletic segment to a mainstream wellness category is supported by the democratization of fitness culture, digital health integration, and regulatory modernization across key markets. The growth is further amplified by the increasing number of health and fitness centers that actively promote sports nutrition products to their members. The market's transformation reflects a broader shift in consumer preferences toward sustainable nutrition, indicating that traditional users alone cannot sustain the market's growth trajectory. As the industry continues to evolve, manufacturers must adapt their product offerings and marketing strategies to meet the diverse needs of this expanding consumer base while maintaining high quality and safety standards.

United States Sports Nutrition Market Trends and Insights

Spike in Outdoor Fitness Activities

The post-pandemic period witnessed a significant shift in sports nutrition demand patterns, driven by increased outdoor fitness participation. According to Sports and Fitness Industry Association , 242 million Americans (78.8% of the population) engaged in physical activities in 2023, marking a 2.2% increase from the previous year. This trend, which has shown consistent growth for ten consecutive years with 5 million new participants in 2023, has influenced product development in the sports nutrition market. Manufacturers are now focusing on portable, weather-resistant formulations, particularly energy gels and ready-to-drink protein beverages, to support extended outdoor activities. The emphasis on outdoor fitness has also increased demand for hydration and electrolyte replacement products. In response, companies are developing specialized formulations incorporating natural preservatives and temperature-stable ingredients to maintain product efficacy across various environmental conditions. This ongoing evolution in consumer preferences and product development is expected to continue shaping the sports nutrition market, driving innovation and growth in outdoor-focused nutritional solutions.

University Athletics Programs

University athletics programs drive the sports nutrition market in the United States through their comprehensive nutrition and supplementation programs for student-athletes. These programs create demand for protein powders, energy drinks, and recovery supplements to support athletic performance and recovery. The expanding student-athlete population and increased nutrition awareness contribute to market growth. The sports nutrition market in the United States benefits from a well-established distribution network of specialty retailers, online platforms, and university partnerships. Professional sports teams and training facilities across the country have also adopted similar nutrition protocols, creating a trickle-down effect that influences amateur athletes and fitness enthusiasts. The National Collegiate Athletic Association's (NCAA) mandatory nutrition education requirement, effective August 2024, further strengthens the demand for sports nutrition supplements among collegiate athletes. The market continues to evolve with innovations in personalized nutrition solutions and clean-label products that cater to specific athletic performance requirements.

Stringent Regulatory Standards by FDA and FTC

Regulatory requirements in the United States sports nutrition market operate within a complex framework established by the Food and Drug Administration (FDA) and Federal Trade Commission (FTC). The FDA mandates manufacturers to follow Good Manufacturing Practices and provide accurate product labels containing ingredients, nutritional information, and allergen warnings. New dietary ingredients require pre-market FDA approval, involving extensive time and financial resources. Companies that fail to meet these regulatory standards risk substantial financial penalties and product recalls, which increase operational risks and costs. Product development timelines extend, and production costs increase due to required documentation, testing procedures, and certification processes. These comprehensive regulatory measures, while ensuring product safety and consumer protection, significantly impact market dynamics and operational strategies in the U.S. sports nutrition industry.

Other drivers and restraints analyzed in the detailed report include:

- Availability of Functional Combination Products

- Rise in Plant Based Sports Nutrition Products

- Prevalence of Counterfeit or Adulterated Products

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Sports protein products maintain market leadership with an 83.83% share in 2024, reflecting protein's essential role in muscle synthesis and recovery across athletic performance levels. Sports non-protein products represent the fastest-growing segment with an 8.48% CAGR through 2030, driven by advanced pre-workout formulations and specialized recovery compounds that address specific physiological needs beyond protein supplementation. The dominance of protein products is further reinforced by increasing awareness among recreational athletes and fitness enthusiasts about the importance of protein timing and dosage for optimal results.

Within protein products, powder formulations remain dominant due to cost efficiency and customization flexibility, while ready-to-drink formats gain market share through convenience benefits. Energy gels and BCAA powders in the non-protein segment show growth as consumers become more knowledgeable about targeted supplementation approaches and their specific performance benefits. The market also witnesses increased demand for multi-component protein blends that offer varied absorption rates and amino acid profiles to support different training phases.

The United States Sports Nutrition Market is Segmented by Product Type (Sports Protein Products and Sports Non-Protein Products), Source (Animal-Based and Plant-Based), and Distribution Channel (Supermarkets/Hypermarkets, Pharmacy/Health Stores, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- PepsiCo Inc.

- The Coca-Cola Company

- Abbott Laboratories Inc.

- Glanbia PLC

- Now Foods

- SiS (Science in Sport) PLC

- Cizzle Brands Corporation

- GNC Holdings

- Mondelez International, Inc.

- FitLife Brands

- Post Holdings

- Nutrabolt

- Red Bull GmbH

- Edible Garden AG Incorporated

- Herbalife International

- Alticor Inc.

- Xiwang Group Co., Ltd

- Simply Good Foods Co.

- JAB Holding Company

- Leprino Foods Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Spike in outdoor fitness activities

- 4.2.2 University athletics programs

- 4.2.3 Availability of functional combination products

- 4.2.4 Rise in plant based sports nutrition products

- 4.2.5 Growing influence of social media and fitness influencers on consumer purchasing decisions

- 4.2.6 Rising demand for personalized nutrition solutions and performance-enhancing supplements

- 4.3 Market Restraints

- 4.3.1 Stringent regulatory standards by FDA and FTC

- 4.3.2 Prevalence of counterfeit or adulterated products

- 4.3.3 Limited consumer awareness in certain demographic segments

- 4.3.4 High product costs limiting adoption among price-sensitive consumers

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Sports Protein Products

- 5.1.1.1 Powder

- 5.1.1.1.1 Whey And Casein Powder

- 5.1.1.1.2 Plant based Protein Powder

- 5.1.1.1.3 Other Sports Protein Powder

- 5.1.1.2 Protein Ready to Drink

- 5.1.1.3 Protein /Energy Bars

- 5.1.2 Sports Non Protein Products

- 5.1.2.1 Energy Gels

- 5.1.2.2 BCAA Powder

- 5.1.2.3 Creatine Powder

- 5.1.2.4 Other Sports Non Protein Products

- 5.1.1 Sports Protein Products

- 5.2 By Source

- 5.2.1 Animal-based

- 5.2.2 Plant-based

- 5.3 By Distribution Channel

- 5.3.1 Supermarkets/Hypermarkets

- 5.3.2 Pharmacy/Health Stores

- 5.3.3 Online Retail Stores

- 5.3.4 Other Distribution Channels

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 PepsiCo Inc.

- 6.4.2 The Coca-Cola Company

- 6.4.3 Abbott Laboratories Inc.

- 6.4.4 Glanbia PLC

- 6.4.5 Now Foods

- 6.4.6 SiS (Science in Sport) PLC

- 6.4.7 Cizzle Brands Corporation

- 6.4.8 GNC Holdings

- 6.4.9 Mondelez International, Inc.

- 6.4.10 FitLife Brands

- 6.4.11 Post Holdings

- 6.4.12 Nutrabolt

- 6.4.13 Red Bull GmbH

- 6.4.14 Edible Garden AG Incorporated

- 6.4.15 Herbalife International

- 6.4.16 Alticor Inc.

- 6.4.17 Xiwang Group Co., Ltd

- 6.4.18 Simply Good Foods Co.

- 6.4.19 JAB Holding Company

- 6.4.20 Leprino Foods Company

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK